Market Analysis

Some very important levels were lost last week, and unless they’re reclaimed, the market will experience a pullback in the coming weeks.

In this week’s report, we go over targets and invalidations for our top picks.

TLDR 📜

- We’re testing a new charting format. You’ll find everything on each chart in one glance.

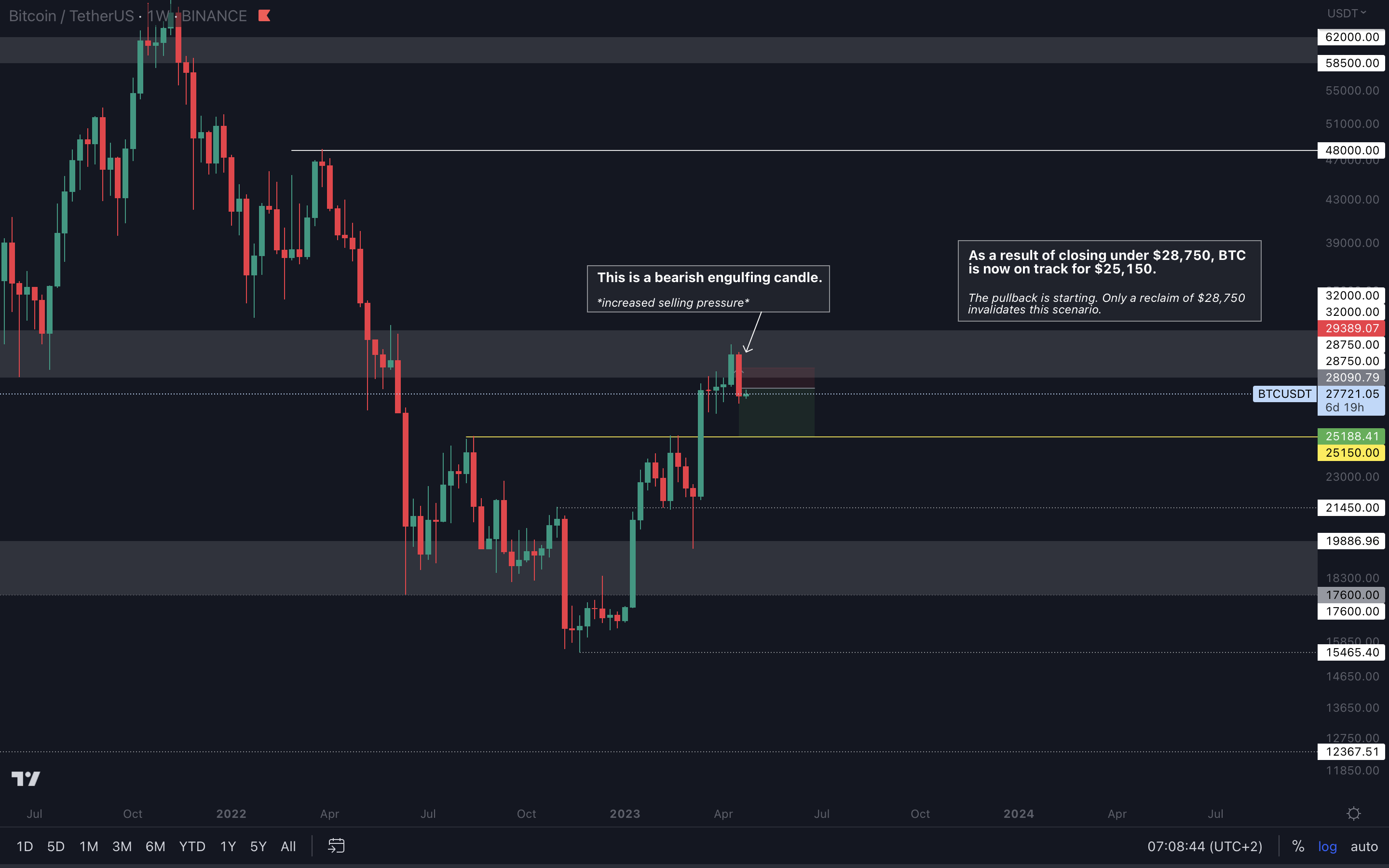

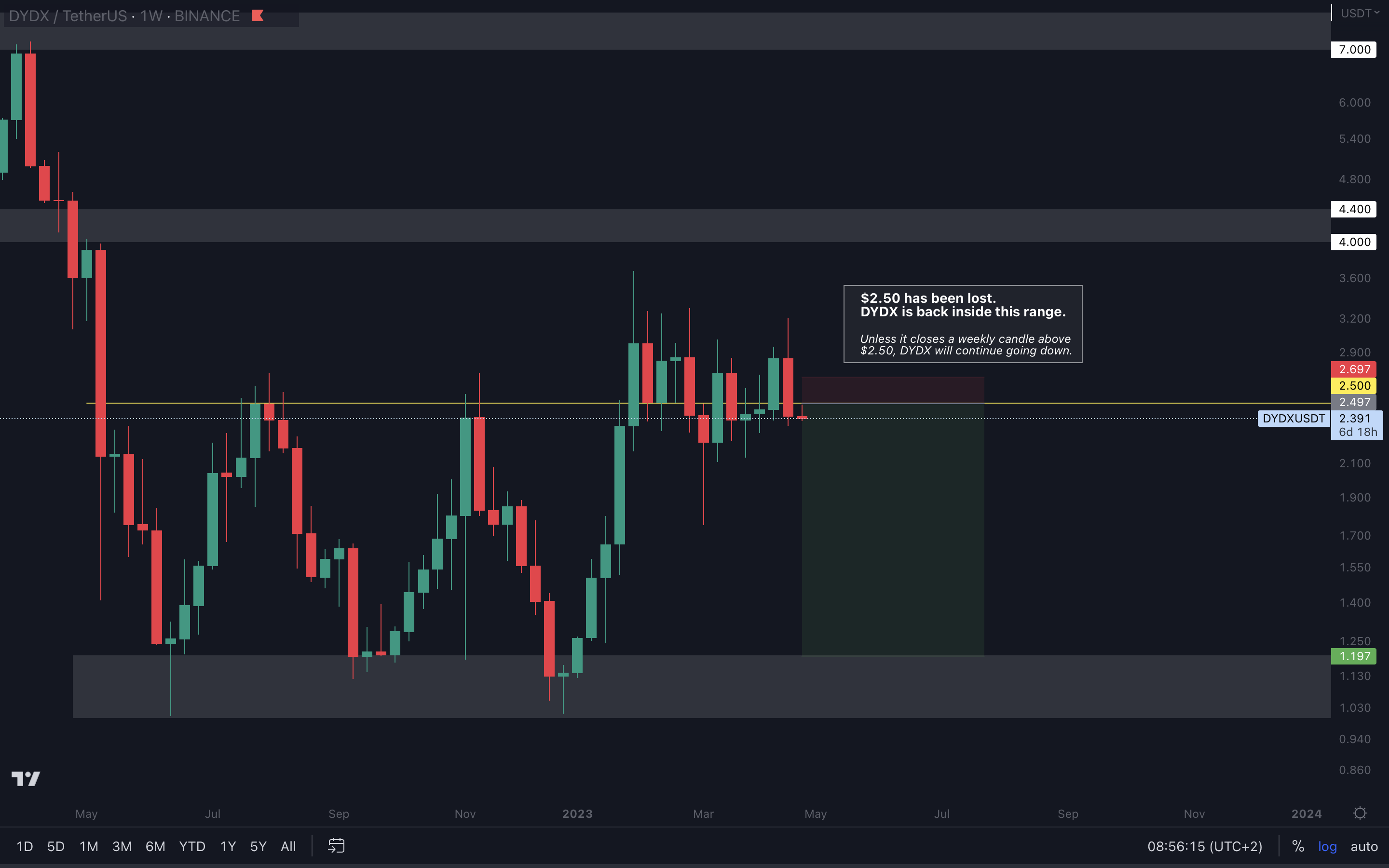

- Total Market Cap, BTC, RUNE, DYDX, PENDLE, DOT, OP, LDO, ASTR, and MINA all closed as bearish engulfings last week, in which an up candlestick is followed by a larger downward candlestick that engulfs the smaller one. This pattern suggests increased selling pressure, and these asset prices will likely continue descending in the coming weeks.

- ETH lost $2,000 as support. It is now on track for $1,740 unless $2,000 is reclaimed (weekly closure above this level is required).

