TLDR

- Over the last month, the DeFi market has seen TVL decreases of nearly 50%.

- Decreases in TVL can be attributed to token prices falling and the total amount of tokens staked decreasing.

- TVL decreases can also be attributed to the de-pegging of UST and the collapse of Luna.

Market By Numbers – Total Market TVL

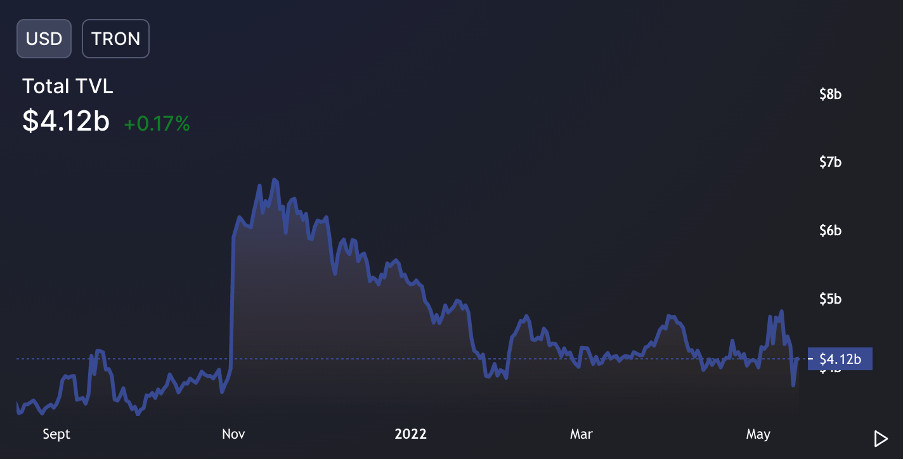

We will begin this week by looking into the total TVL of the market to assess the movements of capital. We can see from the graph below, that total TVL has decreased significantly over the last month from USD 208.97 billion to USD 110.27 billion.This decrease in TVL is to be expected as native token prices have decreased in a capitulatory style manor over the past few weeks. In these kind of market conditions, investors look to de-stake and sell their assets in fear of the market dropping further. Over the past month, the price of Ether has fallen by 35.69%, down to $1,970 at time of writing. Ether is the most staked token, and we can therefore take it as a benchmark for the market.

Total Market TVL By USD

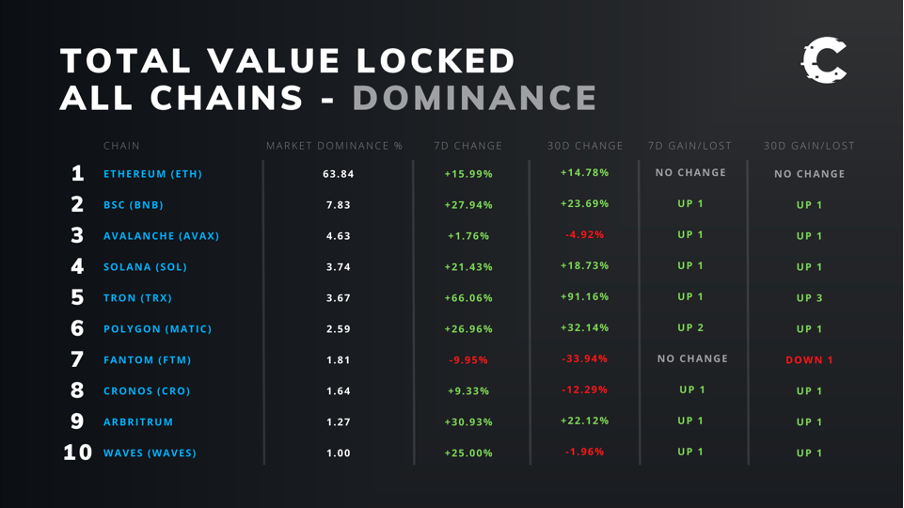

Market By Numbers – Chain & Dominance

Now, we will look at the top individual chains to see how they have performed in comparison to each other over the past month. In the below chart, we can see that Ethereum is still the most dominant chain in terms of TVL, and it has also gained dominance along with many other chains in the past 7 days and 30 days. The reason for this is due to the collapse of Terra (Luna), which was not able to maintain its stable coins’ peg to the US Dollar – UST, however we will cover this in greater detail in a later section.Terra (Luna) used to have the second highest market dominance percent, but since it’s collapse, its TVL dominance has decreased in the past 7 days by 97.17%. A week ago, it had a TVL dominance of 14.86% which comfortably made it the second largest chain in terms of dominance by TVL, however, its dominance has now fallen to a mere 0.42% of the total market. This has meant that 14.44% of TVL dominance was to be gained by other competitor chains. We can see from the below chart that many of the top 10 chains gained TVL dominance due to the collapse of Terra (Luna), but the most stand out winners were Binance Smart Chain, Polygon, Arbitrum and Tron. Tron gained the most TVL dominance over the past 7 to 30 days. We will assess this in another section below.

