Why you should read this report

- This report examines the compelling evidence suggesting that the crypto market is about to enter a thrilling new phase, with Bitcoin leading the charge.

- Jackson Hole sneak peek: What might Powell's speech signal for crypto, and why could it be a "Goldilocks" scenario?

- The halving effect: Is Bitcoin's post-halving rally just getting started? We explore the historical patterns.

- Interest rate shift: How a potential new cutting cycle could fuel a crypto boom.

- On-chain insights: What are key metrics telling us about Bitcoin's current market position?

- Bitcoin dominance: Is the lack of an "alt season" actually a bullish indicator?

- Macro view: August's short-term noise might be masking a much bigger picture for patient investors.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

This week's data

We don't have any primary data this week. But we do have a lot of secondary data, which is becoming increasingly important as the market constantly monitors data for more evidence of a 'soft' or 'hard' landing. We then have Jackson Hole on Friday, which is a major event.This week, we have several Fed speakers. However, Powell's speech on Friday at Jackson Hole is the most significant of these. So, we'd expect the significant message to come from Powell on Friday rather than Fed speakers this week.

Therefore, this week's Fed speakers will likely continue in a similar tone as they have recently, i.e., a general move to being more open to Interest Rate cuts beginning in September.

On Wednesday, we have the FOMC Minutes, which will give us more clarity as to how strongly the Fed considered cutting rates at the July Meeting. On Thursday, we have Jobless Claims. The market will watch these and essentially look for no meaningful jump in this number. The action is on Friday, though, as this is where Powell will speak at Jackson Hole.

What to expect from Jackson Hole

Jackson Hole is an event held every August in Wyoming. It brings together central bankers, policymakers, and economists from all over the world. Fed Chair Powell will outline future policy in his speech, so market participants will be watching keenly.The market is currently expecting Chair Powell to guide towards Interest Rate cuts at the September Fed Meeting. The bigger question is, what does he see as the policy path going forward?

Some economists have suggested that the Fed is meaningfully behind the curve, considering inflation is now at 2.9%, and the rate of Interest is 5.5%. This means that the current real rate is 2.6%, which is very restrictive, and therefore, the Fed needs to begin cutting Interest Rates more aggressively.

This has meant some economists have suggested that the Fed will cut by 50bps in the September and November Fed Meetings. However, with economic data showing that the US is still relatively strong, slowing, but still strong, 50bps of cuts in one meeting, let alone two meetings, seems way overdone.

Therefore, we expect the Fed to cut at each meeting this year (in September, November, and December) but by 25bps, so 75bps of cuts in 2024. On Friday, we expect Powell to allude to this lightly. We believe Powell will strike a dovish tone at Jackson Hole; however, the market is already priced quite dovish.

Therefore, we're not sure that the market will react majorly positively but will most likely remain range-bound. But we do actually think this is positive.

However, if Powell gives off a slightly panicked tone and outright says he was very open to 50bps of cuts, then this would likely worry the markets.

Currently, 25bps of cuts at each meeting until year end is Goldilocks, and this is good for risk assets—assuming the data continues to hold up, which we believe it will/can. Market participants are just perhaps getting slightly ahead of their skis in the short term.

Personal feelings and expectations on the current market

We, and I (Tom) personally, have had a lot of questions recently about what people should do with certain positions, etc., and it seems that quite a few are panicking about positions they may have chased just because they missed out on other positions that ran.In terms of chasing positions, this is not something I/we can help you with; it's just something you have to get better at and become more disciplined in how you deploy your capital. But, what we can do is lay out the picture that we see going forward. If we zoom out, we believe this is the backdrop we're moving into:

A few months post-BTC-halving

We know that from prior cycles, the Bitcoin Halving is an event that precedes Bitcoin bull runs. We also know that the demand effect can take up to 6 months post-halving. The last Halving was mid-April, so we're four months from that, indicating that the impact of this might not be fully seen/felt in prices until mid-October.Moving into an interest-rate-cutting-cycle (accommodative policy):

We're now on the brink of moving into a new interest rate-cutting cycle, having come off the back of a rate-hiking cycle that was used to squash demand and bring inflation down.Inflation has now fallen and without the need for a recession. This is goldilocks for markets and the economy, and with the data remaining strong (slowing, but strong), cutting Interest rates should help fuel a new growth cycle, especially in the smaller companies that were hardest hit by high Interest Rates.