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance” by Cryptonary sometimes uses the R:R trading tool to help you understand our analysis very quickly. They are not signals and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

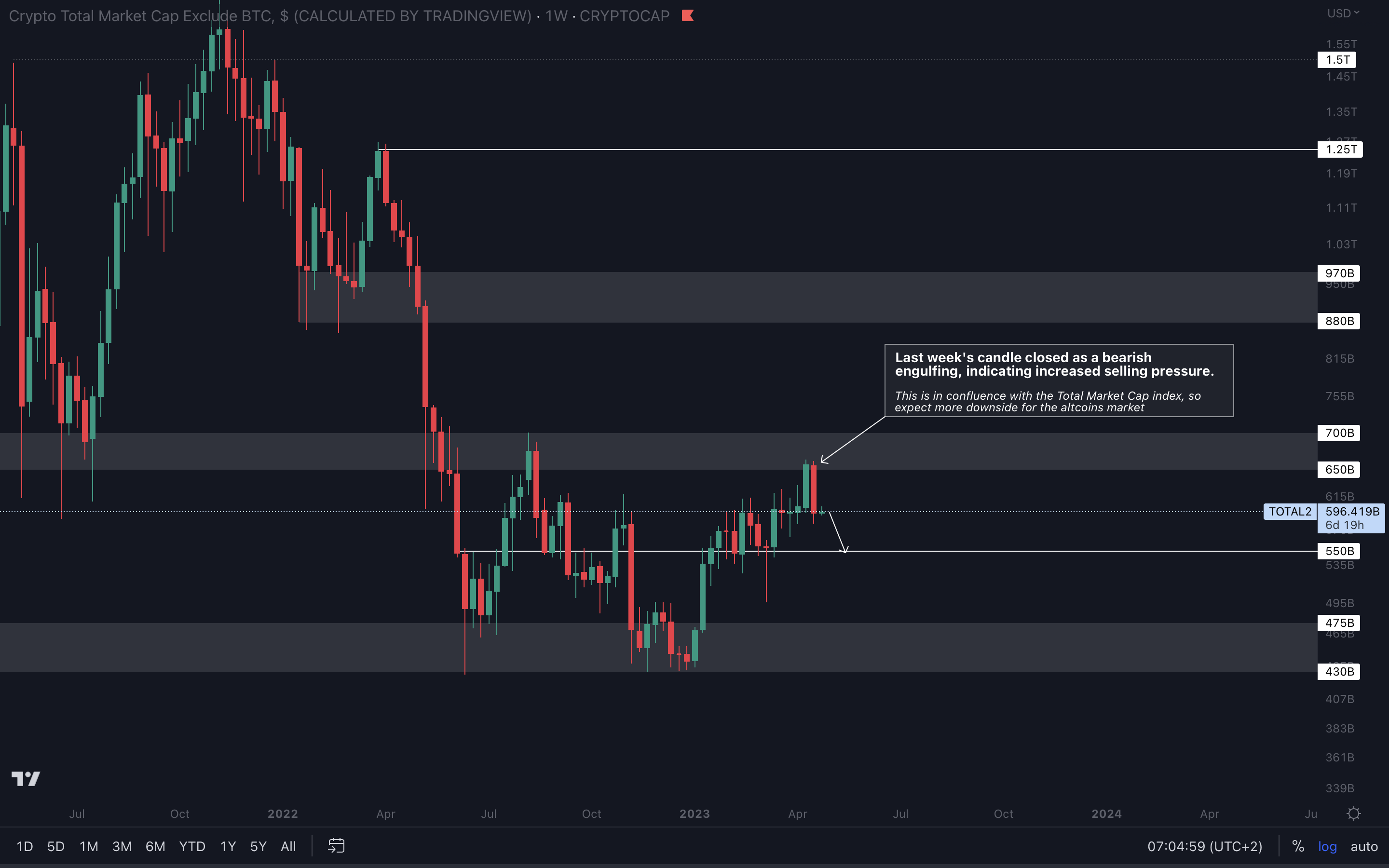

Total Market Cap (Weekly)

The Total Market Cap index represents the entire cryptocurrency market. We track this index to understand where the market is now and predict where it will likely go next.

