Market Direction

Bitcoin has shown its resilience with a powerful relief rally, but the real test is yet to come as it flirts with a critical downtrend.

Ethereum hovers precariously above key support, facing a potential make-or-break moment. Meanwhile, Solana and emerging favourites like POPCAT are at pivotal junctures where a dovish Fed could ignite explosive moves.

Today, we dive deep into the technical and market sentiment driving our favourite coins.

Are you ready for what's next?

LFG!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC

- Price has moved from the low $50k range to the local high of $60k, mostly driven by Spot buying and Shorts being squeezed.

- Funding Rates are close to flat/neutral here now.

- Open Interest has remained relatively flat and range-bound over the last few days.

Technical analysis

- BTC bounced perfectly from the horizontal support at $52,800 and was driven up to $60k as overconfident Shorts were squeezed.

- Price has now rejected just shy of $61k.

- Price is in a local uptrend and has now pulled back slightly to retest the potential support box between $56,500 and $58,200.

- Having moved higher, price was close to testing the downtrend line (red line). A breakout of the downtrend would likely see BTC retest $63,400.

- The next major horizontal resistance above price is at $63,400. We don't expect BTC to reclaim above this level in the short term.

Cryptonary's take

Bitcoin has seen a nice relief rally over the past ten days; however, the price has put in lower highs and lower lows on a macrostructure, while volumes in the short term have downtrend. The key event this week is the FED and the Press Conference. Currently, the market is just about pricing for the FED to do a 50bps Interest Rate cut, which we think the markets will actually like. Therefore, we think BTC can hold the grey box (between $56,500 and $58,200) between now and Wednesday's FED Decision and press Conference. Then, following Powell's press conference, which we expect to be dovish, we think BTC and crypto might then move higher and potentially break out of the downtrend and retest $63,400.ETH

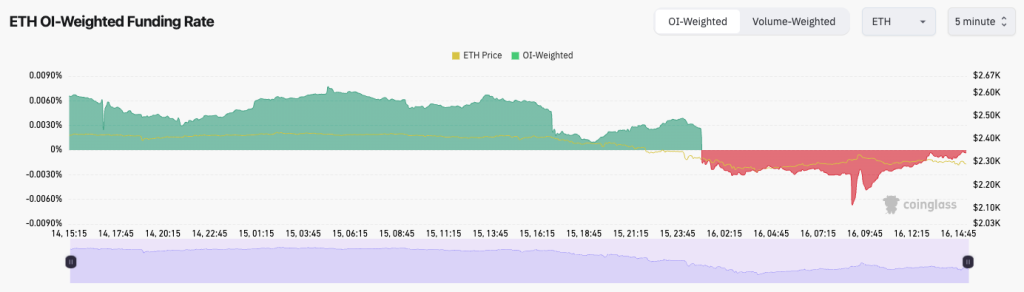

- ETH's Funding Rate has turned negative in the last 16 hours, whilst Open Interest has substantially increased.

- This indicates that more traders are Shorting ETH here, and they may become vulnerable to a short squeeze, especially if bid returns to ETH here.

Technical analysis

- For ETH, we're using a more zoomed-out chart to highlight the significance of the $2,150 horizontal support. We're viewing ETH on the 3D chart.

- If ETH were to lose the $2,150 horizontal support, this would likely open the door to a swift move down to $1,745. We're not expecting this level to be lost, though, at least for now.

- ETH has broken out of its local downtrend line, but so far, price hasn't been able to retest the underside of the local resistance at $2,557, which we initially thought would be very achievable.

- One positive is that the 3D RSI is close to breaking a downtrend that has been in place since the price cycle high in March and is close to oversold territory, indicating a bounce could be on the cards soon, even if it takes more time to play out.

