In this report, we provide a strategic trade recommendation – a move from Jito Labs ($JTO) to SolBlaze ($BLZE).

This recommendation is based on market timing, comparative analysis, and projected growth potential.

Let’s dive in!

TLDR

- With the recent JTO airdrop frenzy dying, traders should focus on the next opportunity - SolBlaze's BLZE token.

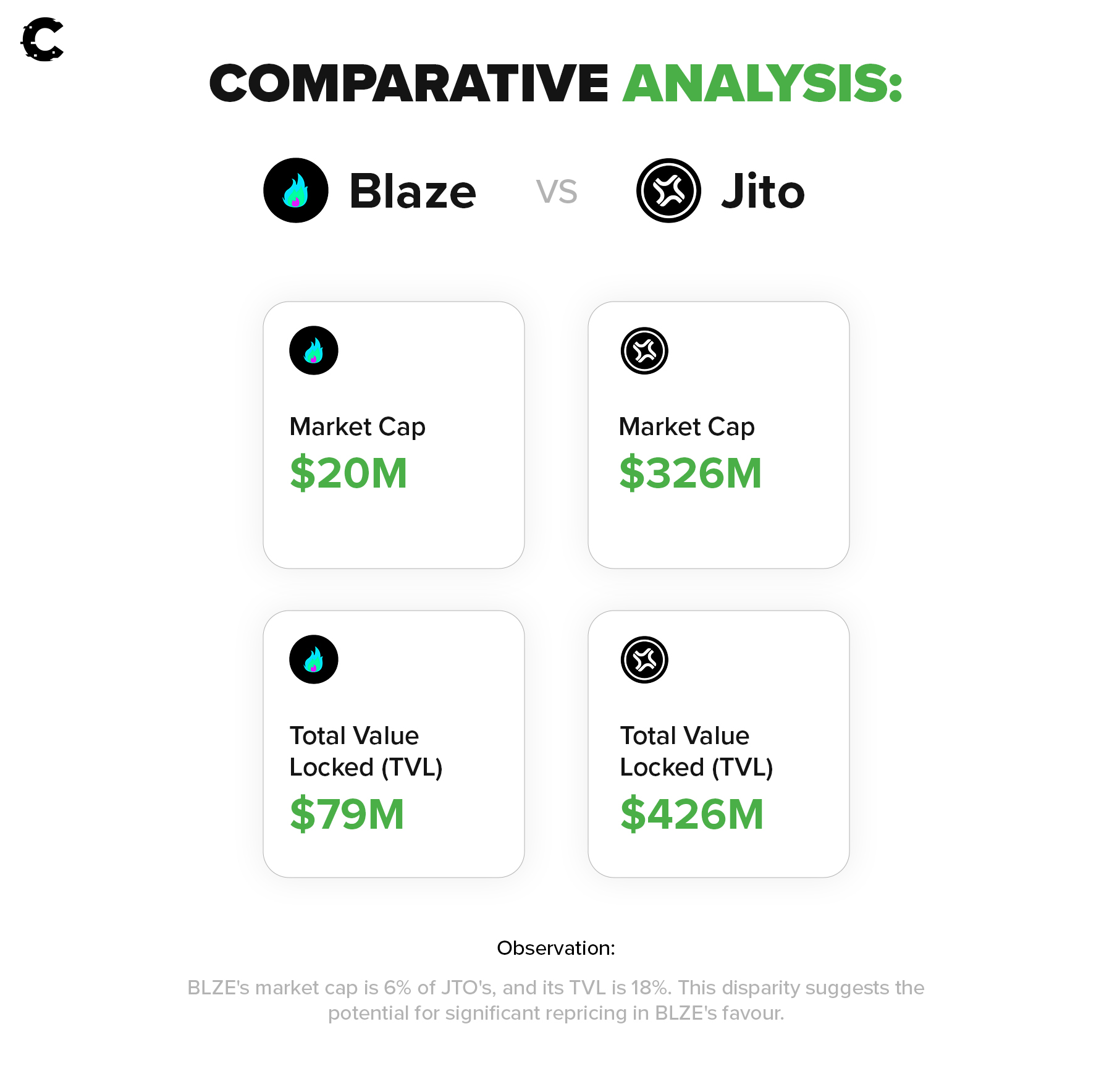

- Comparative metrics show BLZE is significantly undervalued relative to JTO.

