What does the future hold? Will BTC flip $32,000 into support and turn the market bullish?

Keep your tea leaves. We read the future by studying the charts. Let's go!

TLDR 📃

- Total market cap and BTC retested resistance last night. Even so, we remain under resistance and downside will likely continue.

- Many assets (including BTC) closed with bearish engulfing patterns last week. This is no time to be bullish.

- SOL and MATIC are the only assets at support. Because they’re not in confluence with the rest of the market, we’ll have to see how they react to these levels before confirming their next directions.

- Our charting format has changed. You’ll find everything on each chart in one glance.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you understand our analysis very quickly. They are not signals and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

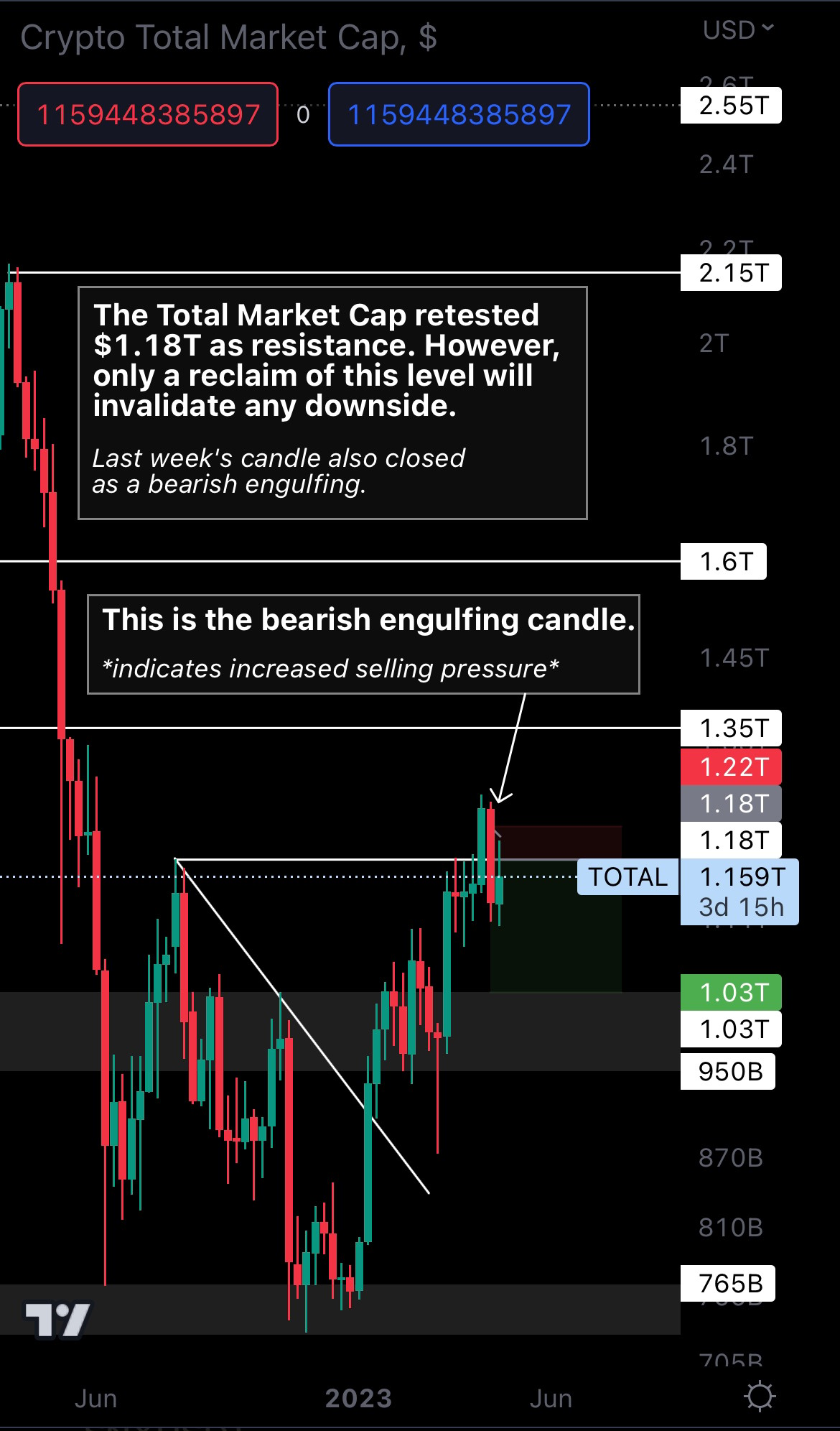

Total Market Cap (Weekly)

The Total Market Cap index represents the entire cryptocurrency market. We track this index to understand where the market is now and predict where it will go next.

