Crypto moves you can’t miss: BTC, ETH, SOL, and HYPE analysis

The market has fallen off the cliff today, and sentiment is extreme fear. But is it time to start buying? We’re revealing our first accumulation zones, potential entries, and how we’re adjusting for the macro. Let's dive in...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

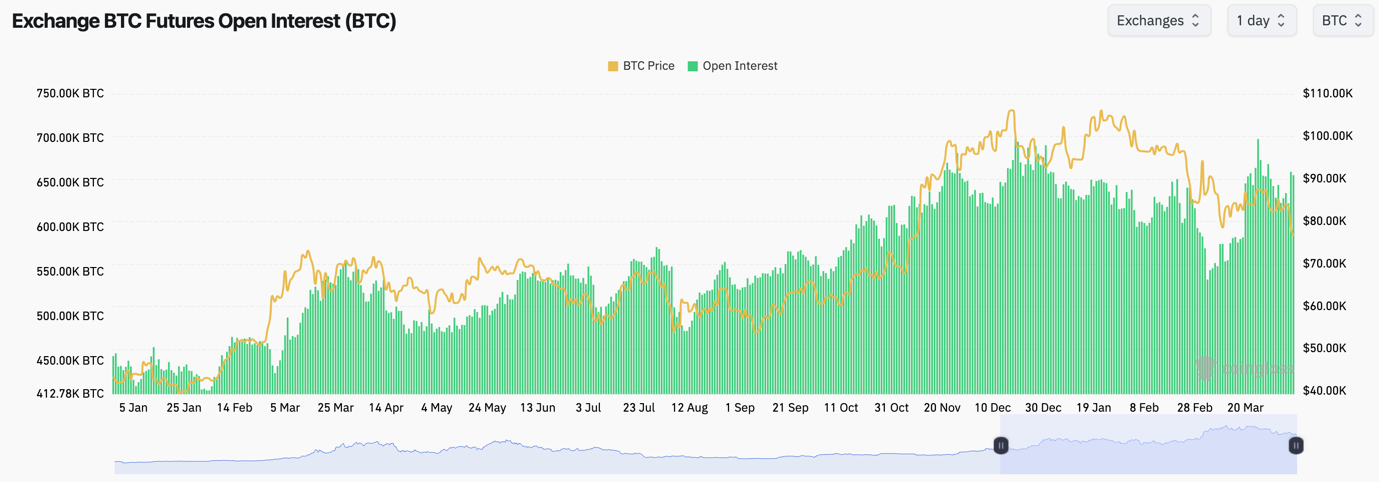

BTC:

- BTC's Open Interest has spiked up slightly, but that's likely due to the price of the coins falling.

- Funding Rates are positive, but they're subdued.

- There is far less appetite than in previous months for traders to be heavily leveraged in trades.

Technical analysis

- BTC moved into our Short box, and it has rejected down to our target zone of $76k to $78k. Perfect move.

- The key battle for price came at the $81,500 to $82,000 level. When the price lost that level, it moved straight into the $78k level as we expected it might do.

- The new supports we're looking at are between $68,900 and $71,500, so again, another zone, rather than a specific price point.

- To the upside, the new horizontal resistance is now at $81,500 (the old horizontal support).

- In terms of resistance, we also have the main downtrend line. But, once price bottoms, we should see a grind sideways, and price will move into that main downtrend line, and that'll be what then potentially sets us up for a breakout.

- The RSI is once again close to approaching oversold territory.

- Next Support: $71,500

- Next Resistance: $81,500

- Direction: Neutral/Bearish

- Upside Target: $81,500

- Downside Target: $71,500

With the S&P and the Nasdaq down substantially, it's possible that a bottom for BTC isn't too far away. Now that doesn't mean we're looking for Longs here, but we would be very wary of Shorting BTC here, even if there is room for another 10% downside move. But, with the huge overextension to the downside in the S&P and the Nasdaq, a potential relief rally could be quite aggressive if it comes.

For now, we're patient and remaining on the sidelines. But, we're seeing many on the timeline getting really bear'd up here, and to us, that seems a bit too late to be doing that. The time for getting ultra bearish was months ago.

Whilst we think there's more downside to be had in the medium term, we're wary of a potential market bounce (just from very oversold levels). Therefore, we're not looking to Short BTC here, and we're starting to eye levels to buy.

For us, that's between $69,000 and $71,500 (assuming we get there). If we do, we'll begin to add lightly. This may come sooner than we expected, and that's due to Trump's aggressiveness.

What’s next?

You’ve seen the analysis for BTC. The next trades — ETH, SOL and HYPE— are lining up now, with targets ranging from -20% to -45%. We’ve pinpointed the exact short zones, liquidation levels, and our strategy for execution.