- BLZE offers a short-term 3x return potential fueled by upcoming rewards for holders

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Introducing SolBlaze (BLZE)

SolBlaze is an innovative liquid staking solution within the Solana ecosystem. It offers a liquid staking pool for participating in a DAO-based treasury that aims to shape the future of Solana. By staking with SolBlaze, you get liquid tokens to plug into DeFi, earn rewards, and accelerate the adoption of DeFi on Solana.SolBlaze is gaining attention due to its upcoming rewards campaign. This is not Solblaze’s first rewards round; they did a snapshot months ago and have done continuous airdrop emissions.

This is, however, the first time that BLZE holdings will be included and the first time a point system will be announced.

The opportunity

SolBlaze has a small team, but the price action lately has been immense – in the last month, the token is already up more than 1600%. This is both a reason to be excited and to be cautious, and that is why we are positioning this as a trade.But why consider BLZE? Well, look at the comparative analysis between JTO and BLZE below.

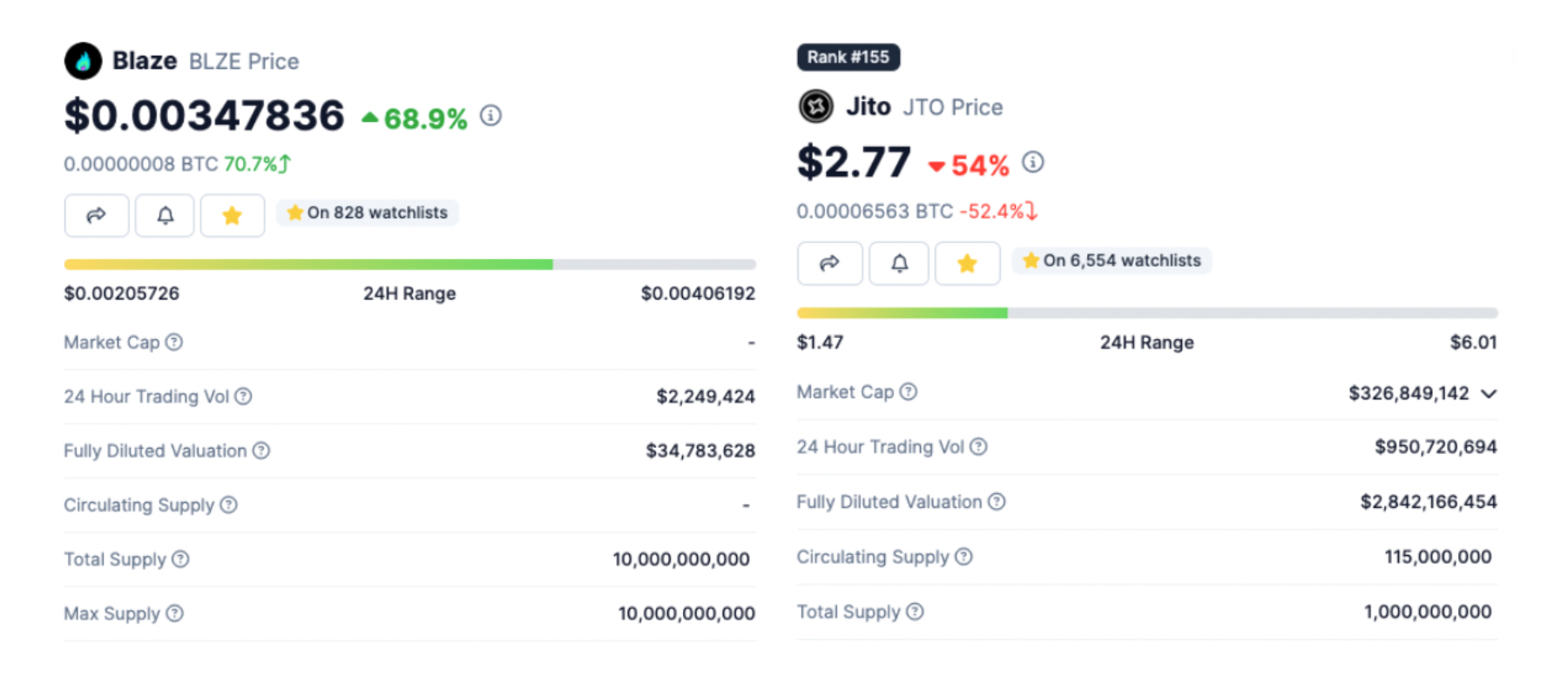

However, the circumstances surrounding this opportunity are rare and require communication. For one, Coingecko (below) does not showcase the circulating supply and corresponding market cap, but we are in direct communication with the team and know it is over 50% circulating.

However, the circumstances surrounding this opportunity are rare and require communication. For one, Coingecko (below) does not showcase the circulating supply and corresponding market cap, but we are in direct communication with the team and know it is over 50% circulating.

Lastly, BLZE is fully community-held, has no VCs, and is rapidly becoming more circulated.

Round number bias

Another key factor in this trade is the psychology of the market.BLZE's price is hovering near half a penny; there’s a psychological desire for it to reach 0.01 per token in the foreseeable future. This price milestone could be sustained throughout the bull market, providing a solid foundation for growth. 1 cent equals roughly $60M MCAP, pretty healthy.

