Market Analysis

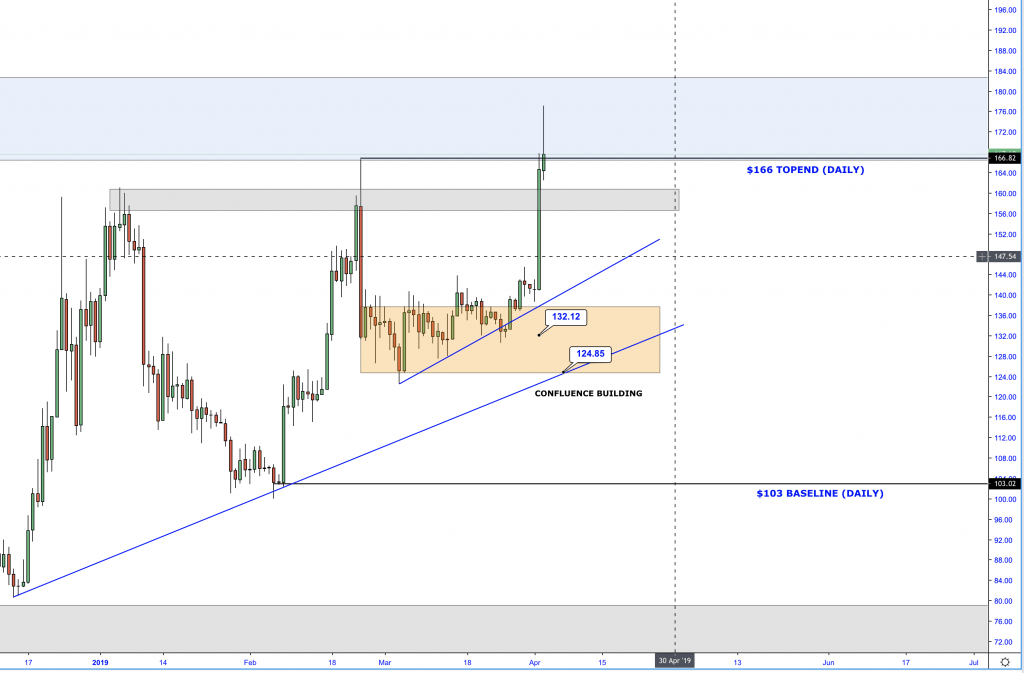

Ethereum recovered swiftly into the start of 2019 from the lows of $81 after dumping over $150 in the last quarter of last year. Similar to Bitcoin, price retraced before starting to form a medium term bullish sentiment on the daily printing a new higher low at the $103 handle marked as 'Baseline Daily' below.

Price started to accelerate with a new yearly 'spike high' forming at $166 in which I marked out as 'Top-End Daily' as it was also a new Daily Higher High which made a significant point past the original retracement high of 2019.

A sudden burst of volume brought the price back below the highlighted liquidity region: $157-$160 (grey zone) marked on from the prior daily wicks into the candle bodies. An area of future supply.

The chart above displays ETH within a consolidation zone derived from the Daily & H4 fusion. The yearly price action allowed for an ascending trend-line to be drawn onto the chart which was and still is governed as a safety harness - bullish until broken!

I outstretched the orange zone to the right as there was a chance that ETH could consolidate further due to low volume. Mapping out clear and concise avenues of price action require the logistics of confluence. I explained to the cryptonary members that the perfect point of call for a new bullish leg would be when price taps the lower edge of the Daily/H4 box coupled with the trend-line which would have given us a perfect third touch.

Price didn't play ball to the T. After 2 weeks of MOMO buildup ETH travelled sideways and printed its last intra-week Higher Low at 131.99.

Upon a clean breakout of the box region shortly after a solid bullish weekly closure momentum to the upside started to gather. I knew that there was around an 80% chance that price would be magnetised into a new higher high area - the takeout of $166 (topend), so I gave the call to the members, up, up, up and away.

As suggested, the grey supply area sucked up the price and the upside target of $170 is on the cards and should soon follow suit.

There are some higher price levels which will be revealed here, inside the members area next week along with a weekly price action breakdown and assistance with new markups.

Thank you, Shaun Lee.