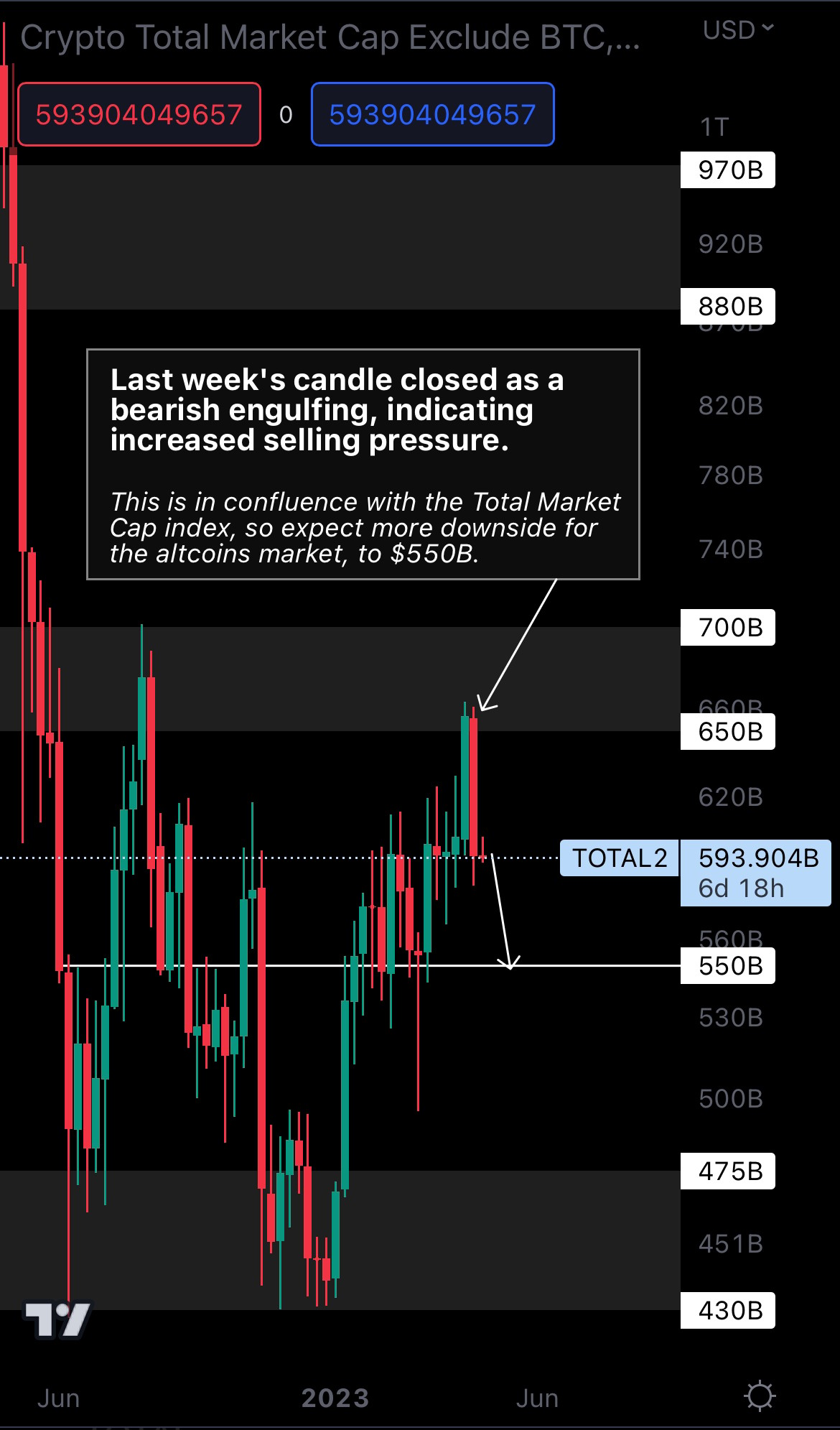

Altcoins Market Cap (Weekly)

The Altcoins Market Cap index represents the entire evaluation of the altcoins market (all coins other than BTC).

Cryptonary's Portfolio

BTC | Bitcoin (Weekly)

ETH | Ethereum (Weekly)

DYDX | dYdX (Weekly)

LDO | Lido DAO (Weekly)

HEGIC | Hegic (Weekly)

PENDLE | Pendle (Weekly)

Cryptonary's Watchlist

DOT | Polkadot (Weekly)

RUNE | THORChain (Weekly)

SOL | Solana (Weekly)

SNX | Synthetix (Weekly)

SYN | Synapse (Weekly)

MINA | Mina Protocol (Weekly)

Astar | ASTR (Weekly)

THOR | THORSwap (Weekly)

OP | Optimism (Weekly)

Cryptonary’s take 🧠

Cryptonary’s take 🧠

When the market tells us something, we always listen. As bears regain control, we’ll likely witness a red market for a few weeks.

We believe a pullback is necessary to keep the trend healthy. It gives us an opportunity to get in lower and it’s beneficial to avoid a market exhaustion dynamic in which prices are overbought, leading to a fast descent.

Action points 🎯

- As soon as BTC reaches $25,150, alts will likely find support as well. This is when you’ll want to start buying, not before.

- Altcoins will experience a much more aggressive drop compared to BTC. If you believe you’re overexposed in the altcoins market, reducing that exposure is ideal.