We dove deep into the latest market dynamics, analysing the health of the top digital assets and identifying exciting short-term trading opportunities.

Strap in because this crypto market is gearing up for some serious volatility and potential upside.

Time to go!

TLDR

- Bitcoin's funding rates have spiked, signalling increased leverage in the market, though we would prefer to see more spot-driven buying fueling the rally.

- Ethereum faces a key resistance level at $3,640, and a breakout could pave the way for a retest of $3,960.

- Solana has shown healthier on-chain metrics than BTC and ETH; a dip below $160 could present a buying opportunity.

- Among altcoins, Arbitrum is shaping up as an attractive short-term trade, with the potential to surge past $2 if it can clear $1.69.

- Meanwhile, Chainlink is coiling up to make a move, with its major buy zone between $13-$14 still intact.

- POPCAT is nearing a pivotal level at $0.38, which could unlock the path to the elusive $1 target.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

BTC

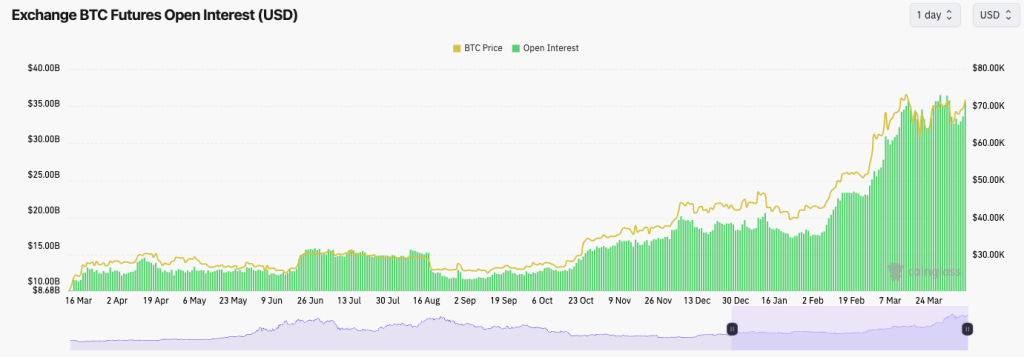

The Funding Rate has kicked up here, having been flat at 0.01%, now at 0.0380%, indicating a quick and increasing bias to long BTC here. This is less healthy than we have seen recently.In terms of Open Interest (the amount of leverage), this has moved significantly higher in the last 24 hours. The move-up in Bitcoin's price in the last 24 hours has mostly been driven by leverage rather than by Spot buying; we'd ideally prefer the opposite.

Bitcoin Open Interest:

Technical analysis

- From a pattern formation perspective, we were unsure if the current formation was a pennant pattern or a bull flag. Both are bullish if price breaks out higher.

- We can see in the chart below that it looks like it was more of a pennant, and that price is trying to break out above the top border. A breakout target would be the green box between $79,200 to $81,400.

- To see a breakout confirmed, we will likely need the rally to be Spot-driven and to close larger timeframe candles (12hr and 1D) above the current high of $73,600.

- With price breaking above the $69,000 horizontal resistance and now also getting above the top border of the bull flag/pennant pattern, this is a bullish sign that we could see further and more significant upside ahead.

- The RSI is also in middle territory in the Daily, although the 3D and the Weekly remain in overbought territory.

- If price rejects from the current level, we would expect $66k and then $63k to act as support in the short term.

Cryptonary's take

Looking at this current move, it looks as if it can go substantially higher.However, I (Tom) still have a certain level of scepticism here as I appreciate we're still relatively early in the cycle, not even at the BTC halving yet.

Ultimately, we would look to add Spot if there was a larger pullback - the Yellow Buy Box at $60k was our target area to add to positions. We still hold Spot positions and expect substantial upside for Bitcoin over the coming 6 to 12 months.

ETH

- ETH's Funding Rate has also increased substantially– now up to 0.0345%. This isn't super high, but it's far higher than the 0.01% we saw just half a week ago. This indicates the traders have piled into Long positions.

- The Open Interest on ETH has also risen considerably, indicating that this move has been driven more by leverage rather than spot buying. This is okay. Of course, seeing it be a Spot-driven rally rather than leverage-driven would be much more positive.

Technical analysis

- We previously identified ETH as potentially being in a bear flag pattern, which usually tends to break to the downside.

- But, price has bounced off the bottom border and now performed very well to get back above the horizontal resistance of $3,525 and into the upper channel of the flag.

- There seems to be a local horizontal resistance at $3,640, so this may be a sticky point for ETH to clear in the very short term.

- ETH perfectly filled/touched its major Yellow Buy Box, so this was the area to add to your positions.

- The RSI is relatively positive. The Daily and the 3D are in the middle territory and not overbought, whilst the Weekly is just slightly below overbought territory.

Cryptonary's take

If ETH can close today's candle closure positively (above $3,640), this may open the door for price to retest $3,960.We wouldn't look to add ETH at the current prices, but we would keep holding our Spot positions for now. Let's let ETH find itself here.

