Market Analysis

Okay, onto the good old XRP tracking which in all honestly has been significantly dead for the first quarter of 2019.

XRP Has a good positional outlook into the future and the XRP token makes up around 18% of the Cryptonary fund holdings.

However, when the intra-week volume is considered, it lies relatively low in comparison to BTC & ETH, not to mention the shocking intra-day volume which is due to pick up over the next 12-18 months. Lets take a look at the charts and what I have deciphered over the last few weeks for the members.

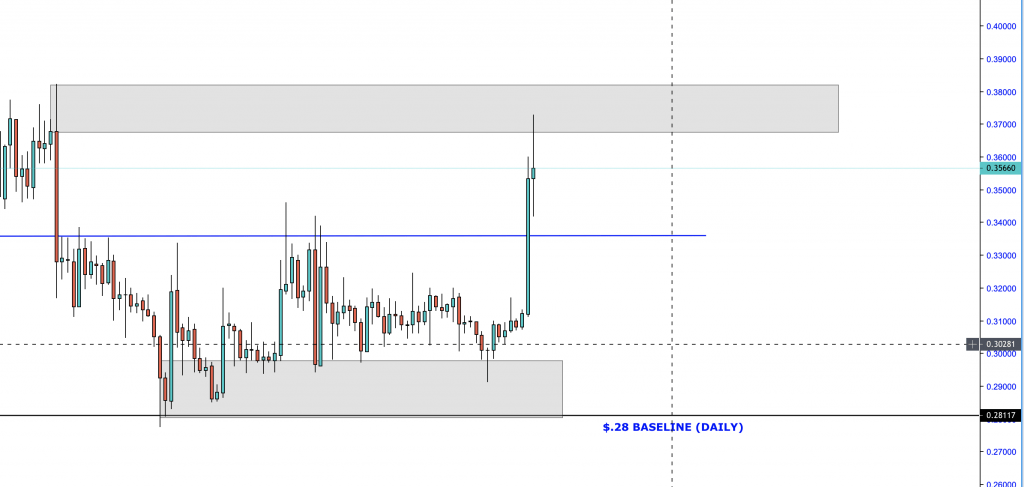

The above chart displays the outlook posted on the 8th March 2019, clean and concise charting on the daily timeframe. After a huge dump from the all time highs, price started to consolidate back at the 28 cent area - exactly where the team put in their initial investment back in June 2017. These orders were recorded back then and will shortly be available as members private education materials over the next few weeks.

Looking closely, there is a highlighted area which marks out the weekly liquidity demand zone. This zone was explained in detail to the members & was a spot in which XRP was due to tap into before a spike higher. Order Pulling - Intra-week.

After much intraday 'noise' and fluttered price action which communicated indecision, I spotted a wedge formation & applied a simple counter trend-line (as I was a little unsure in regards to how much time the buy orders may take to absorb).

You may also notice the 24 cent 'baseline break target' on the lower area of the chart. This was the emergency point of call if the trend-line gave way and price decided that it wanted to spike lower on the backend of volatility, however my bias was still strongly bullish. It was just a matter of time! This area was completely discretionary and experienced based as I have been tracking the price of XRP since 2016.

And then the magic happened! Price rallies 5 cents after a perfect spike pin formation into the liquidity spot. In the chart above you can see the clear cut zone which marks the price range: 36-38 cents. Again the area of value given to our members as profit target number 1.

The final focus is the 45 cent top-end barrier. The secondary price target for XRP given the notion of a continued medium term bull run. A potential for an overall 15 cent move.

Thank you for reading, Shaun Lee.