- Is a major altcoins season upon us?

- Will there be a slight consolidation first?

- If so, could we use it as an opportunity?

All in all, we're looking good.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

This week's data + Powell and Fed-speak

While the economy and markets are in a 'Goldilocks' environment, risk assets can continue to do well, particularly crypto, which is currently benefitting from the halving narrative and the major inflows from the ETFs.Looking at the data, the key data this week is the employment data, which will be out on Friday.

The expectation is for the number of jobs added in the US to be 200k, with Unemployment staying at 3.7%. We've now also just seen ADP jobs come in at 140k, so the numbers still suggest strength in the labour market.

On Monday, we had Fed member Bostic speak. He suggested that the Fed should stay somewhat resilient with Interest Rates, i.e., not cut them too soon, as there is “pent-up exuberance” amongst firms to hire and expand further upon Fed rate cuts—they’ve been given the green light from the Fed to grow their business.

Powell today reiterated something similar: He sees rate cuts in 2024 as "likely appropriate" but that the Fed doesn't expect to cut rates until there is "more confidence in inflation moving down to 2.0%."

Powell has also noted that the labour market is strong, and the Fed could ignite inflation further if it cuts too early. This suggests to me (Tom) that the Fed probably won't cut 100 basis points (4 x 25bps) this year but maybe will just cut once or twice.

Remember, as well, they won't want to cut in Q4 or late Q3 as they'll risk being called politically motivated.

Now, risk assets will need to price this in, but while the economy holds up and corporate earnings remain, risk assets can continue to do well despite only one or two Interest Rate cuts this year.

Yesterday's price action

As many of you will know, we have been advising some caution in the past two weeks—not to sell our Spot bags but to be careful on the leverage front. This is because the amount of Open Interest (leverage) in the system has been extremely high while Funding Rates have also been very high.This means that the overcrowded position/trade is to be Long (people betting for the market to go up). With the high amount of Open Interest, this also means a small move down in price could liquidate some Longs. Then, suddenly, you see a Long liquidation cascade - this usually results in price drawing down substantially. That is exactly what we saw yesterday.

These metrics told us the odds of this event had significantly increased; hence, we suggested being very cautious about using leverage, as many traders were liquidated yesterday (lost their money).

However, the leverage and Funding Rate weren't reset after yesterday's move down to $63k from the all-time highs. But upon the move down to the $57k to $58k area—where our Yellow Buy Box for Bitcoin was—we saw the leverage be flushed out and the Funding Rate reset. This was a perfect touch of our Yellow box.

Price has since bounced to $66,800 (at the time of writing). Unfortunately, Funding Rates and leverage have also massively picked up again in the last 12 hours, so we may be set up for another deleveraging event sometime in the next 5-14 days.

Therefore, the game plan remains the same: stick to Spot trading and refrain from using leverage while the market is like it is currently.