Cryptonary's take

Hard to call ETH here. The current structure has points that suggest price could currently be close to a mid-cycle low, however, we have seen weakness for a long while now, where ETH has struggled to put in any meaningful bounces. Whilst we believe the $2,150 horizontal support can hold, we do have to be open to the idea that ETH could see $1,745 again. However, our expectation is that $2,150 will hold and that this can be a local bottom for ETH before we head into Q4. We are expecting a more positive week this week as we're expecting J Powell to be dovish for markets. If this is the case, then this might be the catalyst needed for ETH to retest $2,557.SOL

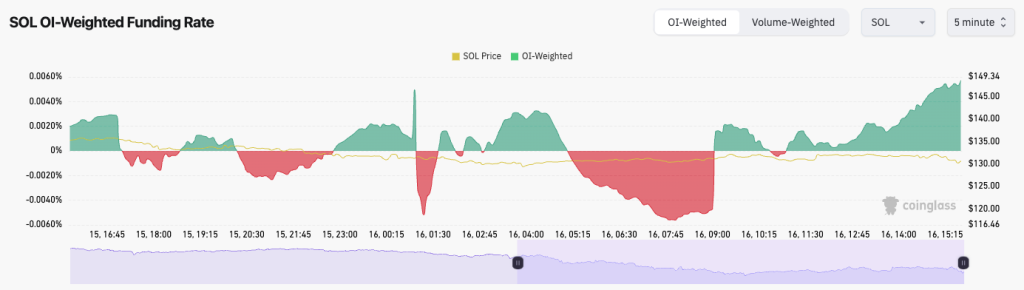

- SOL's Open Interest has increased over the last few days, while its Funding Rate has gone from more meaningfully negative to positive as this OI has increased.

- This suggests that the leverage that has gone on in the last few days has been mostly Longs.

Technical analysis

- Since the start of September, SOL has stayed in a relatively tight range between $120 (the bottom of our called-out range) and $140.

- SOL has been in a longer-term downtrend since March, with price now squeezing up to its local downtrend line.

- We expect $120 to continue to act as support in the short term.

- To the upside, we expect $140 to $150 to continue to be a local resistance zone, with $162 the key level for price to break above, however we're not expecting this anytime soon.

- Volumes have been downtrending recently.

Cryptonary's take

We expect price to break out of the local downtrend line and at least retest $140 in the short term, assuming we're correct that Powell will deliver a dovish message this Wednesday. We're not confident that SOL can break back above $162 in the immediate term, though, and we're expecting the $140 to $150 zone to be a new local resistance for price.WIF

- WIF is still in its longer-term downtrend, and now price is squeezing against the local downtrend line.

- Price is currently struggling to get back into the local uptrend, having found the underside of it as resistance several times now.

- The horizontal level of $1.60 is also acting as a resistance that WIF is struggling to comfortably reclaim.

- Beyond $1.60, the local overhead horizontal resistance is at $1.96 and then $2.23.

- On the downside, we expect $1.37 to be a local support, but the strongest support is between $1.00 and $1.20.

Cryptonary's take

Overall, WIF just seems to have lost its momentum, with traders focusing on other plays rather than trading WIF. However, we have seen volumes pick up in recent days, which could be a sign that some activity is coming back into WIF. If Powell delivers a dovish Press Conference on Wednesday (we think he will), then this might be the fuel that WIF needs to see a larger move to the upside. However, in the immediate term, we're not expecting a major upside; therefore, we expect $1.96 to be a sticking point for WIF.POPCAT

- Just phenomenal strength overall when you consider what the rest of the market has done.

- POP has bounced really nicely, reclaimed its uptrend line, and reclaimed back above its horizontal level of $0.65.

- POP has also broken out of its main downtrend line (red line), with price now pulling back and retesting the $0.65 horizontal resistance, which is now potential support.

- If price can cleanly break above $0.77, then $1.00 would be the next target.

- If price were to break down, you'd like to see the $0.55 to $0.65 zone hold as new support, with a relatively quick reclaim back above $0.66.

Cryptonary's take

POPCAT is currently one of the best charts we're looking at, and it has held up extremely well in relation to other assets such as SOL and WIF. If we do see a more material risk-on attitude return to the market, then we think POPCAT is the play that could see a more substantial lift-off. Most of this week comes down to Powell on Wednesday. If he is dovish, POPCAT to $0.77 should be easily achievable, if not a more substantial break above this level. We're expecting POPCAT to perform well over the next 3-5 days. We'll see how the week plays out and re-assess post Powell.