Can it make that more substantial move higher or not? If not, we expect the Yellow Buy Box to be filled again, but if BTC can break out and drag the rest of the market with it, ETH can also likely move higher.

SOL

From a mechanics point of view, SOL looks much better than BTC and ETH. The Funding Rate is at 0.0190%, which is relatively okay. There is a slight bias amongst traders to be Long, but certainly not overcrowding of positioning—healthy.The Open Interest is up slightly but not near the recent highs. This suggests less leverage has piled into SOL, especially in comparison with BTC and ETH. SOL, mechanics-wise, is a healthier setup than BTC and ETH.

Technical analysis

Interestingly, SOL broke below its bullish pennant pattern and refilled the Yellow Buy Box again - this is why it's always great to have buy orders in the Yellow Boxes.

Price is now attempting to reclaim the pennant but is finding the underside of the bottom border of the pennant as resistance.

If SOL cannot break back into the pennant, then a rejection is likely, and a retest of the upper Yellow Buy Box is likely a minimum. If we were to get a rejection, anything under $160, I (Tom) would look to add to my SOL bags.

The RSI is okay. It is in the middle territory on the Daily and overbought on the 3D and Weekly.

Cryptonary's take

If SOL breaks out higher, that would be fantastic. Still, I (Tom) would prefer to see another rejection, price consolidate for another couple of weeks, and then make a larger breakout in May, as I would see this as a healthier move to go into the Bitcoin halving. However, if BTC breaks out higher, it'll likely drag the rest of the market, including SOL.We're not looking to sell SOL Spot bags; if anything, we'd like to continue adding, particularly if the price falls below $160.

We still believe serious alpha exists in the SOL ecosystem plays and SOL meme coins.

ARB

- Chart-wise, ARB looks really clean here.

- ARB has trended lower and filled a major Yellow Buy Box between $1.39 and $1.50, which has been positioned for a long while and has finally been filled.

- Price is now attempting to move higher, having broken out of the local red downtrend line, while price also formed a bullish divergence just slightly above oversold territory.

- As a trading opportunity, this looks great to go higher in the short term.

- There is a relatively meaningful horizontal resistance at $1.69, just above the current price. However, if price can clear above this level, this would open the door for a move higher to $2.00.

Cryptonary's take

Long-term, I (Tom) am not a huge fan of ARB because I believe there are better opportunities elsewhere. However, in the short term, ARB looks like it could go higher from here, particularly if BTC breaks out of the all-time highs. ARB is an attractive trading opportunity here.LINK

- LINK has filled its local Yellow Buy Box several times now, and price has been able to bounce each time.

- LINK is now squeezing into the pinpoint where the horizontal support of $17.70 meets the red downtrend line. It can have a volatile move once price breaks out or goes down.

- If price breaks out of the red downtrend line, we would expect a relatively swift move back up for price to $22.00.

- Ultimately though, LINK is one of the coins whose major Yellow Buy Box between $13.10 and $14.10 hasn't been filled yet.

- The RSI has been reset for all major timeframes. This is a good setup to potentially see a more substantial upside for price in the short and medium term.

Cryptonary's take

Setup-wise, LINK looks relatively positive here.The full bullish mode would be on a break out of the red downtrend line and then a break of the local high at $23.00. If you're under-exposed to LINK or have no exposure, LINK may be a good opportunity to diversify away from SOL and the SOL ecosystem. I (Tom) personally have a small bag of LINK. I am considering adding a small order that adds slightly to my overall position at today's price for LINK.

POPCAT

- In recent days, POPCAT broke beneath its long-term uptrend line, initiating a further price sell-off.

- Price has then since broken out of the red downtrend line and reclaimed the main uptrend (above the yellow uptrend line).

- Alongside this, price has also reached the key horizontal level of $0.2688.

- Between $0.27 and $0.34 is a really key zone for price. Above it, POPCAT can see serious upside, below it, and we could see more substantial downside.

- We'd like to see a potential retest of $0.27, but not to lose/fall below that level, and then for price to bounce from there and push higher to $0.38.

- At $0.38 is a key horizontal resistance level. If price can clear above that level, then this opens the door for a move up to $0.45 and then for price to potentially move on to $0.55. But, that $0.38 horizontal level, and price clearing above that level, is really important for price to get above of.

Cryptonary's take

As usual, we have had to stomach some serious volatility over the past week or so. Price is now back into the low $0.30s, having been at $0.013 in the first few days of March. It's not bad overall. What we'd love to see here is for price to consolidate for a day or so between $0.30 and $0.34, although we don't mind tests of $0.27 as long as price can bounce from there. If we get this, then we'd feel confident that price can break above $0.34 and give the horizontal level of $0.38 a really good battle in terms of price then potentially getting above that level.If that can be achieved, then it's $0.45 and beyond that, who knows?

We're confident here holding POPCAT, and we believe it has the potential to reach the $1 mark, if not substantially higher.