TLDR

- Ethereum (ETH) is at a crucial resistance zone between $1,823 and $1,853.

- ETH has outperformed Bitcoin (BTC) in the last 24 hours, but caution is advised due to overbought conditions.

- Technical indicators like RSI suggest potential bearish divergence, urging careful consideration.

- Positive funding rates indicate a one-sided market with most traders holding long positions, posing a potential risk for longs.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Technical analysis

ETH is getting its time in the spotlight now, having outperformed BTC in the past 24 hours.ETH has now moved into its main resistance area between $1,823 to $1,853. This latest move shoves ETH into further overbought territory. Price-action-wise, we’re seeing a double top play out on the 12-hour timeframe (chart attached below), with the sticking point being the resistance area between $1,823 and $1,853.

If price can clear above this range, we could see ETH head up to $2,000. However, one would have to be cautious here; with BTC at a major resistance zone and ETH seeming to struggle into its resistance zone (between $1,823 to $1,853), one would have to be cautious here.

ETH 12 hr

RSI and funding rates

The RSI is in overbought territory, and now, on the 12hr, we could potentially see a bearish divergence form - we would need that higher high in price, though. The RSI is set for a bearish divergence; we would just need that higher high in price to get that.Larger timeframes remain well into overbought territory, which should keep us somewhat cautious.

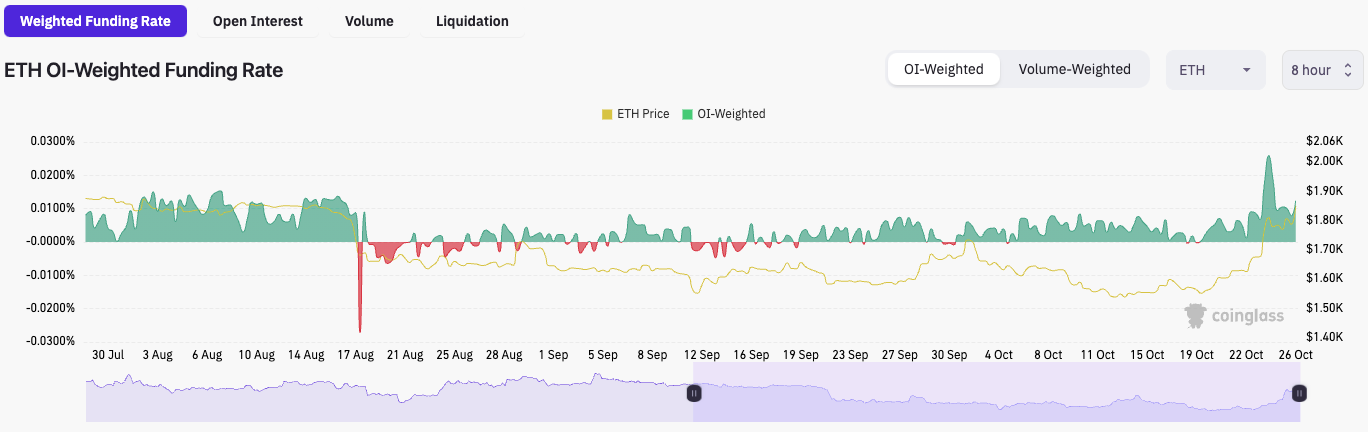

In terms of funding rates, ETH has a very positive funding rate. If we look back on the past few months, the rate is now very positive in comparison. So, longs are paying a substantial premium to shorts to be long. This is a somewhat one-sided market (in terms of positioning), meaning that most traders are long. This could set longs up to be squeezed.

ETH Weighted Funding Rate

Cryptonary’s take

ETH could outperform BTC in the very short term. As participants feel they have missed the BTC move, they may buy into ETH, hoping to catch that train that sometimes leaves the station slightly later.However, if BTC rejects more meaningfully from the $34,500 horizontal resistance and ETH cannot clear above $1,853, we’d expect ETH to be dragged back down with the rest of the market.

Action

- So far, ETH continues to reject in the resistance area of $1,823 to $1,853.

- Longs shouldn’t be encouraged here because the general market is overbought. In addition, BTC is at a horizontal resistance of $34,500, with many sellers appearing at that price point.