It’s exciting to catch the perfect wave while surfing – thrilling. However, you've got to know when to ride and when to bail out! The adrenaline rush is real, but let's not get swept away in the excitement just yet.

Today, we're looking at six tokens from the recent pump. It's all about smart trading today, and we're here to ensure you're not caught in the undertow!

Ready to ride the wave?

Let’s jump in.

TLDR

- Recent market surge prompts evaluation of six prominent tokens.

- Unveiling potential overbought signals using technical indicators like RSI.

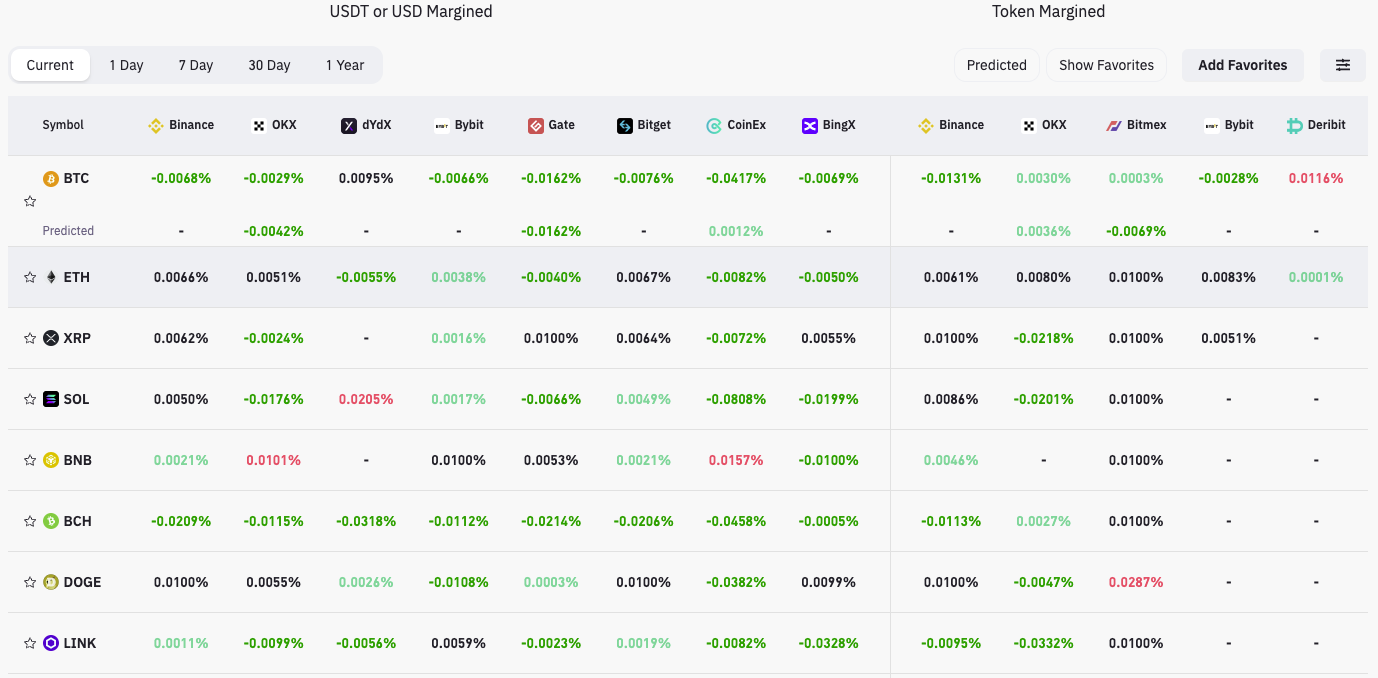

- Deep dive into funding rates to assess market health for each token.

- Tactical trading advice: when to ride the wave and when to exercise caution.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

Trading BTC | Bitcoin

Phenomenally interesting price action and understanding the mechanics of moving price is important to put together why this move has happened as it has.Technical analysis

Our initial feeling was that we'd move up to $27,100 and potentially reject from that area. We got there but then stormed higher and tested the $28,300 horizontal resistance. This $28,300 level is another crucial resistance area, particularly as it lines up with several MA's, which can also add to the resistance.

