Yet, on this exhilarating journey, there's more than meets the eye. With fluctuating funding rates and a market laden with leverage, some curveballs could be on the horizon.

TLDR

- LINK shines with a strong breakout from a pennant pattern and $13.38 resistance.

- Limited local resistance ahead, with the next major hurdle at $17.30 to $18.00.

- The funding rate fluctuates but remains positive in a highly leveraged market.

- There's potential for a meaningful short-term pullback, but we are long-term optimistic on LINK.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Technical analysis

LINK is another that has had a brilliant performance. It already broke out of the pennant pattern and cleared above the horizontal resistance of $13.38 with relative ease. LINK is now working to hold $13.38 as support, having already bounced off that level of support yesterday.There are not too many local resistance levels above the current price. In fact, the next major resistance area is $17.30 to $18.00, which is 20% higher than the current price.

LINK 1D

Market mechanics

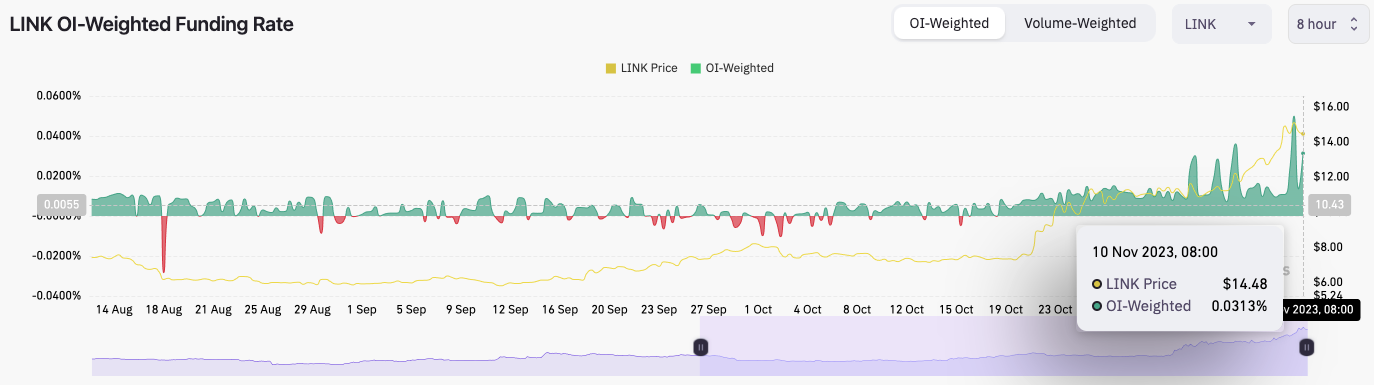

The funding rate for LINK was very high; it reset and is now very high again. That is likely due to some of the highly leveraged longs being flushed out in yesterday’s move down to the $13.60s. However, we’re now seeing a positive funding rate again while the open interest level remains very high.This is another play with a large build-up of leverage, and it’s heavily-sided on the long side. Historically, when this has been the setup, longs are flushed out more meaningfully. This flush-out could see price going considerably lower than it is now - to say, sub $13.38 and back into the range of $9.67 to $13.38.

Cryptonary’s take

LINK has been a phenomenal performer, and we like it for the long term. Currently, the leverage market is overheated, so we may experience a more meaningful pullback in the short term. But it’s certainly possible that LINK could move to the $17 area first before it has a pullback.Ultimately, with the momentum in the current market, this suggests further upside, but the mechanics suggest a leverage flush out is due - likely meaning a price decline.

We will be buyers for the long term if LINK falls back into the old range of $9.67 to $13.38.