Lower Interest Rates should see the Dollar ($DXY) come down. This has historically been positive for risk assets and Bitcoin. The chart below shows that when $DXY is down, $BTC is up.

BTC vs Dollar:

On-chain metrics still show there's a long way to go

Whilst a number of the on-chain metrics suggested that we got slightly overheated in the short term back in March, many of the 'Market Indicator' metrics still suggest we're early in the bull cycle and that 2025 is likely to be the year we see a blow-off top.MVRV Z-Score:

BTC Dominance suggests early bull

In prior bull markets, capital has rotated out of Bitcoin once Bitcoin has made a substantial run above its all-time highs. This is where we see an alt season and BTC dominance fall. We haven't had that this cycle so far, which suggests we're more likely in the early/middle part of a bull run rather than the later part. I'd somewhat argue that it suggests early bull.BTC Dominance:

There are more bullish factors out there, such as the ETFs, which we think are being undervalued by market participants. Once more investors have access to them, the passive flows that can come from them will likely be big. But we've highlighted above the major bird' s-eye view factors that we believe will be the key drivers of the market going into year-end and 2025.

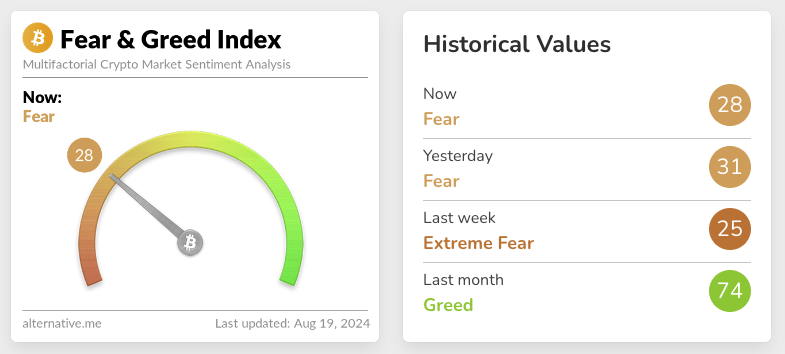

In the short term, investors are too emotional about the short term, which is reflected in negative funding rates (leverage traders want to be Short) and the very low Fear & Greed Index.

Fear & Greed Index:

However, August is typically characterised by lower volumes and poor price performance. Hence, the negative market sentiment (at this point in August) isn't much of a surprise to us. It usually takes well into September for volumes to return and the markets to begin building up steam again.

Cryptonary's take

In short, we believe investors are getting too emotional about the short-term negativity, which is somewhat understandable considering prices have come down. But, they haven't come down in a manner that isn't typical with prior bull market drawdowns.We, therefore, have to ask ourselves: why are prices coming down, and are we moving into a new environment that suggests that we're moving into a new bear market?

If we take a more zoomed-out approach, we can see in the above factors that it looks like we're more likely early bull, and things haven't got fully going yet, rather than being at the back end of a bull market that's ending. Therefore, we can put recent price performance (which hasn't been very bad) down to seasonal factors rather than a change in the macro setup that would suggest a new bear market. From a zoomed-out view, most data suggests that we're in an early bull.

Whilst we believe it may take more time for the market to see more significant upside momentum, possibly late September/mid-October, we think it's absolutely wrong to capitulate on current positions. If anything, lower prices in the short term (if we get them) should be seen as a great buying opportunity.

Our key message here is patience and discipline. We expect prices to be substantially higher in 6-12 months, so don't over-trade in the short term and cut up what are likely great long-term positions.

How does Bitcoin look to you on the Monthly chart? To us, this setup looks very bullish. If we then overlap that with the macro factors and some of the other factors we've outlined above, it would be very difficult not to be supremely bullish on Bitcoin here with a 6-12-month view.

Do not let short-term noise cut your portfolio up.

BTC: