Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Funding Rate is at 0.005%, indicating there is some Short interest here.

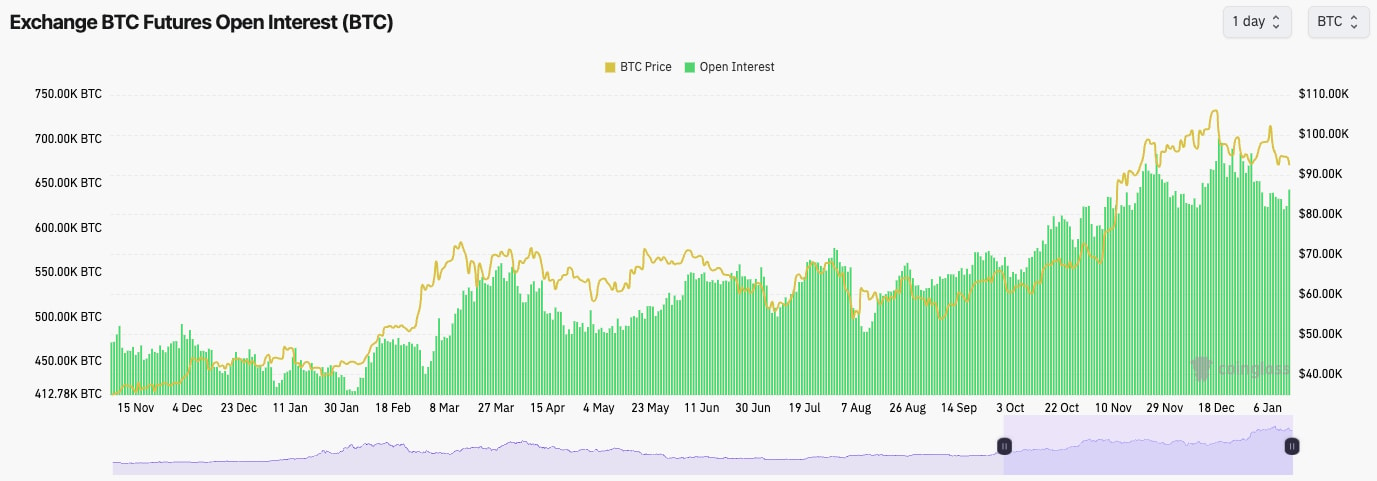

- BTC's Open Interest is up 4% from the lows but still remains 10% off the highs. The recent 4% increase is likely more dominated by Shorts. However, it is not so dominant that the funding rate has gone negative.

- Positioning is still relatively even overall here.

Technical analysis

- Bitcoin is currently playing between the key range of $91,500 (support) and $95,700 (resistance).

- Beyond $95,700, the main horizontal resistance is $98,900.

- There is a zone of support below $91,500, with that extending down towards $90,000.

- If $90k is lost, it's possible that the price dips into the low $ 80k in the short term.

- The RSI is at 41, so it's a middle-ish territory, but it probably still has room to go down further, particularly as it is below its moving average and remains in a downtrend.

- Next Support: $91,500

- Next Resistance: $95,700

- Direction: Bearish

- Upside Target: $95,700

- Downside Target: $87,000

Cryptonary's take

So far today, the price has held the lows (in the $ 90k range) and actually responded positively. However, we'll need a strong amount of bidding to push BTC into the resistance of $95,700 and then beyond that. Whilst BTC remains between $91,500 and $95,700, we remain with the view that it's more likely we'll see a breakdown and for BTC to head into the $80k's in the short-term.A breakout above $95,700 would invalidate this. Today, we have the S&P and Nasdaq gaping down, so we might see a bid there as they close the gap, which could give BTC a bid. However, we expect them to reject after the gap has been filled, and that would also likely result in BTC going lower with them. We expect BTC to head into the low $ 80k in the short term (next 1- 2 weeks). No, we don't believe the inauguration is a buy-the-news event.