Altcoins Market Cap (Weekly)

The Altcoins Market Cap index represents the entire valuation of the altcoins market: all coins other than BTC.

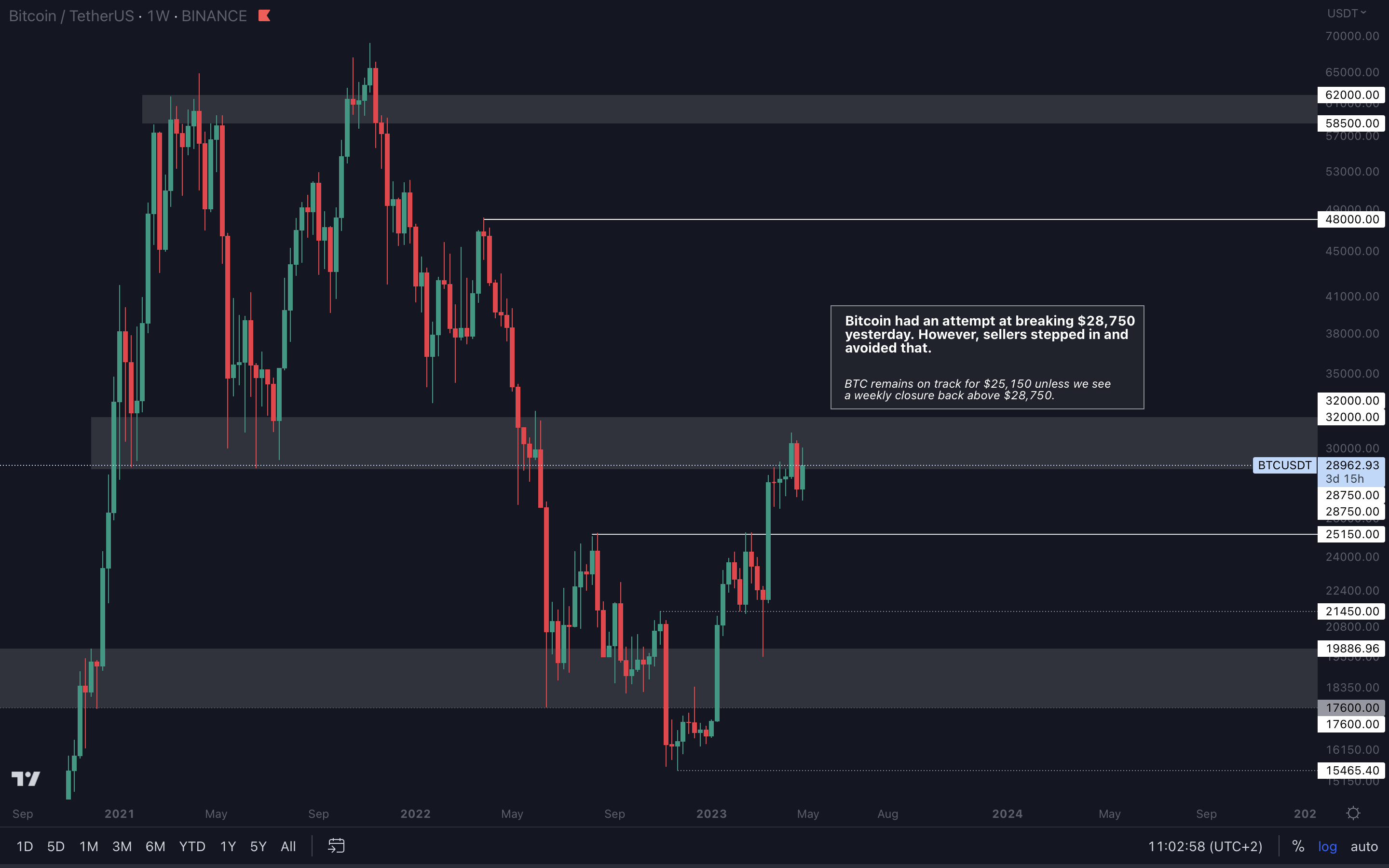

Bitcoin | BTC (Weekly)

