In today's update, we'll cover some general topics and how they relate to some of this week's key data points that the markets will be watching closely.

Bitcoin is likely to be highly responsive to the macro data this week. The data will help us decipher whether a September Interest Rate cut from the Fed is more or less likely. It's a big week to dial in.

LET'S GO!!!!!!

Key questions

- Is the Fed's balancing act between inflation and recession about to tip? Discover how this week's crucial job data could reshape the crypto landscape.

- What's the hidden link between job openings and Bitcoin's price? Uncover the surprising connection in our deep dive into JOLTS data.

- Are we on the cusp of a major shift in interest rate policy? Learn why Friday's unemployment figures could be a game-changer for crypto investors.

- Is the bond market signalling a Trump comeback? Explore how election fears are silently influencing your crypto portfolio.

- Ready for Bitcoin's next big move? Find out why we're eyeing a specific price level and what it could mean for your trading strategy.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Staying fixed is essentially tightening

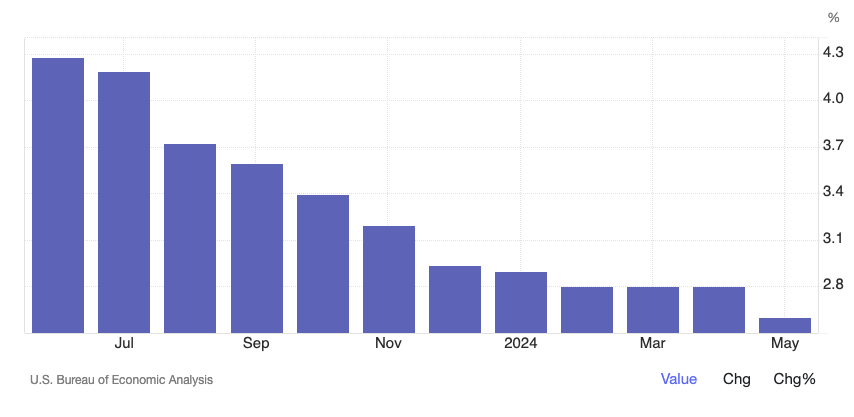

Many of you will know that the Fed has raised Interest Rates in response to much higher-than-expected inflation over the past few years.Raising rates increases the cost of borrowing money, which should squash demand, which then results in lower prices. We're now a year after the Fed's last Interest Rate hike, and the Interest Rate is at 5.50%, while the Fed's preferred inflation data point is at 2.6%, having trended down for the last year.

Core PCE Price Index

This means that the real rate in the US is 2.9% (5.50% minus 2.60%). This is a restrictive policy.

Now, while the labour market is holding up, a restrictive 2.9% 'real rate' puts pressure on businesses and consumers in the form of higher costs to service their debt. This means that the consumer has less disposable income to spend, which means corporate revenues decline, which means businesses have to cut costs (layoffs). You get the picture; it's a spiral effect.

The Fed is currently managing these dual risks of not staying too tight (high Interest Rate) for too long, or they risk pushing the labour market/economy over the edge and into a recession, and the other risk of cutting Interest Rates too soon, and they end up letting inflation move back up having not killed it.

So, we're constantly watching the inflation and the labour market data, and the market is pricing in the incoming data. This is key for us to get crypto correct, as crypto is a macro asset. Getting the macro analysis right will help substantially in getting crypto right.

Key data the markets will watch this week

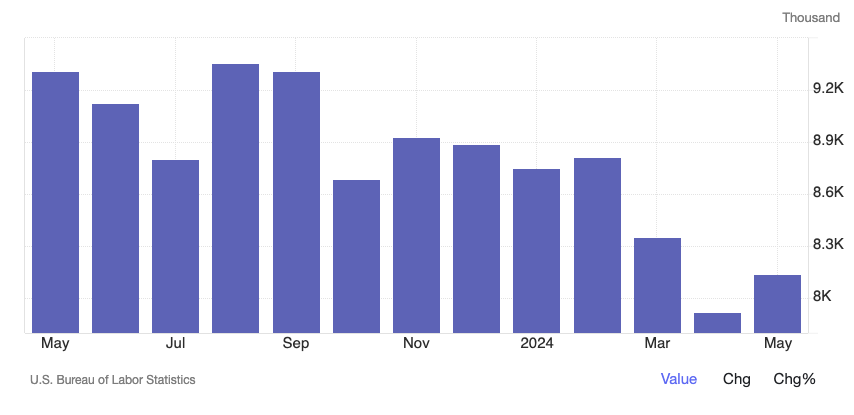

Today, we have the JOLT's Job Openings data out. It came out slightly higher than expected at 8.14m. However, it is still mostly in a downtrend, indicating that there aren't as many jobs available for new workers as before.In the past, a falling JOLT has been a precursor to the increase in the unemployment rate.

JOLT's Job Openings

A slightly hotter print today, but it's still in a 12-month downtrend.

However, the key labour market data is available this Friday. We have non-farm payrolls and the unemployment rate. The expectation is for the Unemployment Rate to remain unchanged at 4.0% and for Non-Farm Payrolls to be 160k, well below last month's 272k print.

If these figures come in 'strong,' i.e., a 4.0% Unemployment Rate (or less than 4.0%) and Non-Farms at north of 200k-220k, that'll indicate a still strong labour market. It'll encourage the Fed to maintain the Interest Rate at 5.50% for more time. The markets would likely sell down a tad.

However, the opposite, so a higher Unemployment Rate and Non-Farm Payrolls under 160k, would suggest that the labour market is beginning to weaken and that the Fed needs to start forward-guiding Interest Rate cuts to make the 'real rate' less restrictive in order to start providing some relief to the labour market.

If the data comes in weaker, then the market will likely rally, as the data will suggest the Fed needs to cut Interest Rates. However, this form of Interest Rate cut would be a moderation of the rate rather than a 'panic cut'.

Rising bond yields re-pricing for a Trump win

In the last few days, long-end Bond Yields have re-priced higher. This is likely due to the Bond market re-pricing for a potential Trump win in the November election and a Republican sweep.If this were to happen, and for now, it seems more likely following Slow Joe's (Biden) performance last Thursday, the Bond market realises that Trump's policies will be more inflationary.

With the US currently running a large deficit, the bond market's re-pricing suggests that investors want to be compensated with a higher yield to hold longer-term US debt. A rise in longer-term US Bond Yields is bearish for risk assets.

So, until the last few hours, Bitcoin has performed well in holding up (not moving significantly lower) under the pressure of these rising US bond yields.

US 10Y Bond Yield

Cryptonary's take

We're still constructive on the market, having added to our longer-term Spot positions on any meaningful dips; as we see Q3 and Q4 to likely be positive for crypto, we are also maintaining an element of patience.Bitcoin is likely to be data-driven in the short term, depending on whether this week's labour market data is hot or cold.

Bitcoin has found resistance at the top border of the bear flag, which also converges with the horizontal resistance of $63,400. We're looking for Bitcoin to pull back and potentially retest the $58,500 - $59,000 level again. This would be the formation of a lower-low in price and a higher low on the oscillator - a bullish divergence and likely printing it in oversold territory. This would be a bullish setup if we were to get it.

BTC

However, we still strongly believe that price action will be dependent on the data this week, and that's why it's so key to understanding what the data means as soon as it's released.

Summary breakdown:

- Hotter data (lower Unemployment Rate, higher Non-Farm Payrolls) will likely be bearish for Bitcoin and crypto.

- Softer data (higher unemployment rate, lower non-farm payrolls) will likely be bullish for Bitcoin and crypto.