Bulls and bears battle it out as Bitcoin hovers near $38K

Bitcoin continues to struggle at the $37,700 - $38,000 resistance zone. Bulls took a deep breath after indicators reset from overbought territories, but excessive longs piling in late may find themselves squeezed. BTC is stuck until one side breaks - which way will it go next?

TLDR

- Bitcoin bounced off support at $35.6K but faced resistance at the $37.7K-38K area.

- Indicators reset from overbought levels, giving room for further upside.

- The long/short ratio shows more longs piling in, risk of a squeeze to the downside

- Overall rangebound, a break above $38K is needed for a bullish breakout

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

- The US traditional markets are closed today due to Thanksgiving.

- The key data out yesterday was the Jobless Claims. Initial Claims came in at 209k, while Continuing Claims came in at 1840k. Both of these prints were below consensus and below the prior reading. Positive for risk assets.

- Traditional Indexes such as the S&P and the Nasdaq are in overbought territory, while the Dollar is close to oversold. We may see a short-term reversal in the coming week where risk pulls back slightly, and the DXY gets a small relief bounce.

BTC 4hr

Technical analysis

- Following Bitcoin’s move down to the horizontal support of $35,600, Bitcoin has had a significant bounce and is now close to retesting the resistance zone of $37,700 to $38,000.

- The underside of the local uptrend line and the $37,700 areas act as local resistances.

- All of the RSIs are out of the overbought territory and have been rest, except for the 3D and the Weekly. This is positive as it means price is less exhausted to the upside than it was a week ago, and therefore, it now has room to go higher potentially.

- There is a bearish divergence on the 3D timeframe, which, if it plays out, would see Bitcoin pull back more meaningfully.

Overall, this is a relatively healthy setup for Bitcoin from the technicals point of view. Of course, the key level for price to clear above is $38,000.

Market mechanics

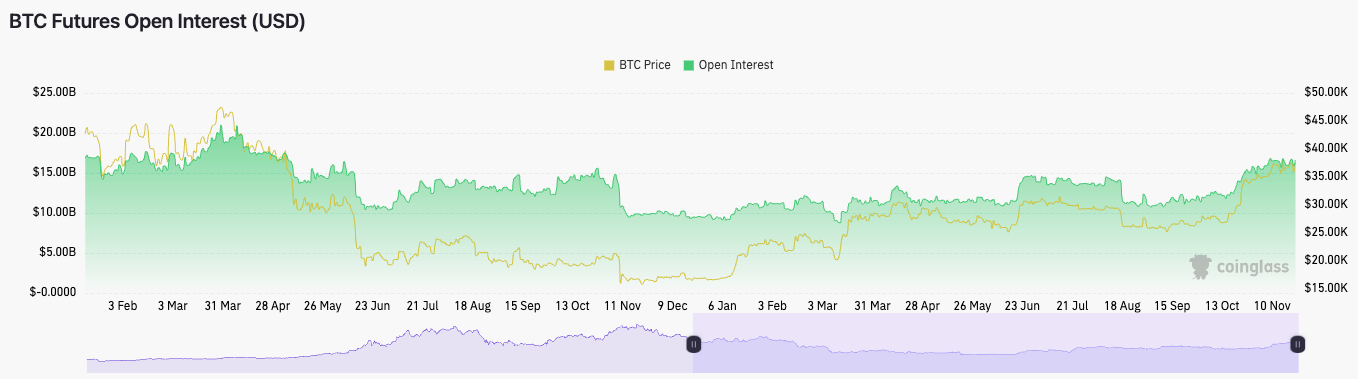

- The Open Interest on Bitcoin has popped back to its highs at $16.6b.

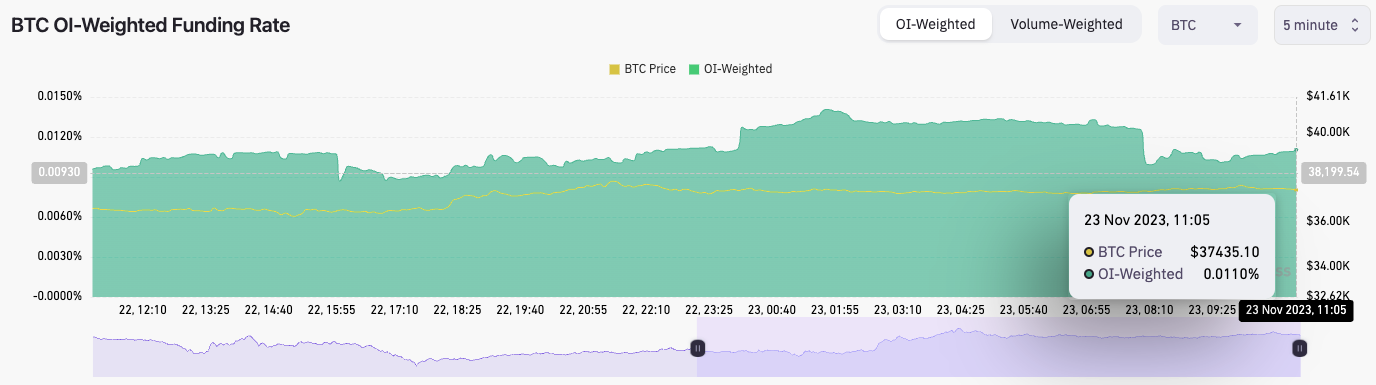

- The OI-Weighted Funding Rate remains relatively flat at 0.0108%, indicating that there’s a relatively even balance between Longs and Shorts.

- However, the Long/Short Ratio is at 1.0354. This means more participants piled into Longs over the past 24 hours than Shorts. They likely chased the move higher yesterday evening. These late Longs may be vulnerable to a squeeze, which could see price pull back to $37,000.

Cryptonary’s take

Bitcoin continues to struggle at the $37,700 - $38,000 resistance zone despite a number of the trading indicators resetting back from overbought levels and, therefore, having room for the price to go higher. We also notice that around the lows, there is a strong level of Spot bids coming in at the $35,600 to $36,000 area.Bitcoin remains range-bound and has shown great strength recently, having bounced well from key supports. With a balanced positioning and the futures market not too overheated, Bitcoin may be better set up here to move past $38,000. We are concerned, however, with the constant selling coming in at the late $37,000s.

Whilst Bitcoin is range-bound, we’re not looking for any short-term trades. Bitcoin is difficult to call here, and we don’t have a strong conviction in a move in either direction. If Bitcoin does break the $35,600 lows and we get a test of $34,000, that’s where we’ll be DCA buyers with a 12-18 month time horizon.