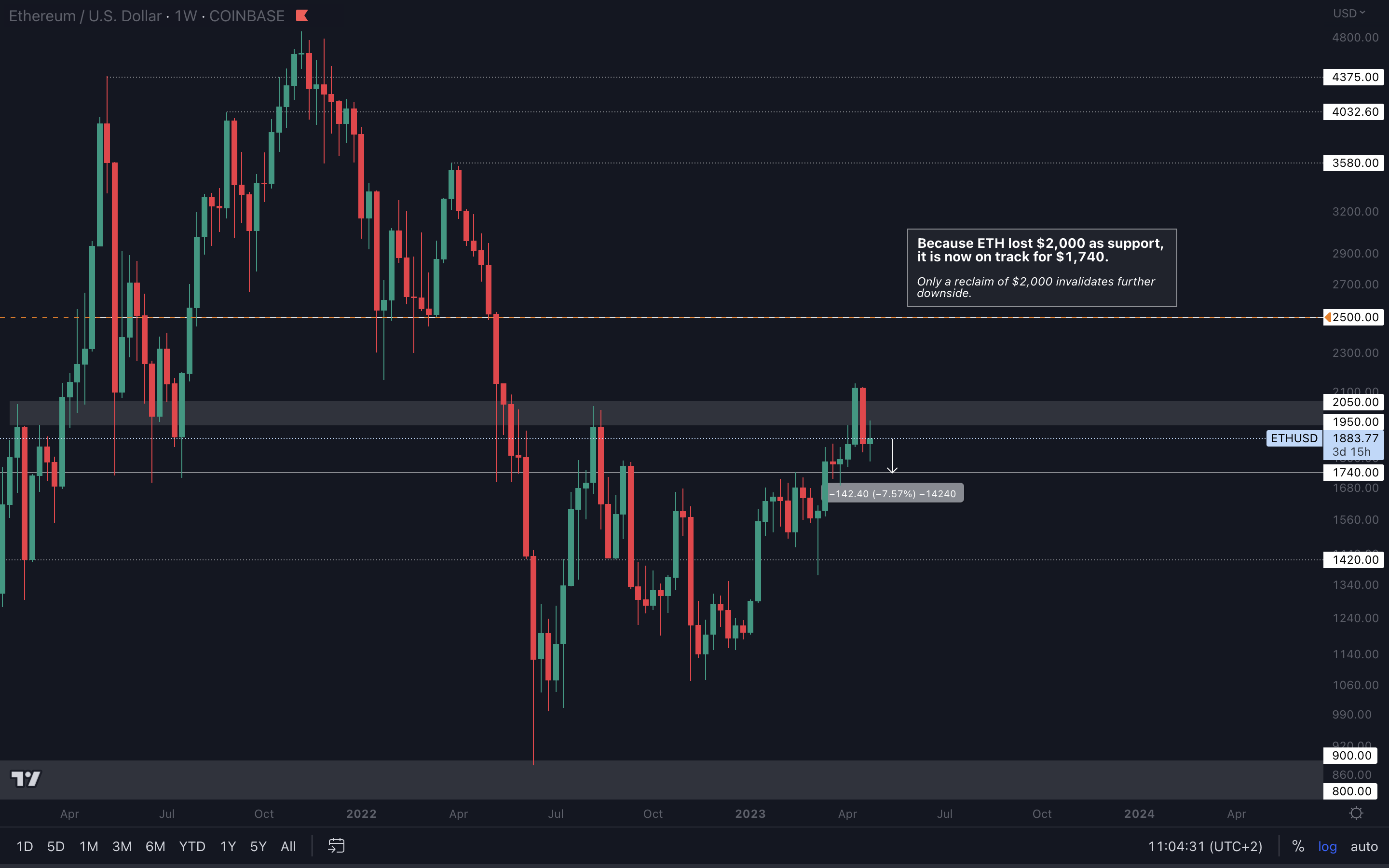

Ethereum | ETH (Weekly)