SOl-staking is set to grow

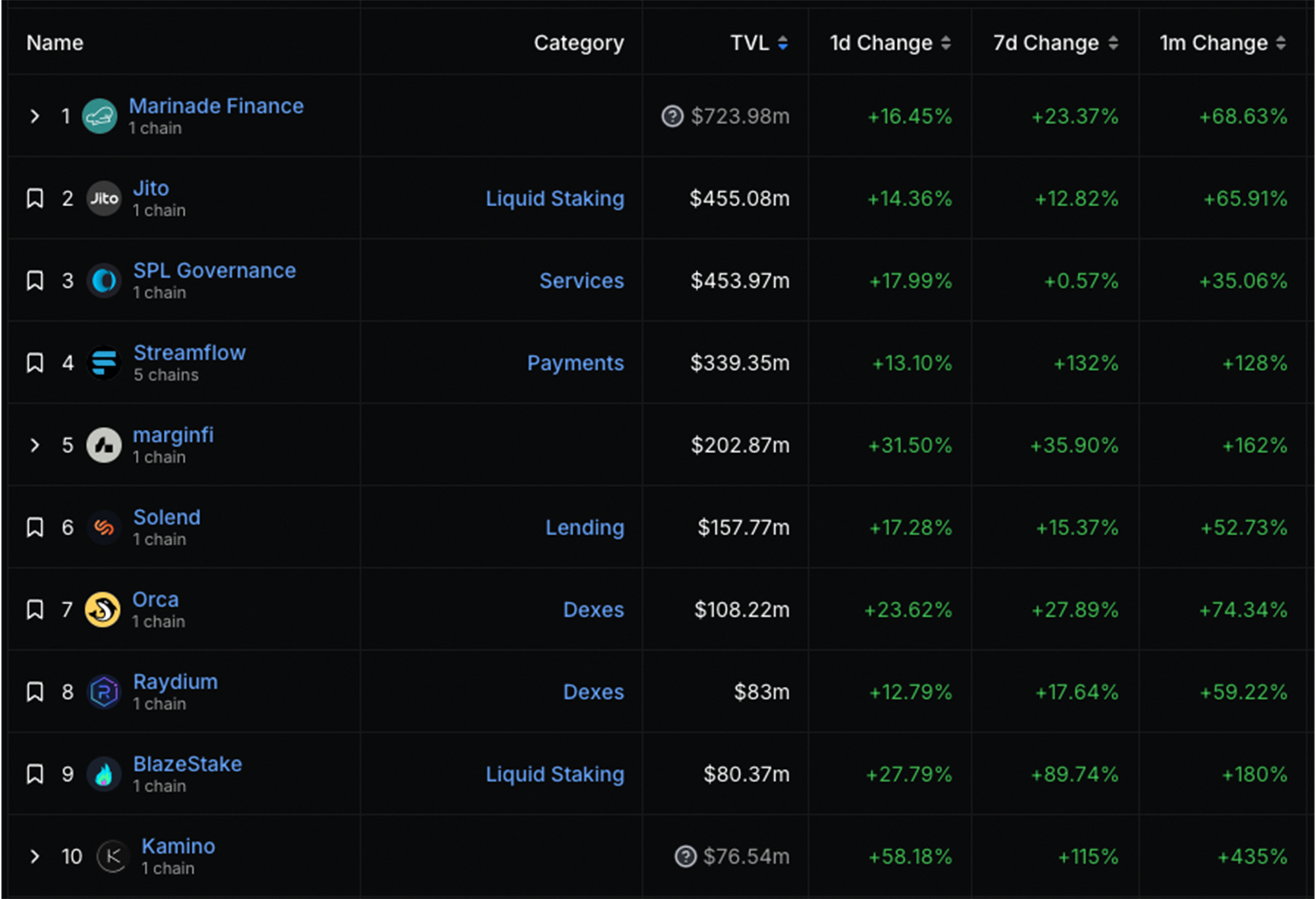

Solana just crowned itself as the #1 PoS chain by staked value. However, we should note that the overall staking rate for the Solana network is horrendously low. Staked SOL still stand at around 5%, which presents an opportunity for the entire Solana-based LST protocol community.Whether you believe in Marinade, Jito Labs or Solblaze – Sol-staking will continue to grow.

Market timing

The timing for this trade is optimal, as Jito Labs just completed its airdrop phase.The massive JTO airdrop has already created froth, pushing the market cap of JTO to extremes. People who missed JTO are looking for the next big thing. People who benefited from JTO are looking for similar opportunities. This confluence of desire for the next JTO-like opportunity makes this an ideal moment to consider investing in BLZE.

Liquid staking has been one of this year’s only performers. With SOL’s performance over the last few months, holders are itching to generate the best yield possible. This is key - Solana liquid staking is primed.

While most market participants focus on Marinade as the dominant Solana liquid staking protocol, we suggest leap-frogging and moving assets into BLZE.

If you were lucky enough to benefit from the JTO airdrop, we recommend selling 25-50% and re-capitalizing. If you missed that airdrop, stay tuned for our upcoming Solana Airdrop report.

FYI: Buying BLZE will count towards the upcoming rewards season. Staking SOL into bSOL and using it in defi will do doubly. Read the upcoming report!

Long-term vs. short-term perspective

While we maintain a long-term bullish outlook on Jito, we propose the BLZE trade as a short-term strategic move.Considering the current valuations, BLZE presents a potential 3x return opportunity, especially when juxtaposed with Jito's speculative high value.

Both offer services to Solana. Jito is more mature and feature-rich, but token funding and oversight come with that. The SolBlaze team is more daring and quick to iterate.

Cryptonary’s take

The shift from JTO to BLZE represents a compelling trade opportunity with promising returns, especially given the current market dynamics, SOL’s performance, and BLZE's upcoming rewards campaign.That said, BLZE is a short-term swing trade opportunity – as more information emerges, we may do a deep dive into the project to offer an investment thesis. But for now, if you are looking for a quick win as the JTO frenzy starts to cool off, BLZE appears to be positioned to deliver that jolt of energy to your portfolio.