RSI

Bitcoin is moving into over-bought territory on the daily RSI here, with the 12hr and 4hr well into over-bought territory already.Funding rates

Over the weekend, we saw Open Interest (the amount of leverage being taken out) increase by $350 million, and funding rates go negative, so shorts were essentially piling in. A spot buyer then dived in at $27,100, which drove the price up, liquidated many of the shorts, and reset the funding rate.

Open Interest then reset, yet it has all built up again now at $28,300 with another $370 million Open Interest added and funding rates going deeply negative again. So, shorts have piled in AGAIN, which we think opens the door to see this squeeze higher for the second time. If BTC’s price got to $28,600, that would wipe out a lot of these newly built-up shorts.

Conclusion on trading BTC

Too many market participants do not believe this move and are therefore looking to short Bitcoin. Even though the RSI is hitting over-bought levels, we wouldn't be encouraged to short this, until the outstanding shorts have been wiped out and market expectations have been reset. We also would not long this, though, as we are sat at a crucial resistance of $28,300.Action points

We are still just watching. We only trade when we think opportunities are really clear cut, and for now, see where the market is, and there are several battles going on.The two key battles are the horizontal resistance of $28,300 and then the negative funding rates, where there can be another short-squeeze. If we do get a move up to, say, the late $28k, then we think this would reset the Open Interest and the funding rates, and that would then probably provide a better opportunity to short. Because of our macro opinion, we think it's hard to be really risk-on here. Hence, going long is risky because we believe it is trading against the macro trend.

Trading ETH | Ethereum

In our last Watchlist (last Friday), we called for ETH to move into the $1,700 level and test into the $1,745 horizontal resistance, and we've got exactly that.Technical analysis

A perfect breakout from the main red downtrend line. We then got above the $1,660 local horizontal resistance and have now cleared through until the more major horizontal resistance at $1,745.

Unless BTC can get another short-squeeze, we think ETH will have a bit more of a battle at this horizontal resistance of $1,745. What I'll be watching here is what sort of formation ETH’s price forms.

Do we reject immediately? Do we form a bear flag or a pennant? What do we get? For that, we will need more days of action. Let's see how it plays out.

RSI

Like BTC, ETH’s RSI is very close to overbought conditions on the daily timeframe and already into overbought territory on the smaller timeframes. This should encourage you to exercise caution, particularly as this last move higher was driven by BTC moving higher from a short-squeeze rather than having been driven from the Spot market.Funding rates

BTC has a deeply negative funding rate, whereas ETH is in a middle positive area. So, very varying here.The positive funding rate is a sign of better health here for ETH, particularly when you compare it to BTC, despite the fact that BTC's unhealthiness is what may actually drive it higher. We know it doesn't feel like it makes sense, but that is what it's telling us.

Conclusion on trading ETH

ETH looks healthier than BTC, in our opinion, which means it should reject or at least have a short-term price pullback from the $1,745 horizontal resistance.BTC's unhealthiness comes from the amount of shorts that have been built up, which are essentially vulnerable to a short squeeze. This could take the market higher. But, we think ETH is a better reflection of where the market is. We feel that's telling us to exercise more caution despite the fact that we could get that BTC short-squeeze.

Action points

We've had some nice breakouts of downtrend structures, but we won’t be getting long here. Again, this would be trading against the macro trend, in our opinion. We therefore recommend more caution.Trading SOL | Solana

Phenomenal move from SOL, but this is where we'd be booking profits if we had a position. It's possible we go higher and push towards the $25.98 horizontal support, but this move again has been futures-driven rather than spot-driven, and usually, that's not sustainable.Technical analysis

We crushed through the horizontal resistances at $19.90, $20.40, and $21.18. We thought these would provide some really heavy resistance, and we absolutely underestimated how much strength there would be in this.

Similar to ETH, we think this now needs to give us more data as to how it's going to form.

