Can SOL breakout to $80 as bulls regain control?

After shrugging off the market-wide deleveraging, Solana appears poised for liftoff. SOL held critical support at $52 while broader crypto assets pulled back. The mechanics are aligning for SOL to push towards the key target of $80. Here’s how to play SOL from here out.

TLDR

- SOL held critical support at $52 during the market pullback.

- Bull flag breakout targeting $80, key support at $48.67.

- Funding rates and open interest are reset; market mechanics align for a move higher.

- We are bullish long-term – SOL is a top contender for the next bull run.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Technical analysis

After SOL had a pullback to $52 yesterday, it was quickly bought up, and now SOL is retesting its highs at $63. The upside target for a breakout is $80, with the main support at $48.67 if SOL turns lower. For now, SOL remains in the local range of $52 to $63.When looking at the RSI, we’re very overbought on the 3D and weekly timeframes, along with the daily timeframe, which is also now putting in a bearish divergence. We should note that we have had several of these, and they haven’t led to any meaningful pullbacks yet.

SOL 1D

Market mechanics

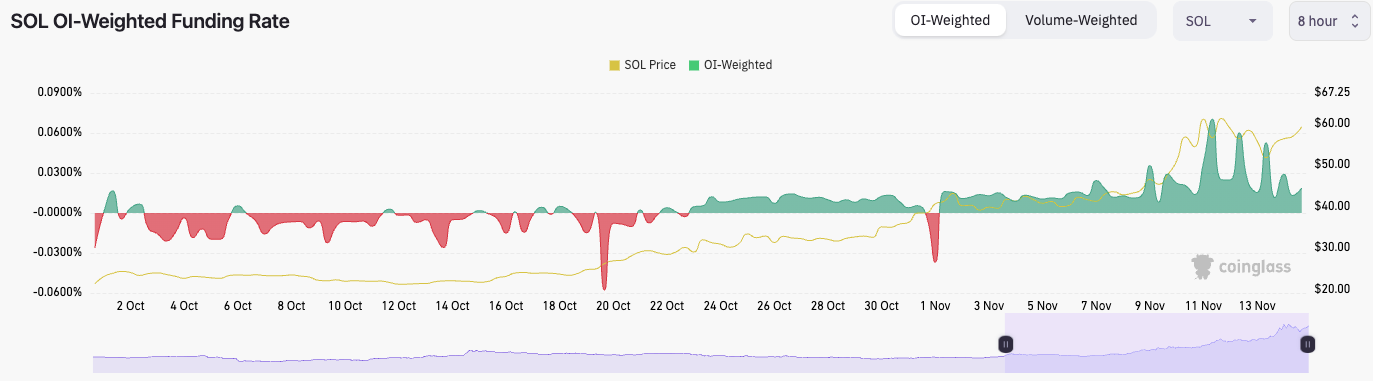

The funding rate for SOL has been extremely volatile, leading to volatile price action and vice versa - a vicious cycle. The funding rate has now reset to less exaggerated levels but remains very positive at 0.0187%. There is still a bias to be long.

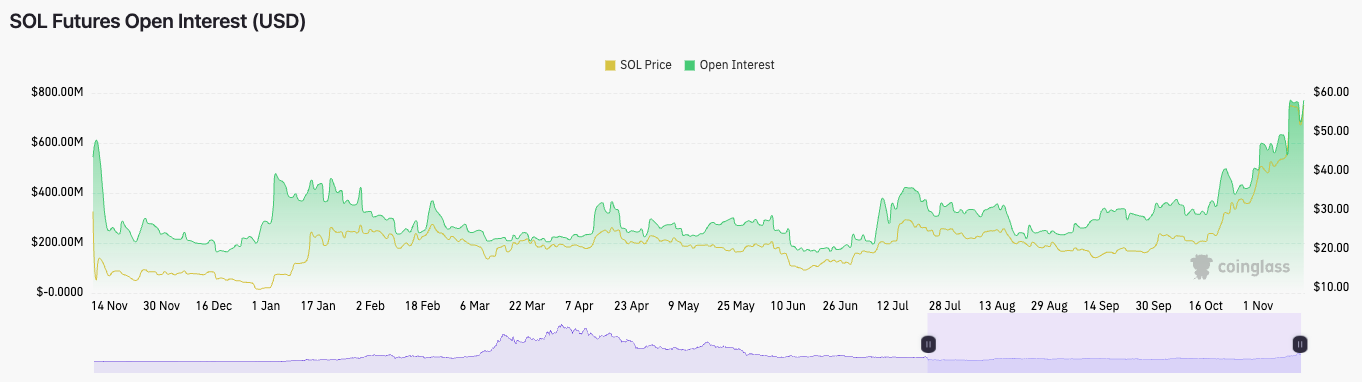

The open interest remains high despite the fact there was a flush lower yesterday. Open interest is straight back up to where it was just 24 hours later, with the funding rate coming down. This suggests an even balance between longs and shorts over the last 24 hours regarding participants. But, there is this slight bias overall to be long on SOL.

A further flush-out will likely be needed at some point, but we may see open interest increase first in the short term.

Cryptonary’s take

SOL is still overheated here, but with BTC and ETH seeing somewhat of a flush out yesterday, the market as a whole may have some room to go slightly higher, and considering how well SOL held up yesterday, it’s possible SOL gets further upside in the short-term.In the short-term, we’re very 50/50 on SOL, as it is quite capable of continuing on higher, but it is also overheated, and we would expect a deeper pullback at some point that would flush out the excess leverage. Does that come now or at a higher price? It is hard to say; we, therefore, have a low conviction on SOL’s direction in the short-term.

For the long-term, we see SOL being a front-runner in the next bull run, and today’s price is still relatively cheap if you have a 12-18 month time horizon.