Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

DOGE:

Market context

DOGE continues to hold its key level at $0.35, a level we've been discussing for weeks as the primary accumulation zone. Bitcoin has been leading the market with a strong move over the last couple of days, printing new all-time highs of around $107,000.

This dominance movement highlights the 5% range where capital is flowing between BTC and the rest of the market. Understanding this range is crucial for predicting where attention and liquidity will go next.

DOGE, being the 7th largest cryptocurrency by market cap, is naturally positioned as a key recipient of capital rotation. As Bitcoin continues to dominate the headlines with mainstream adoption and more people entering the market, assets like DOGE are typically among the first to gain attention in the next wave. This is standard market psychology and reinforces DOGE's role as a leading altcoin.

Price action

- Current positioning: DOGE is hovering above $0.35, the key level we've identified for weeks as the primary accumulation zone.

- Potential pullback: A retrace to $0.35 represents a 13% downside move, which is very reasonable for DOGE, given its typical price behaviour.

- Upside narrative: If BTC dominance begins to pull back, there's a strong case for capital rotating into larger assets like ETH, SOL, and DOGE, which could fuel DOGE's next leg up.

BTC dominance is a key driver here. If dominance tops out and begins to pull back as BTC consolidates or retraces, we could see that capital flow into large-cap altcoins like DOGE. DOGE's recent history also supports this narrative.

The asset has consistently attracted attention during moments of capital rotation and remains a prime candidate for bids during a BTC slowdown. DOGE's position as the 7th largest crypto asset strengthens its case as a go-to asset for speculative capital once the broader market looks for rotation plays.

Playbook

Buy box:

- $0.35 remains the key level to accumulate DOGE. This area offers an attractive risk-reward setup for both short-term traders and long-term holders.

Dollar Cost Average (DCA):

- For those not looking to time the market, DCA strategies can also work well here, especially within the $0.35 range.

Cryptonary's take

DOGE remains one of the most exciting assets to watch in this cycle. Its position as a top 10 crypto asset makes it a prime candidate for capital rotation as BTC dominance begins to stabilize or pull back. The $0.35 level is where we'll continue to look for bids, as it aligns with historical price behaviour and market dynamics.Whether you're accumulating through the spot or using DCA, this level offers an excellent entry for exposure to DOGE. While not much has changed from our previous analysis, the broader market context of BTC dominance and capital rotation further solidifies DOGE's position as a key player in the altcoin market.