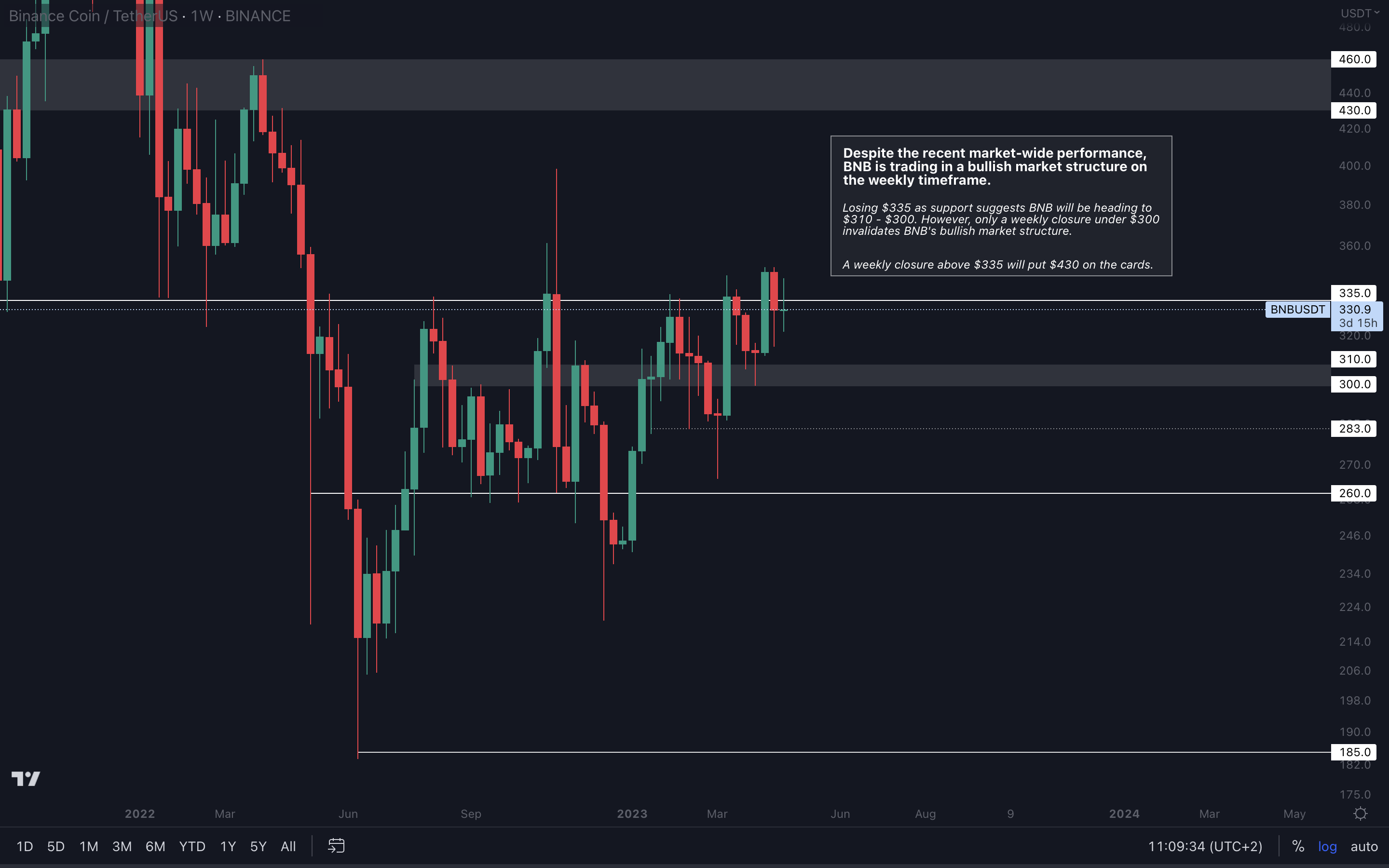

Binance | BNB (Weekly)