TVL of All Chains – Dominance

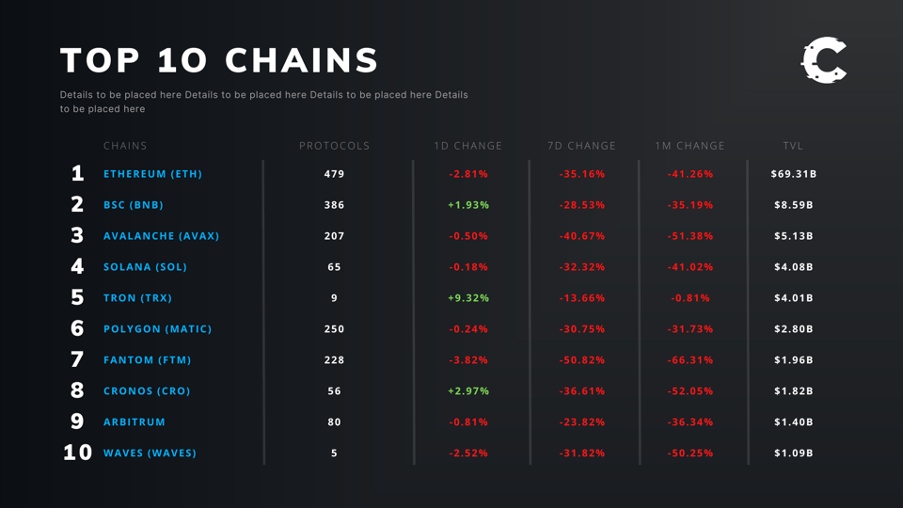

Market By Numbers – Chains

Now, we will look at the top individual chains to see how they have performed in comparison to each other over the past month. In the below chart, we can see that Ethereum is still the most dominant chain in terms of TVL, but it has also suffered large TVL losses in the past 30 days, along with the rest of the DeFi market. In the last month, only one of the top ten chains has not suffered significant TVL losses – Tron, down 0.81% in this time.Top 10 Chains By TVL

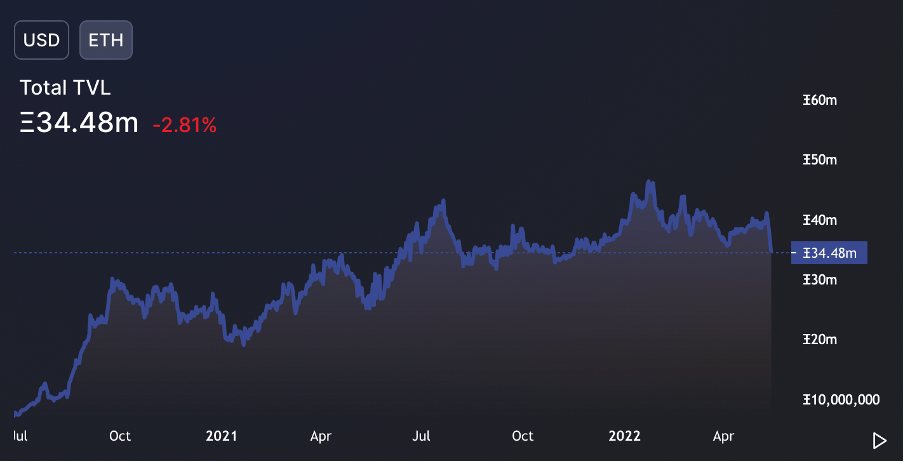

If we look at Ethereum, we can see that it has suffered a TVL decrease of -41.26% over the past 30 days. We can see that this is due to the amount of Ether being staked decreasing from 38.25 million Ether to 34.48 million Ether. Along with this the price of Ether has fallen by 35.69% as reported above.

Ethereum TVL By USD

Ethereum TVL By Ether Staked

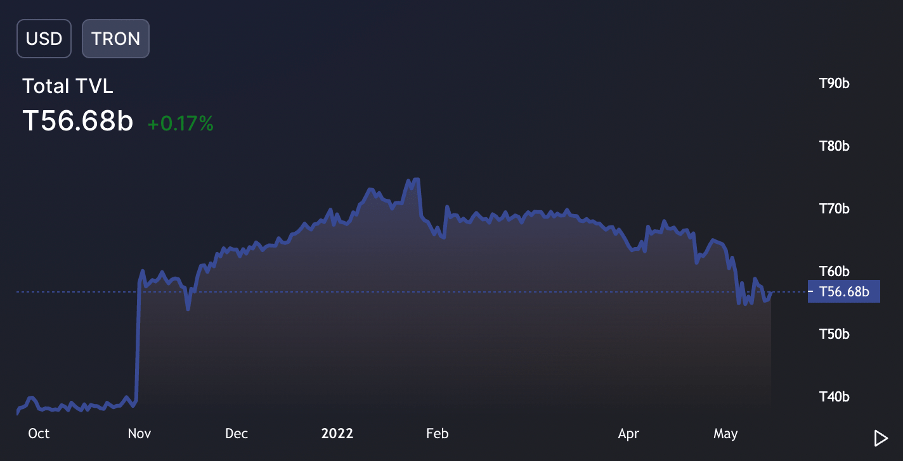

The above Ether charts represent the majority of what has taken place with the other chains also – native tokens being de-staked whilst their token prices have also fell during these time periods. Tron on the other hand, is one blockchain that has held up relatively well in TVL terms, having only seen a 0.81% decrease in TVL. For this reason, we will investigate this further. Firstly, the amount of Tron staked has decreased from 66.73 billion Tron to now 56.68 billion Tron. This represents just over a 15% drawdown in the amount of Tron staked, however, the price of Tron in the last 30 days has increased by 11.60%. This has almost made up for the TVL lost in tokens that have been de-staked.