RSI

We're now in significantly overbought territory on the daily and also smaller timeframes. But, we have seen with SOL before that even in overbought territory, it can go and shoot another 10% or so higher. So, have this in mind: if you do want to short it, you'd need to have really wide stop losses and adjust your position sizing to accommodate this.Funding rates

Funding rates are pretty mixed here but mostly positive. So, not giving off any negative signs. Will continue watching how this evolves. However, nothing in this part to worry us that a short-squeeze may occur (unless it's BTC-driven).Conclusion on trading SOL

For this to go higher, it likely needs a short squeeze, and with funding rates where they are, it's not set up to do so.If BTC gets another short-squeeze (and it is more set up to do so), then this could give SOL some more fuel to go higher and potentially run into the resistance at $25.98.

However, mostly, we would be very cautious here. The whole move hasn't been very sustainable and driven by futures rather than Spot, which isn't usually too positive.

Action points

Doing nothing for now on SOL. If it does get up to $25.98, and the funding rates are positive and close to 0.01%, then we would look to open shorts around that horizontal resistance at $25.98.Trading LINK | Chainlink

LINK has had a monstrous move up over the past few weeks, which, in our opinion, is now showing some signs of exhaustion.Technical analysis

A clean straight uptrend has broken out of the red downtrend line. We've cleared through all of the resistances and finally look to have some more meaningful resistance at the $8.07 horizontal resistance.

We have, however, remained in the uptrend. So, it's possible that we get a slight pop higher. We are thinking back to the $8.30 area before eventually breaking down.

RSI

The RSI has just pulled back from overbought conditions. We are now looking for a move back to the $8.30, which we think will give us a higher high in price and a lower high in the oscillator (so a bearish divergence) that may then provide a good short opportunity for LINK.Funding rates

Funding rates are mixed but mostly positive, so there is not much to take from this.Conclusion on trading LINK

As opportunities go, we like LINK the most. If we can get that higher high in price and the oscillator gives us the lower high, then we may begin actively looking for shorts around $8.30.Trading RUNE | Thorchain

RUNE can be a frightening play if you're in our shoes looking for shorts, as it is one of those that can go ballistic.Technical analysis

A perfect hold of an uptrend so far, and having cleared all of the resistance, we now find ourselves in the last major resistance zone. After there, there is relatively clear headway up to $2.90. We are looking at the $2.20 to $2.27 area as a possible resistance zone, with $2.46 as another level.

Ultimately, RUNE looks overextended here, but how much more it can go is really tricky to identify. We certainly wouldn't be looking to add long here.

RSI

The RSI is quite clear. It's overbought, and we’ve now hammered out 3 bearish divergences. Not positive for further price upside. We'd really exercise caution here.Conclusion on trading RUNE

As mentioned already, this does look over-extended. It's possible it does run further, but you couldn't pay us to long this here. It's overbought and created a number of meaningful bearish divergences.Action points

If we do see the price move higher, and we mean towards the $2.30 region, we may begin looking for some small shorts.In terms of shorting, RUNE isn't one we'd play with massive size simply because it's capable of moving further than you expect, and this can be costly when on the wrong side of it.

Trading ARB | Arbitrum

ARB has moved relatively well, and if we are honest, it probably surprised us, considering how weak we think the overall play is.Technical analysis

We have seen ARB clear above its horizontal resistance really nicely, with the $0.92 being the more major one. We've now also got above the main red downtrend line and looked to be heading to the $1.05 horizontal resistance.

RSI

The RSI is approaching over-bought areas, and on the smaller timeframes, it's already in over-bought areas.Conclusion on trading ARB

ARB has performed relatively well and definitely performed better than we expected. We thought we'd see more major resistance at $0.92.Despite its more positive performance, if we had a position, we would look to take some size/risk off the table at the $1.05 horizontal resistance if ARB can get there. If it does get there, it'll likely be heavily overbought and looking somewhat exhaustive.

Let's see if it does get there and re-analyse then. Look out for over-extensions and bearish divergences forming; these could be key.

Cryptonary’s take

Today, we have charted:- BTC

- ETH

- SOL

- LINK

- RUNE

- ARB

As always, thanks for reading. 🙏

Cryptonary out!