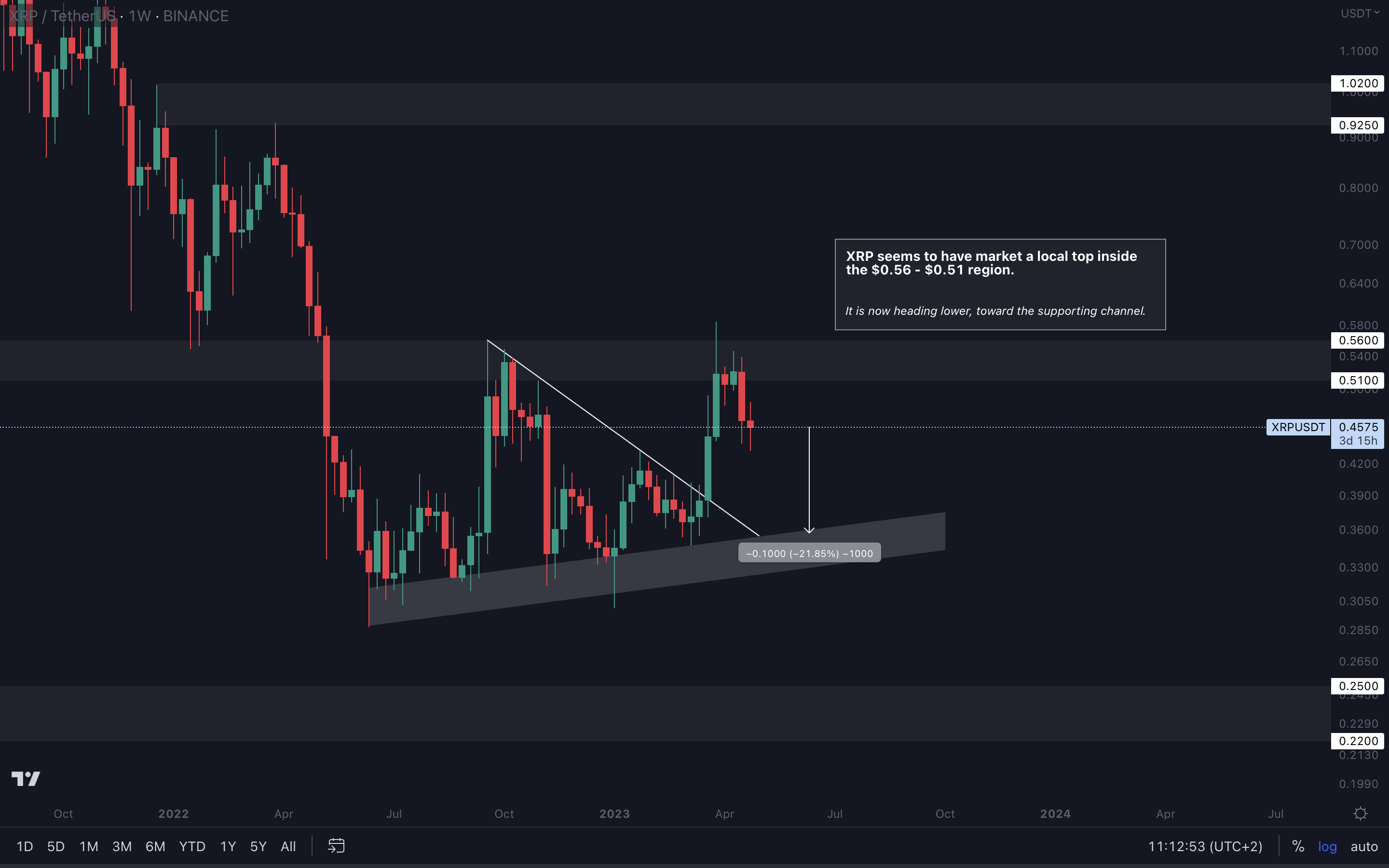

Ripple | XRP (Weekly)