Tron TVL By USD

Tron TVL By Tron Staked

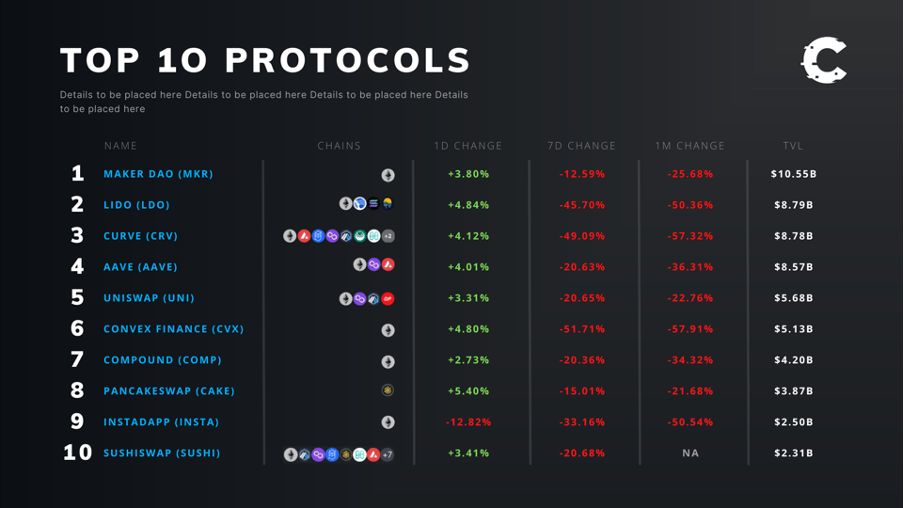

Market By Numbers – Top 10 Protocols By TVL

If we now turn our attention to the top 10 protocols by TVL, we can see that many of them have had decreases in TVL over the past 7 and 30-day periods.Top 10 Protocols By TVL

Of course, looking at the above chart we can see every protocol has seen negative TVL changes over the past 7 and 30-day timeframes. However, it must be mentioned that over the past week, there have been some changes in the top 10 protocols. Firstly, Curve was ranked a week ago as the top protocol by TVL and Anchor was ranked third. But, after the Luna/UST saga, Anchor has dropped to 64th in terms of biggest protocols by TVL. Curve and Anchor have taken some TVL hits because of the Luna saga. So, what exactly happened with Luna/UST and how and why were Curve and Anchor impacted.

It all started with an entity borrowing 100,000 Bitcoin (entity unknown), which the entity then Shorts (sells to the market in the hope they can buy it back cheaper, profiting the difference). The entity has also bought USD 1 billion of UST, in order to effectively attack. The Luna Foundation Guard announces a shift from 3 pools to 4 with LFG removing USD 150 million UST from the 3-pool in preparation for the new 4-pool. The entity/attacker then uses USD 350 million of the UST they own to drain the 3-pool, now meaning it has gone from USD 1 billion (in UST) of liquidity, down to USD 500 million. There is an USD 85 million sell on Curve from UST to USDC, putting the pool slightly out of balance and de-pegging UST, but only down to USD 0.98 – USD 0.995. However, rumours begin to circulate on Twitter that UST has de-pegged. As rumours circulate, deposits to the Anchor protocol begin to drastically decrease (now effecting two of the largest DeFi protocols – Curve and Anchor). Whilst this is happening, the peg is now down to USD 0.97, and Bitcoin is trading much lower, meaning Alts (Luna in particular) are following, adding to the panic. The entity/attacker then sells its remaining USD 650 million of UST, increasing the de-pegging, but LFG is selling its Bitcoin which it took months to accumulate (over 80,000 Bitcoin) in order to sell that to then buy UST and maintain the accurate peg. However, this extortionate selling of Bitcoin is panicking the market even further causing more people to sell Luna and a de-pegging spiral is coming into full effect especially now at this time, the market is seeing what’s going on and sells in UST and Luna are large. As deposits on Anchor fall drastically, more people are trying to sell their UST at whatever price they can get, and this sell pressure causes an even greater de-pegging to the point that LFG cannot keep up with the sell pressure, UST de-pegs (down almost 80% at this point), and market confidence in UST and Luna is practically lost. This entity is then able to buy back their 100,000 Bitcoin at a far cheaper price (as they’ve forced LFG to market sell their 80,000 Bitcoin and the market has plummeted), and now pay back their 100,000 Bitcoin to the entity which which they borrowed them from(at a much cheaper cost) and they have profited the difference. All in all, a fantastic trade/attack from the entity but destroying LFG (and many investors) in the process.