Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

You'll all have looked at the charts and will be able to see that prices have come down drastically over the last 72 hours. This has mostly been due to the market being over-leveraged for quite a while now, and there is too much confidence in "up-only". I (Tom) look back at the last 3-5 Market Directions, and in all of them, Open Interest has been constantly increasing.

This happens as the "up-only" crowd gets more and more confident in prices going higher, and they then take more and more risk - therefore putting on more and more leverage.

As prices then come down, and sometimes only slightly, as pull backs are natural. Those that then have a tight stop-loss, a close liquidation price, or too much leverage see the unrealised loss as the price goes against them. They then bail out, and the price goes down further, and you can then envision the cascading effect. This is what has happened and is still likely in the later stages of happening.

We can see that yesterday was the largest day of liquidations for Longs of this cycle so far.

Total liquidations chart:

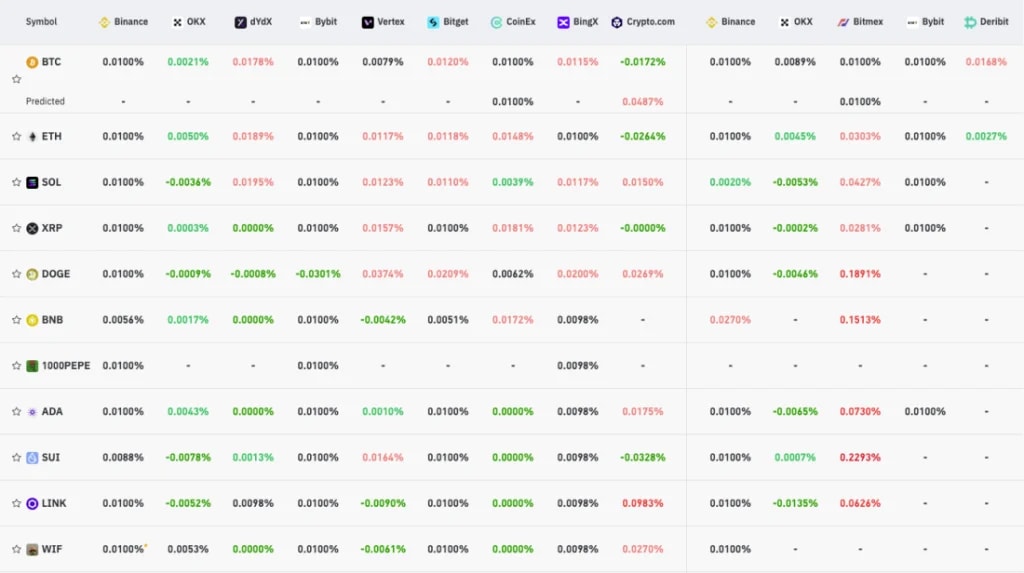

We can also see that all Funding has now reset back to or close to 0.01%. 3-5 days ago, some of these Funding Rates were as high as 0.07% to 0.09%.

Funding rates reset more fully:

We have seen these flushes in the Funding Rates in prior weeks building up to today, but we never really got a full reset of the Open Interest (the amount of total leverage). We have been getting that on this move over the last 72 hours. A full flush out and resetting.

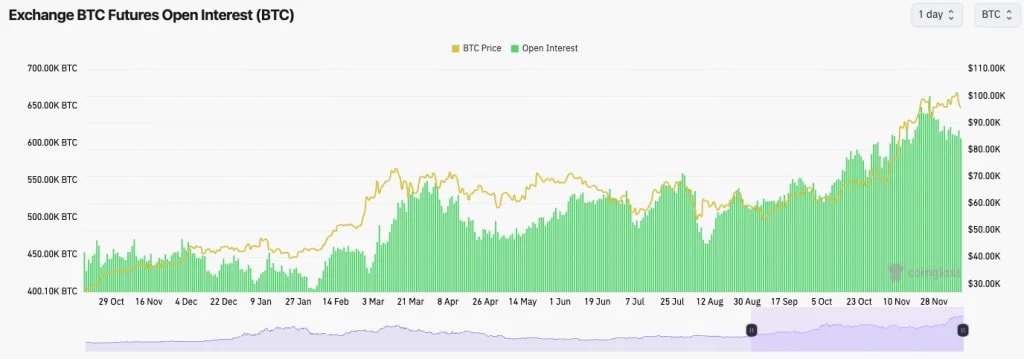

BTC open interest:

BTC's Open Interest has pulled back from 663k BTC down to 606k BTC, so a 10% flush out. But if we now look at some of the Alts/memes that retail trade and get more bulled up on as they try to chase gains, we can see that they have and are experiencing more significant Open Interest drawdowns.

- SOL is down from 25.5m SOL in OI to 23.59m and is approximately 7-8% flush out.

- DOGE down from 9.55b DOGE in OI, down to 7.55b, approximately a 21% drawdown in OI.

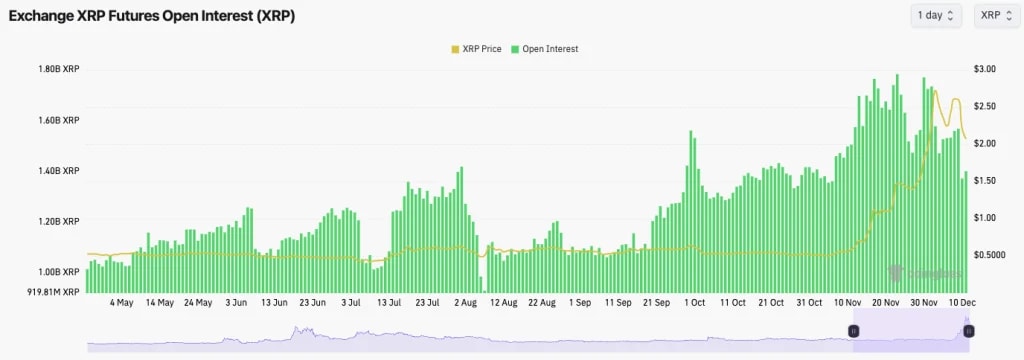

- XRP down from 1.77b XRP in OI down to 1.37b, approximately a 26% flush out.

- WIF is down from 208m WIF in OI down to 175m, an approximate 13% drawdown.

Cryptonary's take

As we stated in our updates yesterday, as this was unfolding, when leverage gets too high, it is going to be flushed out at some point. Usually, it happens when funding rates soar. However, that hasn't been the case as much during this bull cycle. But, we were due for a more significant flush out, and that has now come.Now, these flush-outs are extremely difficult to call; you can see the mass build-up in Open Interest, but that build-up can last for a very long time, especially as prices soar higher and leave lots of people in profit with prices now a long way away from their entry levels.

Is this flush-out done? So, things can sometimes get crazier, but when we look back at old cycles, 15% to 30% flushouts in Open Interest usually mark a local bottom and an ending of the flush out. Now, it is possible that prices remain at the lows for some days after the flush out, as it takes time for confidence to come back in and for buyers to step in again with real size.

But, seeing this level of Open Interest drawdown, we'd say this flush-out is close to being done, and therefore, prices are at a bottom here or very close to one. Either way, for any spare USDT you might have, we think these prices are good for longer-term Spot holds and that today/yesterday does provide a good opportunity to get or increase your overall exposure.

I (Tom) have personally put all USDT back to work today. I usually keep 10-15% on the sides for events like this, and then I sell on any meaningful rebound. It's a good way to build up the 10-15% USDT stash. It hedges me from drawdowns as well, and I also get the opportunity to buy any major dips. Of course, this 10-15% USDT loses out on gains when the market is "up-only", but I'm ok with that.

I look at that allocation as safer money that I only put to work when I see real panic and fear from participants. These usually provide good opportunities for entries. I think we're currently in that period now.