Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Open Interest (in USD value) is massive. In the last three weeks, OI has increased by 43%. But, the BTC price has increased by 50% since one month ago.

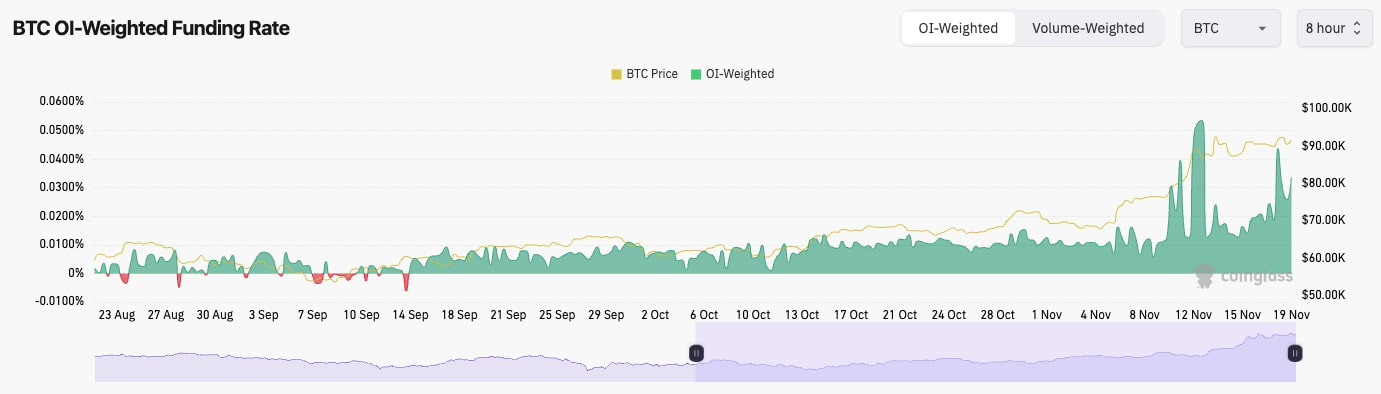

- The Funding Rate is creeping higher again. For now, it's still ok. But, if it were to rise substantially further, then this may result in a leverage flush out with the price falling. When this happened a week ago, the price went from $92k down to $87k. So, not that bad, really.

Technical analysis

- BTC has managed to remain around its highs in the low $ 90k range, which is impressive considering the size of the rally from the late $ 60k.

- Price is holding its local uptrend line, but currently, it's finding the $93,000 level as a horizontal resistance.

- Price has used the $87,100 area as support, so that'll be the first area to watch on a possible price breakdown.

- Beneath $87,000, the levels are tricky to identify. But, if the price does fall below $87k, we'd expect $82k to be the support.

- The RSI has remained in overbought territory, and it is currently printing a bearish divergence (higher high in price, lower high on the oscillator). In the euphoria phases of the market, BTC can shake off bearish divergences, but we would be somewhat wary of this one.

Get the latest Bitcoin price prediction—dive into our detailed analysis to stay one step ahead!

Cryptonary's take

Price has had a mega move up, and with Open Interest and Funding where it is, we wouldn't be surprised to get some sort of flush out to the downside. However, if we did, we'd expect it to be shallow. On the other hand, we do believe BTC is in the "euphoria phase" of the market, and these moves higher can just continue.Therefore, we remain bullish in the medium term, and we continue holding all spot positions. However, we're open to the idea that there may be a 5-10% pullback in the short term. But we're not super confident about this, and we wouldn't sell Spot bags with the aim of re-buying them at a lower price. Retail participants are beginning to come in, and that can just continue to push prices higher for now, so we wouldn't be surprised to see BTC continue to increase.

In short, we're in a bullish environment, but it's possible we're slightly over-extended in the very short term. We're super bullish on all other timeframes, and it's also possible that BTC will just continue to rip in the immediate term. No plans to sell anytime soon.