Crypto gains momentum as jobs data surprises

After last week's jobs data blew past expectations, we've seen BTC, SOL, and meme coins like POPCAT make significant moves. The labour market's strength has reshaped interest rate forecasts, giving crypto assets a fresh push higher.

The market is bracing for more shifts with the FED speeches and inflation data looming. Let's dig into how these events are impacting key assets like Bitcoin and altcoins.

In this report:

- Last Week's Jobs Data & This Week's Data.

- Cryptonary's Take & $BTC.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Last week's jobs data

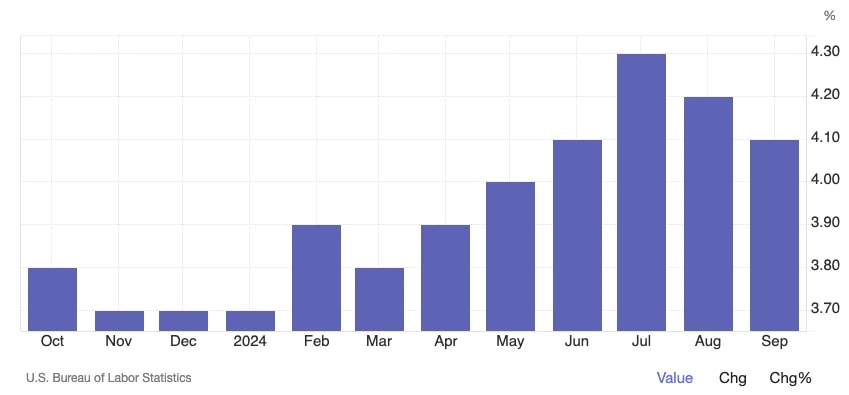

As inflation has fallen back to a more sufferable level over the last 12 months, the market has shifted focus to a potentially weakening jobs market. However, last Friday, we saw the opposite of a weak jobs print.Non-farm payrolls came in at 254k (big jobs growth), whilst the Unemployment Rate came in at 4.1%, ending what was a multi-month uptrend in the Unemployment Rate.

US unemployment rate:

A far stronger than expected jobs print saw the market price out some of the future Interest Rate cuts that had been previously priced in. This is because a stronger than expected labour market, matched with positive GDP growth, means that less FED easing is needed.

The result of this was that Bonds sold off (Yields up), but risk assets were bid (due to the 'goldilocks' narrative) - hence Crypto and Meme's went up.

US 10Y bond yield:

We mentioned that we expected Crypto to go up in our reaction post following the release of the data, and we were right. Although, the market took some time to make its mind up before we finally saw a bid come in and it moves higher.

How assets have performed since the release of Friday's jobs data:

- S&P: +0.24%

- 10Y Bond Yield: +5.29%

- BTC: +3.34%

- SOL: +5.68%

- WIF: +23.43%

- POPCAT: +30.44%

This week's data

This week's focus is on the FED speech and Thursday's Inflation data.There is a plethora of FEDs speaking every day this week. We expect that FED Members will be looking to still be somewhat noncommittal as there's more data between now and the next FED Meeting in early November.

However, we expect them to be more supportive of 25bps interest rate cuts at the upcoming meetings. It's possible that if the FED speak is slightly more hawkish than how we expect them to be, as explained above, then this might provide a small headwind for risk assets in the very near-term (this week/next week).

On Thursday we have Inflation data. Now, generally speaking, Inflation data has taken more of a backseat in comparison to the labour market data recently, but the market will be looking for the data this Thursday to come out in line with the forecasts.

An upside surprise could see risk assets sell-off very slightly. An in-line print/downside surprise could help risk assets to continue their grind higher. Crypto would likely go higher under this outcome.

Cryptonary's take & $BTC

This week has the potential to be a slightly quieter week as the market might remain subdued until after the release of the Inflation data on Thursday. This is similar to last week, where the market made its more decisive move following the release of the economic (labour market) data on Friday.Beyond this week, we have a quieter few weeks ahead of us in terms of economic data-wise until the last days of the month. We then expect fireworks in early November as important labour market data, a FED Meeting, and the US Presidential Elections roll in.

The executive summary for the next month, and maybe beyond, is this:

- 'Goldilocks' US economy (growth positive, labour market positive, and inflation positive).

- Bitcoin on-chain data metrics suggest we're in a pre-bull euphoria phase.

- Market mechanics have more healthily reset, meaning Bitcoin tourists/weak hands aren't here yet.

Market wise, Bitcoin has played out as we had expected it. This is the zoomed out chart we gave for Bitcoin on the Market Update we released on August 22nd (scroll back and check out at the time of print).

$BTC on 22nd August market update:

Note the arrows we drew that price may follow. This is the same above chart today with the price action since...

$BTC on 8th October market update:

Price has followed the arrows we drew out almost perfectly... Spooky.

We have now served our time in the Yellow box, and the price is now close to climbing up into the Green box, where we might finally see lift-off.

Stick with us; we'll serve you right!