Why you should read this report

- BTC's funding rates and open interest tell an intriguing story - find out what recent market dynamics could mean for price action

- ETH's technical indicators are painting an interesting picture - discover our analysis on potential support and resistance levels

- SOL's performance relative to the market may surprise you - learn why we're keeping a close eye on this alt in the coming months

- WIF reclaimed a key level, but what's next? Our take on the crucial price points to watch

- POPCAT's recovery has been noteworthy - see why we still consider it a core holding despite potential short-term movements

- TREMP and the PolitiFi narrative - unpacking our evolving stance and the catalysts that could shake things up

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC

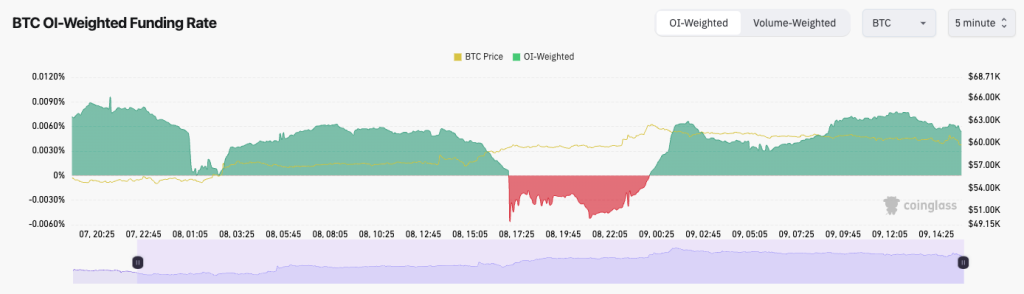

- Bitcoin's Funding Rate is now flat between 0.00% and 0.01%, indicating there is a relatively even balance between Longs and Shorts.

- Open Interest has now reset to healthier levels. The recent flush-out was needed. OI has reset from $37.5b to $28.3b.

- Yesterday, Funding Rates went negative, meaning Shorts piled in as price moved up to $59k. This led to a short squeeze, which then propelled price from $59k to $62k relatively swiftly.

Technical analysis

- Bitcoin bounced superbly from the horizontal support of $52k, although price had wicked substantially lower.

- Our first thought was that Bitcoin might begin to form a bear flag. However, this hasn't been the case, and we've seen somewhat of a V-shape recovery so far.

- We also expected the $58k to $60k level to become new resistance; however, the short squeeze pushed price beyond this price zone.

- For now, the prior horizontal support of $63,400 is likely to act as the next major horizontal resistance.

- To the downside, we believe $56k can be a support area, even if price dips slightly below this area.

- The RSI has reset back to neutral territory after being in oversold territory on Monday.

Cryptonary's take

While we're impressed by how much Bitcoin has recovered so far, we do expect a slight pullback here and for price to potentially retest the $54k to $56k area over the coming 2-4 days.We believe Bitcoin can be more range-bound, and we're not expecting any explosive moves past, say, $63,400 in the near term, at least not until Powell speaks at Jackson Hole in a few weeks' time (Aug 22nd—24th).

ETH

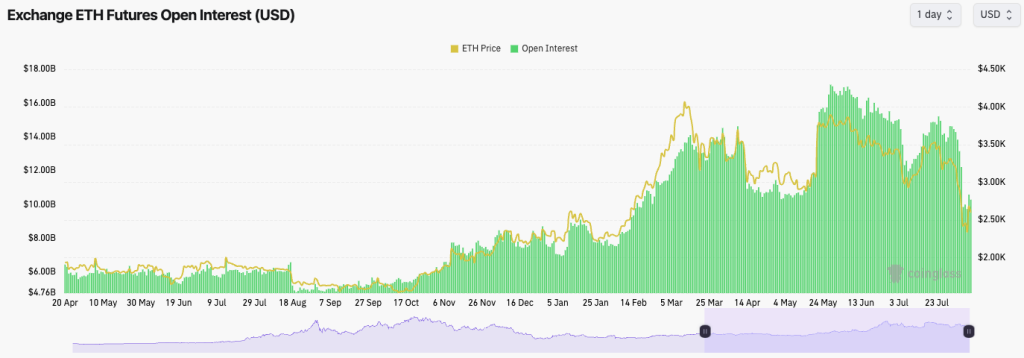

- ETH's Funding Rate is flat here, indicating there is a more even balance between Longs and Shorts.

- ETH's Open Interest significantly reset from $17.1b in late May to $9.7b yesterday. This is really healthy and needed resetting.

Technical analysis

- Having bounced off the horizontal support of $2,150, ETH isn't clearly forming a price formation yet.

- Price has bounced, having been majorly oversold, at 20 on the RSI, and we were right to call for a more significant bounce for ETH in our last Market Direction update because of this.

- Price has now hit the RSI-based moving average and has been seemingly rejected, for now.

- Price also lies well below what's likely to be it's next major horizontal resistance of $2,875.

- If price were to pull back from here, and we think it can, then we'd eye $2,400 as the area we'd bid again.

Cryptonary's take

So far, the recovery has been good in percent terms, but price still lies well below the levels it was trading at just weeks ago.The bounce play for ETH that we put out on Monday has played out well. However, it's now likely that price might pull back and retest $2,400 in the coming 2-4 days.

Anything under $2,400 is likely to be an area to bid on with the view of buying for a longer-term hold. We expect that over the next week or so, price will remain range-bound between $2,300 and $2,700.

We'd be surprised if price can claim back above $2,875 before Powell speaks at Jackson Hole towards the end of the month.