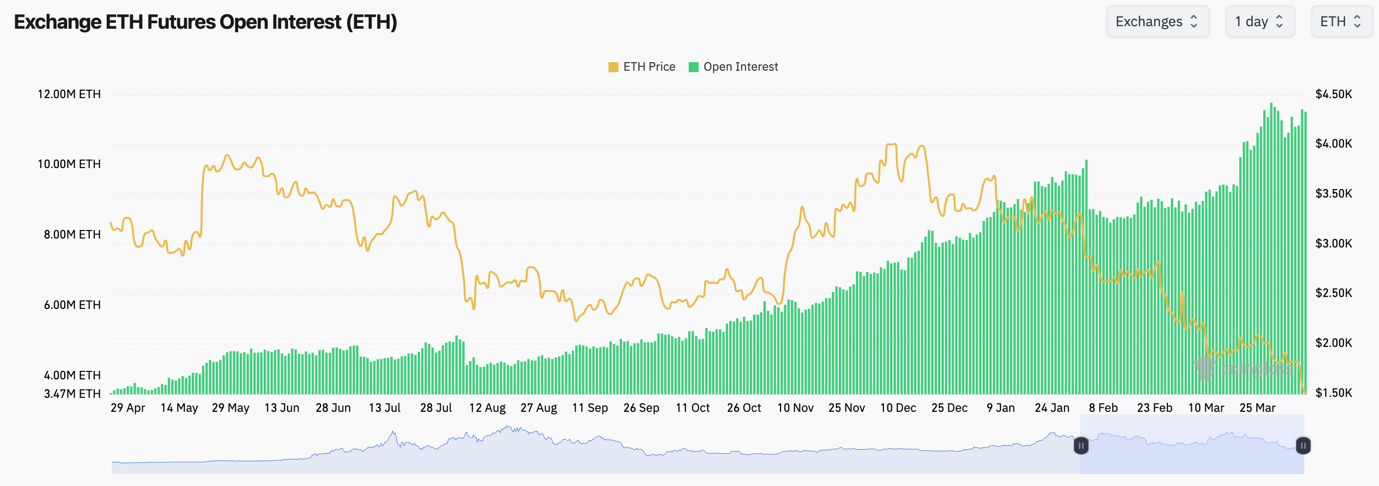

ETH:

- ETH's Open Interest remains really high, however, this is due to the coin's price going down, hence OI by the number of coins goes up, as it becomes cheaper to leverage ETH.

- ETH's Funding Rate is fluctuating between slightly positive and slightly negative, suggesting that there's a lack of conviction and indecision amongst investors.

Technical analysis

- ETH moved down to the horizontal support of $1,745. But, price quickly broke down from that support ,and ETH is now fighting at the next horizontal level of $1,530.

- Below $1,530, the next major horizontal support is at $1,230. If ETH were to get there in the short/medium term, we might have to consider some light buys.

- On the RSI, ETH remained in its downtrend before breaking down more significantly. The RSI is now into deep oversold territory.

- To the upside, the $1,745 horizontal level will now be the new resistance. We wouldn't get bullish again until ETH reclaimed that level.

- ETH remains in both of its downtrend lines for now (dotted down-trending red lines).

- Next Support: $1,230

- Next Resistance: $1,745

- Direction: Neutral/Bearish

- Upside Target: $1,745

- Downside Target: $1,230

Cryptonary's take

ETH's price action has been really poor. It's essentially been straight down, with rallies being weak, and crucial support levels eventually being lost. Where this price decline stops is hard to say.Right now, price is very oversold, but with ETH really lacking in positive narratives, it's possible ETH can go lower. At some point, it'll reach a point where it starts to look attractive from a valuation point of view. $1,230 may be that level.

For now, we'll sit tight and see how this plays out, but we are getting closer to these buy levels, and it has happened quicker than we expected due to Trump's aggressiveness.