BTC Funding Rate

BTC Open Interest

Market metrics

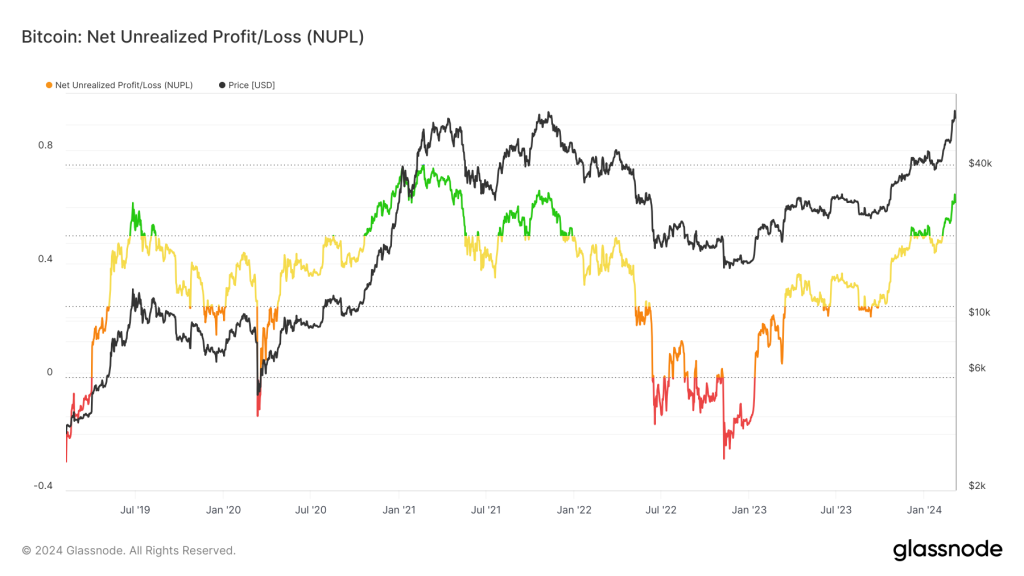

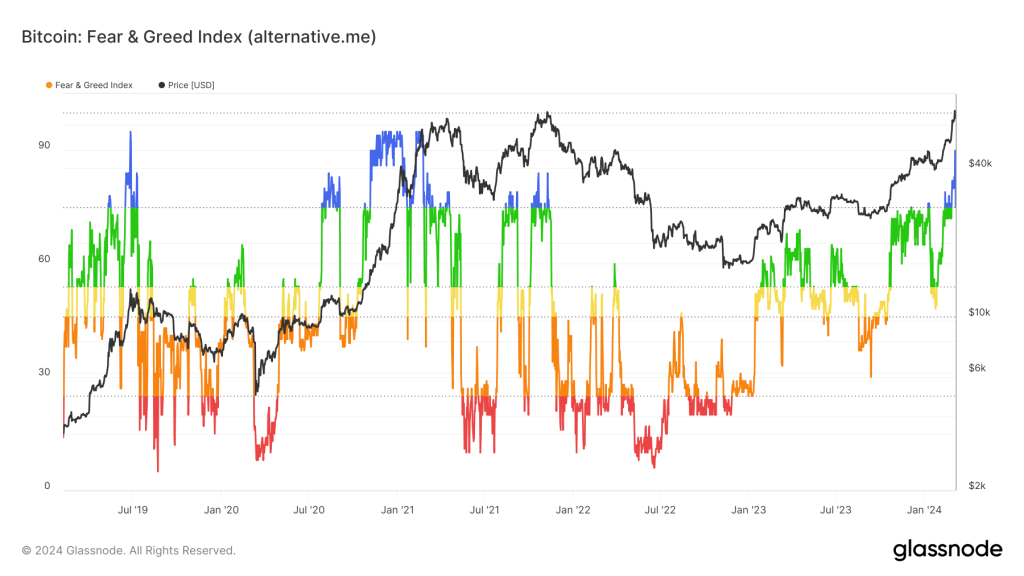

In providing an update on this market aspect, we still see that the market indicators and market metrics are hot, indicating an overheated market. These metrics do need to be reset somewhat.The ideal scenario here would be for BTC to consolidate between, say, $57k and $69k for the next few weeks/month, allowing these metrics to pull back from very overbought levels, especially considering how early in the cycle we are.

The metrics we’d like to see reset in some form are:

- Net Unrealised Profit/Loss

- Fear & Greed Index

- Percent Addresses in Profit (slightly less concerned about this one)

Fear & Greed Index

Percent Addresses in Profit

Cryptonary's take

Despite being somewhat cautious about some signals in the market, we are very bullish mid-term and long-term overall.We expect Spot positions to continue performing well, especially beta plays and the riskier side of the risk spectrum - altcoins, memes, etc.

We suggest continuing to let Spot positions run, even if the majors consolidate in the coming weeks. We'd suggest buying any major pullbacks. For now, we're exercising caution on using leverage, as flush outs and volatility will be significantly greater in the open interest environment.

If we look at ETH/BTC on the 3D chart, it's in a really nice spot. If it can break above 0.0597 (which we expect in the coming weeks/months), we expect it to move considerably higher—altcoins will run.

ETH/BTC 3D

Total 3 is the crypto MCap excluding BTC and ETH, so ALTS.

This may need a slight pullback or consolidation in the coming weeks, but this is another we expect to go considerably higher in the upcoming quarters.

Total 3

When we look at the indices we have created, the Large Caps Index (excluding SOL) is just beneath horizontal resistance.

If we get a breakout, we can most likely see an explosion in altcoins. This may take more time, but in my mind (Tom), a breakout of the horizontal resistance on this chart above 22.00 would be the real kick-off for the altcoins season.

If there is a period of consolidation or even a slight pullback into the late $ 50k—early $60k range for BTC, we'd suggest allocating it to new alt positions.

Large Caps Index, excluding SOL