Market Analysis

March BTC volume was relatively low with a daily baseline being printed at $3,435, within a weekly liquidity region that stems from $3,000 To $3,659.

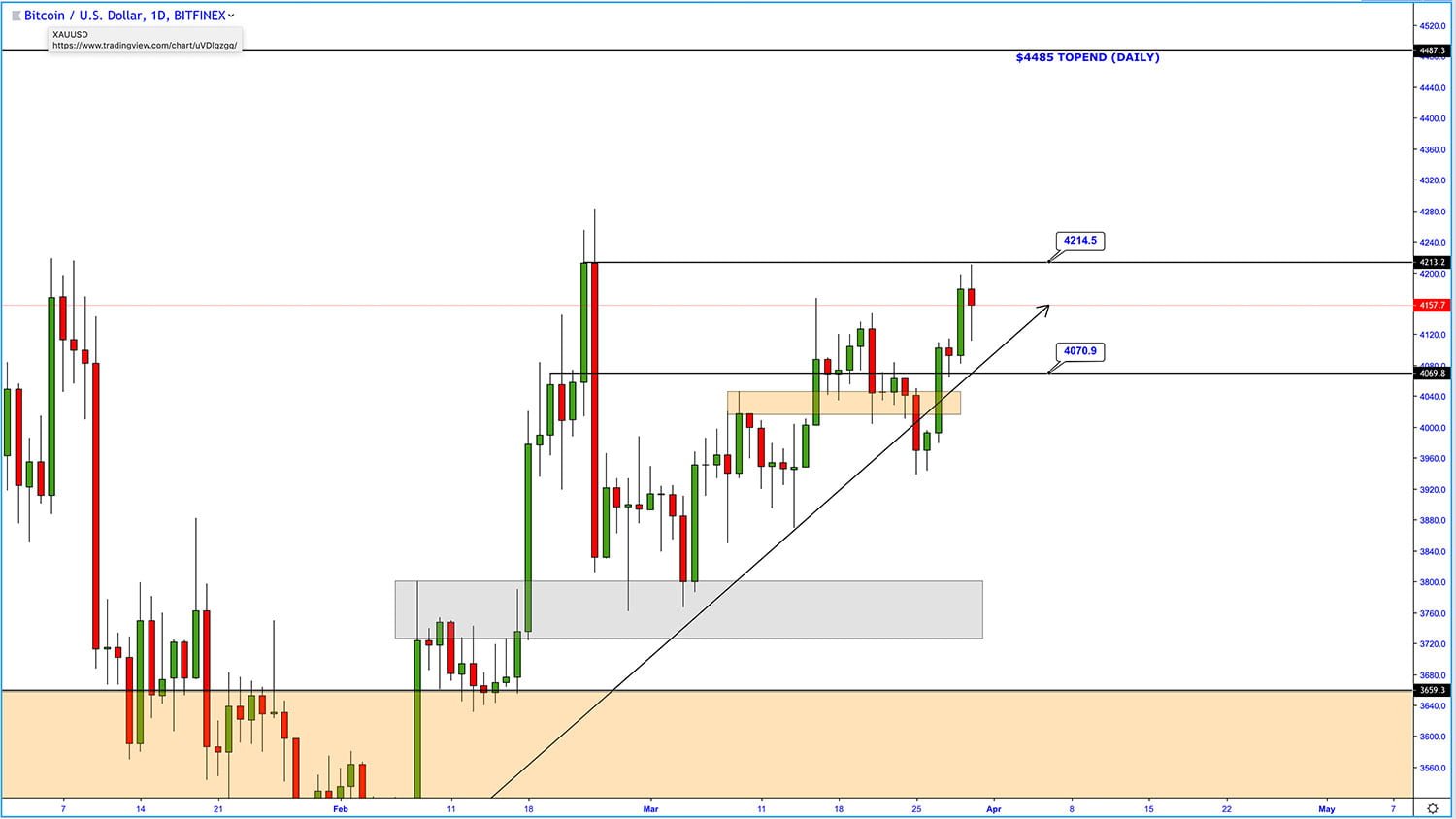

Price pulled up and above on the Daily timeframe where bullish volume pushed the price into an intra-week high of $4,278. Price swiftly retraced back into the highlighted area of $3,800, retesting on two occasions that allowed for further liquidity to be filled around the 6th March marked on the chart below.

Price action suggested that the start to a medium term bull run was in play as long as $3,800 held firmly. Much of the BTC volume which was consolidating at this time was "untrue' but was relatively easy to decipher if a professional top down outlook was utilised in more of a discretional manner, i.e - experience based charting.

The market continued to throw intraday spikes (displayed above) and allowed the opportunity for a simple Daily Trend-line to be drawn as a reference for 'bullish guidance'.

Short term upside targets were marked at: $4,055 then $4,213 with the mid point being a 'danger zone' for potential dumping grounds. Price did in-fact pick up pace after rejecting the $3,920 Handle, painting two new higher swing lows on the Daily TF shown below.

We did alert our members that price may pullback swiftly from this area however the medium term bull sentiment was still intact. It is best to stick to the medium term swing approach in the cryptocurrency markets as lower timeframe trading/analysis can often get too messy in low volatile pitches.

As displayed above, the market pulled back ever so slightly with a false downside break/fake-out. At this moment in time the weekly sentiment was still bullish due to the technical standpoints explained in the members portal. Shortly after BTC was done fishing for sellers, price regained bullish momentum and once again confirmed a new higher swing low.

What was due next? A higher high, above and beyond the initial peak: $4,280.

Into the second quarter we go and BTC runs straight through the profit target given to members. An astonishing price jump above $4,485 steaming all the way through the psychological level $5,000! Epic!

I now foresee more upside but a retest of the grey area: $4,450-$4,700 before heading up to $5,800. Once we reach the higher price range I will then look for potential BTC shorts.

Taking every step as it comes for now whilst journalling the progress of BTC throughout the rest of the year!

Much more to follow from the Cryptonary team.

Thank you, Shaun Lee.