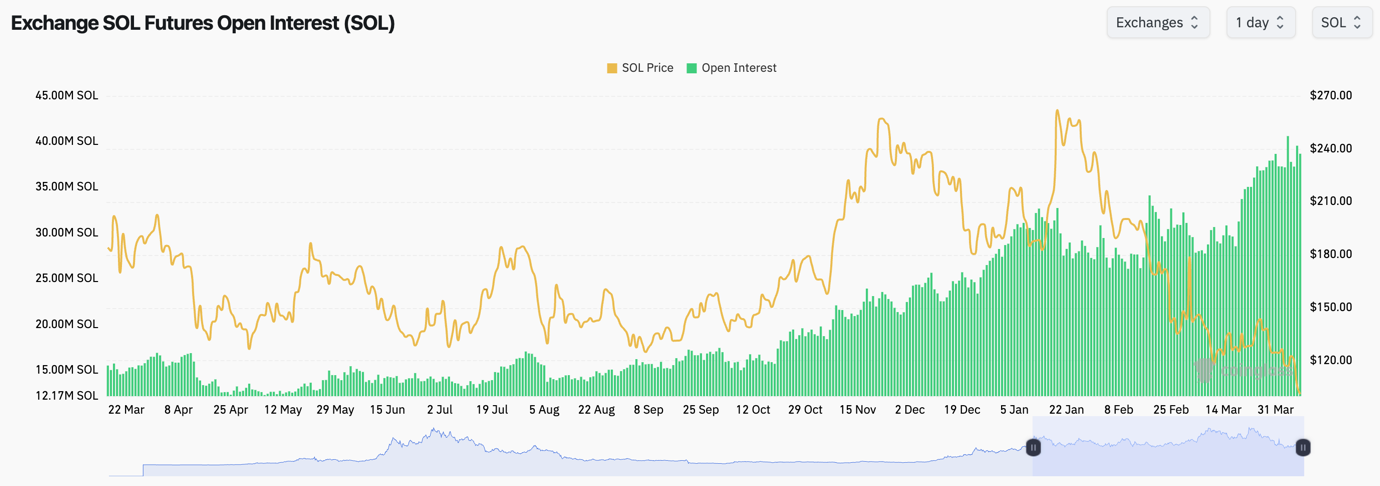

SOL:

- Like ETH, SOL's Open Interest (by number of coins) is up, due to the price of SOL falling and it becoming cheaper to leverage 1 SOL. However, the USD value of OI is down substantially.

- Funding is fluctuating between slightly positive and slightly negative, but it's more on the side of slightly negative. This suggests more appetite amongst traders to Short.

- Ultimately, there is less appetite to leverage a bet on SOL here, but what appetite there is there is slightly weighted toward Shorts.

Technical analysis

- Chart-wise, we're looking at SOL on the 3D timeframe.

- Price broke below the major horizontal support at $120, and it swiftly headed down to the next horizontal and psychological level of $98/$100.

- If the $98/$100 horizontal support is broken to the downside, the next major horizontal level is at $81. At that point, we'll see where we are on the macro front, but we might consider chipping in with buys at $81 (assuming price can get there).

- If the $81 level is lost, then $52 is next. If we did get that, it'd be a strong buy.

- The RSI is entering oversold territory on the Daily timeframe, and it's also very close to oversold territory on the 3D timeframe, whilst also putting in a bullish divergence.

- To the upside, the major horizontal resistances are at $120 and $148. We'd struggle to get bullish before a reclaim of $120. That may take time.

- Next Support: $81

- Next Resistance: $120

- Direction: Neutral/Bearish

- Upside Target: $120

- Downside Target: $81

Cryptonary's take

In keeping this really 'short and sweet', SOL has broken a really key level of $120, and the price has swiftly moved down to $100. We expect the $81 level to be tested in the coming weeks. If the price trades at $81, we'll consider buying at that level. However, we'd want to see less retaliation on tariffs and deals starting to be done.There seems to be more to the tariff uncertainty and markets responding with downside. For SOL, we're not looking to buy yet.

HYPE:

- HYPE has recently continually moved into resistance, rejected, and broken down below the next support.

- Price has also now fallen below the major horizontal support of $12.00, and it's moved into single digits (now in the $10 area).

- Price has broken to the downside and it's now in price discovery. It's hard to know where the stopping point is. But, it'll likely be in a large panic move, or when the macro market turns. For now, we have neither as of yet.

- The price really respects the major downtrend line. It'll be a bullish signal for us when there is a price breakout of this downtrend line. We'll particularly get more bullish if/when the price breaks out of the downtrend and reclaims above a horizontal resistance. The first would be $12.00.

- To the upside, the first key level to reclaim is $12.00, and then $14.50.

- The RSI is very close to oversold territory, with it also now putting in a bullish divergence (lower low in price, higher low on the oscillator).

- Next Support: $6.00

- Next Resistance: $12.00

- Direction: Neutral

- Upside Target: $14.50

- Downside Target: $6.00

Cryptonary's take

HYPE is a coin we like for the long-term, but with the macro environment as it is, it's not necessary to be diving in and buying it here.When there are signs of a bottom, or the macro environment is beginning to turn, that's when we'll look for longer-term Spot buys, and we'll take the price we're given at that time. Ultimately, the multiples we could get on HYPE in the future could be great, but that doesn't mean we have to be careless and rush the buys now. Patience will really pay off on this one.

In the short term, let's see where the price finds a potential bottom. And in terms of playing a risk-on move, a breakout of the downtrend line is what we'll be looking for as the first sign that a risk-on move might be beginning. But for now, we're not seeing that.