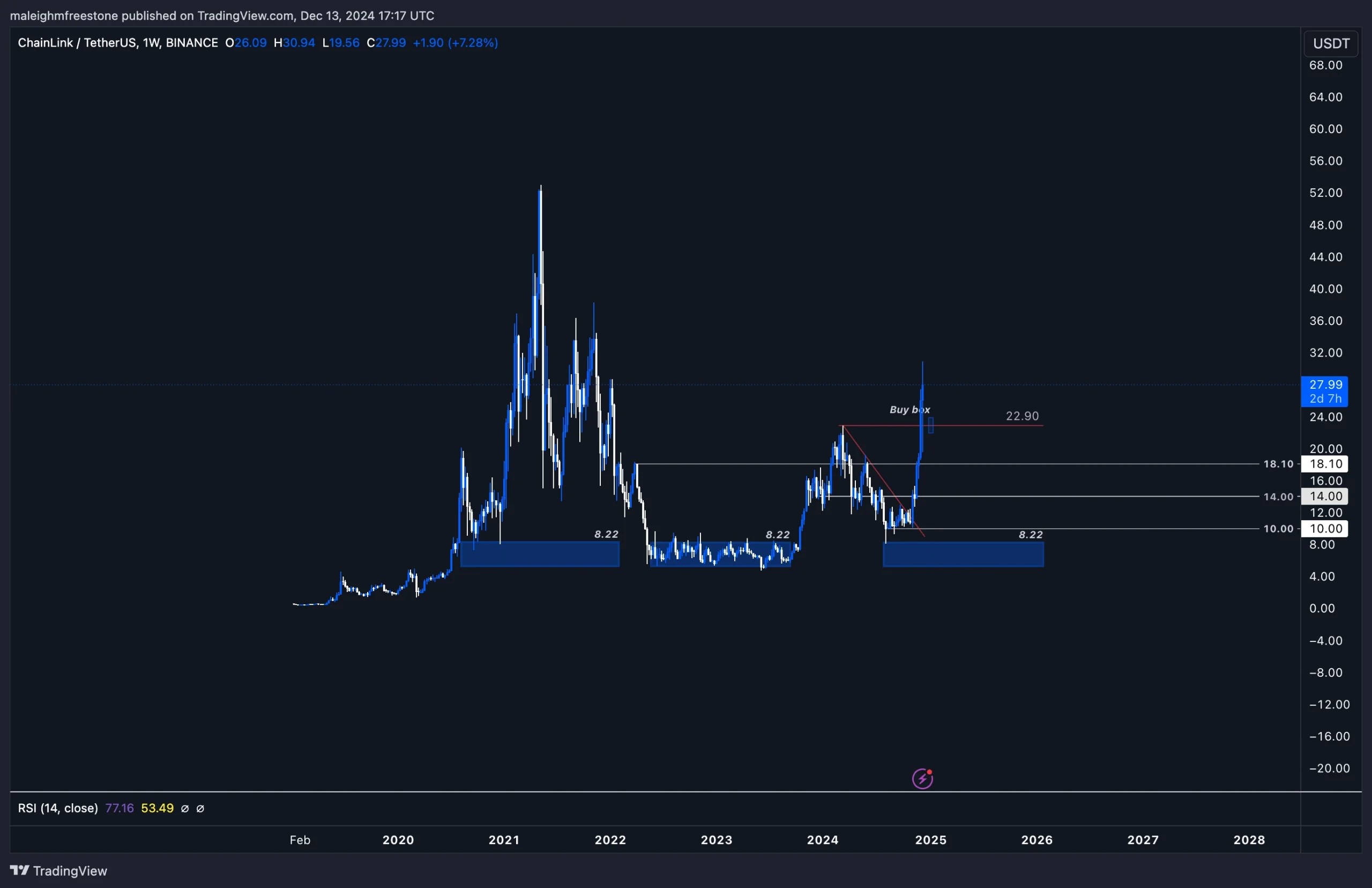

Chainlink (LINK):

Market context

Chainlink has been a standout performer recently, delivering impressive gains from its $8.22 cycle low region. From that level, LINK has rallied approximately 277%, highlighting its strength and ability to recover from significant sell-offs. The April/March 2022 sell-off was particularly deep, but LINK has since broken out of those levels and reclaimed them earlier this year in February 2023.Over the last two weeks, LINK has printed two strong bullish weekly candlesticks, surging 66% during this period. This reclaim and price action reinforce LINK's position as one of the strongest assets in the market right now, supported by high volume and significant bullish sentiment.

Price action

Key support: $22.90 (Buy Box)

- LINK has reclaimed this level following the market flush and used it as support before its recent pump.

- This area will act as the critical buy box for the accumulation of potential pullbacks.

Upside projections:

- $40: This level represents a 66% upside from current prices and is the next significant target. Given the current volume and strength, it looks achievable in the near term.

- All-Time High: $52.50 (Approximately 130% upside). A return to all-time highs remains the ultimate target if the broader market maintains bullish momentum.

Playbook

Buy box:

- Place the buy box at $22.90, as this level has proven to be a key support during the recent flush and subsequent recovery.

Upside targets:

- $40: Next significant target and likely achievable if volume persists.

- All-Time High ($52.50): The longer-term target, representing a 130% upside.

Strategy:

- Look for accumulation opportunities around the $22.90 buy box during any pullbacks.

- Monitor volume and broader market conditions to gauge the likelihood of sustained momentum into the new year.

Cryptonary's take

LINK's recent performance is a textbook example of bullish price action supported by strong volume. The reclaim of $22.90 and subsequent pump solidify its standing as one of the strongest altcoins in the current market. Looking ahead, the focus will be on $40 as the next upside target, with consolidation or a pullback to the $22.90 buy box providing a key opportunity for further accumulation.While the path to all-time highs may take more time and depend on broader market conditions, LINK's momentum and volume make it a prime asset to watch. Let's see how it plays out from here. For now, keep a close eye on $22.90 and monitor for signs of consolidation or continuation.

SUI:

Market context (SUI's performance)

In our previous analysis, we highlighted SUI's strength, with buy boxes placed between $3 and $2.8. On November 26th, the price went into this zone before climbing higher, confirming it as a strong area of interest for buyers.Since then, SUI has continued its impressive performance, rising to a new resistance level at $4.8. This resistance has been tested multiple times, with daily candles wicking into the region but failing to close above, signalling selling pressure.

On today's candle, SUI has printed a shooting star candlestick, which indicates strong selling pressure at $4.8 despite buyers attempting to push the price higher. This gives us a clear signal: buyers are losing momentum for now, suggesting a potential short-term pullback.

SUI price action

SUI remains one of the strongest-performing altcoins this cycle:- Initial $0.75 buy calls have delivered over 500% returns - a testament to its dominance.

- Price reached a local resistance at $4.8, which has held firm with several rejections.

Given the structure

- A retracement is now expected after two strong bullish candles drove SUI higher.

Updated accumulation zones

We are moving our buy box up to account for the most recent price action:- $3.6 to $3.4 - This range captures:

- Wicks printed on December 9th, 10th, and 11th - areas showing strong buying pressure.

- Previous resistance-turned-support levels were observed throughout late November.

Playbook

Updated buy box

- $3.6 to $3.4 - Revised accumulation zone, capturing recent wicks and previous resistance zones.

Strategy:

- Monitor price action around $3.6-$3.4 for potential entries.

- Look for bullish signals like long lower wicks or supportive daily closes within this zone.

Cryptonary's take

SUI continues to dominate mindshare and performance this cycle. From its initial breakout at $0.75 to the recent $4.8 resistance, it has proven to be one of the market leaders. The failure to close above $4.8 and the printing of a shooting star candlestick indicate that buyers are currently losing momentum. This sets the stage for a healthy pullback to our new accumulation zone at $3.6-$3.4.While SUI is not part of our CPRO picks nor in our investment portfolio, its performance and market cap growth demand continued analysis as it remains a standout altcoin in this cycle.