Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

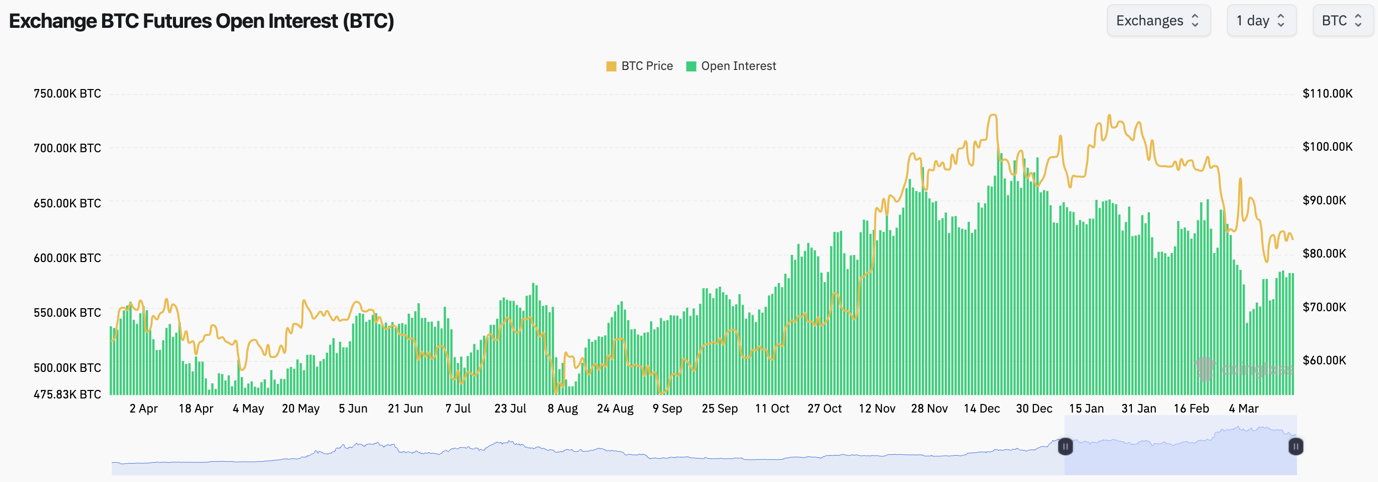

- BTC's Open Interest is up approximately 10% from the bottom, seen a few weeks ago. Although it still remains in a downtrend. This indicates that traders have less appetite to leverage trade BTC.

- Funding Rates are mostly flat, or fluctuating between slightly positive and negative. This suggests that there is indecision amongst traders.

Technical analysis:

- Bitcoin has moved up from the lows, as we expected, following the bullish divergence that is being formed (lower low in price, higher low on the oscillator).

- Price has now bounced into the $85,000 to $86,300 range which is a resistance zone, and also a lower high.

- The zone of major resistance, and where we'd strongly consider Shorts, is between $86,300 and $91,700.

- The RSI remains in a downtrend, although it's not in oversold territory, whilst it's also sat on top of its moving average and potentially looking for a breakout in the short-term.

- On the downside, major support remains between $77,000 and $78,000. A loss of this zone and price likely dips into $72,000, the old horizontal resistance, now potentially new support.

- Next Support: $78,000

- Next Resistance: $86,300

- Direction: Neutral

- Upside Target: $86,300 to $89,000

- Downside Target: $78,000

Cryptonary's take:

Bitcoin has moved off of the local lows, having put in the bullish divergence. Price has now slowly moved up, and likely helped by the bounce in TradFi Index (SPX and NDX). In the short term (coming days), we do think the price can continue this slow grind higher.However, we still expect we're in a multi-month downtrend, and therefore, if the price were to move into the $86,300 to $91,700 zone, we'd look to layer Short orders in that range for a move back to $ 70k over the coming 2-4 weeks.