SOL

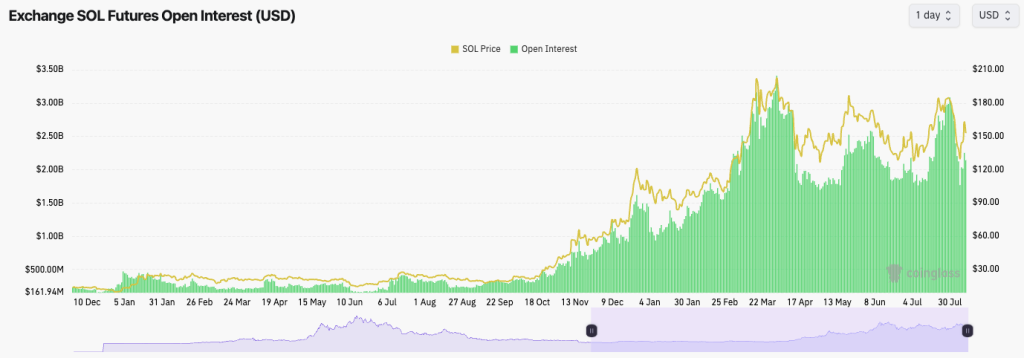

- SOL's Funding Rate is close to going negative, indicating there is an appetite for Shorts to start stepping in here. If this increases significantly, it could cause short-squeeze.

- SOL's Open Interest has reset from its recent highs. However, it has also rebounded by 20% off the lows, indicating participants are beginning to jump back into trades, just not with the risk appetite they had previously.

Technical analysis

- SOL has rejected from a strong resistance level. This resistance level is the horizontal resistance of $162 and the main downtrend line (red line).

- Price is also stalling out at the RSI-based moving average here.

- $162 is likely to remain a key level for SOL to reclaim back above.

- So far, there isn't a candlestick formation, and there is no bear flag, for instance, but we have had a sharp recovery, meaning that the current slight pullback we're seeing could come down slightly lower.

Cryptonary's take

On this recovery, SOL outperformed, which we, of course, take as a sign of things to come in the upcoming months. However, in the next 2-4 days, we're expecting SOL to pull back to the $135 to $145 zone.Over the next week, our thinking is that SOL doesn't see a major upside, and we don't see it breaking above the horizontal resistance of $162. It is likely just going to stay range-bound between $135 and $160.

We will reassess again next week, but we expect SOL to be substantially higher in 2 months' time.

WIF

- The most pleasing part for WIF is that it has been able to get back above the $1.60 level, which was prior support for price. We feared it may become new resistance, but luckily, it didn't.

- If price pulls back, we'd want to see $1.60 become support again, and price bounce off of that level.

- Beyond this, the horizontal resistance we'd want price to reclaim is the $2.23 level. We believe a break above $2.20 would be the bullish reversal.

- The RSI is in the middle territory, having bounced nicely from oversold levels.

Cryptonary's take

Over the coming days, we expect price to pull back with the rest of the market. Our hope, but potentially not outright expectation, is that price can hold support at $1.60. If so, this would be a bullish sign. If not, then we would be worried that price could retest the lows around $1.10. But we do think $1.60 can hold.Beyond the next few days, we see price being range-bound between $1.50 (assuming there are small dips/wicks below $1.60) and $2.20.

POPCAT

- The recovery overall from the lows is phenomenal, but then again, the drawback on Monday was also very over the top.

- We're really pleased that price has been able to maintain above its main uptrend line (thick yellow line) and also reclaim above some key horizontal levels: $0.40 and $0.55.

- For now, price has seemingly been rejected at the underside of the local uptrend line (dotted yellow line) and at the prior highs of early May and early July.

- It's now possible, and we think likely, that price will pull back slightly. The key levels we have identified are $0.55 and then $0.45.

- The RSI is also back in neutral territory.

Cryptonary's take

Long-term, we still really like POPCAT as one of our core holdings. But in the next 2-4 days, we think it's possible that the price will pull back slightly and potentially retest somewhere between $0.45 and $0.55.Ultimately, if price falls below this range, we'd want to see $0.40 hold up, although the mega support is at $0.34. We're not expecting price to revisit that level.

So, expect a slight pullback in the coming days and then range-bound at these levels for the next week. We'll then reassess next week after we've seen this weekend's price action.

TREMP

- TREMP has been in a downtrend since early June and has not shown much sign of recovery. Following Kamala's odds increasing over the past week or two, TREMP has pulled back further.

- Price lost the $0.40 that we expected it TO lose. However, price has now moved lower than we thought it might have.

- Price is now battling at one of its lowest horizontal levels of $0.18.

- Volumes have been significantly lighter in the last week than they were in June and July.

- If TREMP can avoid breaking down and hold the $0.18 level, price will move closer towards breaking out of the downtrend line.

Cryptonary's take

Due to the price action and the PolitiFi narrative not being as hot as we first thought it might be, along with the fact the price action was so hot on PolitiFi just a few months back, our conviction in TREMP and PolitiFi, in general, has diminished somewhat.However, there are great catalysts in September, with Trump and Harris debating a number of times, and we would expect price to do well in that period. The worry of course, is how does price fare in the meantime.

While short-term price action is hard to call for TREMP, we are considering reducing our position down, not to nothing, but just reducing our size in TREMP due to our conviction diminishing slightly.

Now, TREMP has never been one of our bigger plays, and it certainly isn't on the level of WIF and POP, but TREMP has shown that it can have explosive price action. Going into the September debates, we feel it's still worth holding TREMP. We just wouldn't look to have a huge bag of it in relation to the rest of your portfolio. TRUMP should be a risk-on play that you play with a small size.