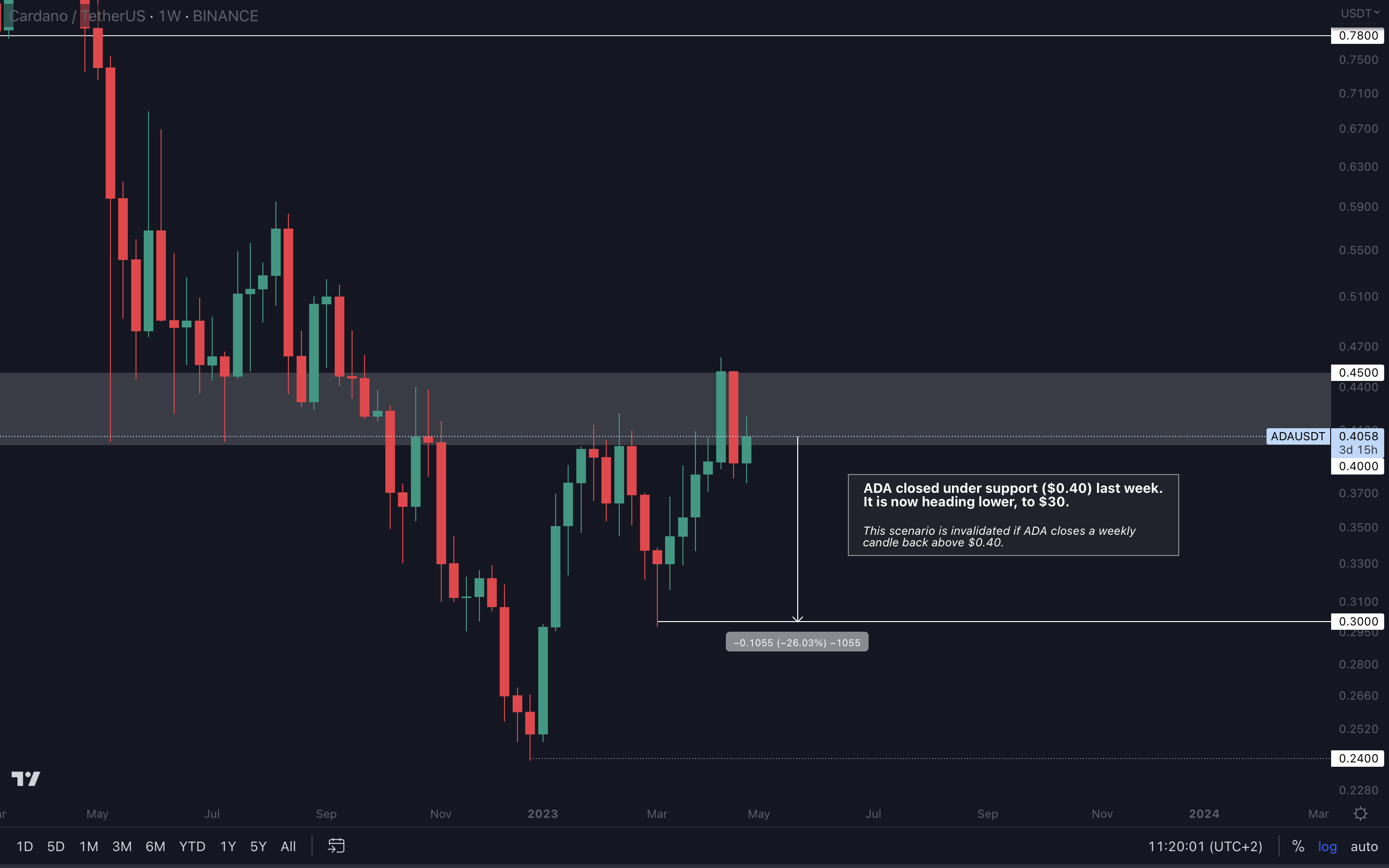

Cardano | ADA (Weekly)

Dogecoin | DOGE (Daily)

Polygon | MATIC (Weekly)

Solana | SOL (Weekly)

Last week SOL closed an almost full-bodied candle, suggesting high demand. Now the asset is back at support ($22) after yesterday’s market-wide drop.

Upside to $30 can continue as long as SOL can hold $19 as support. That is the bottom of its current support area.

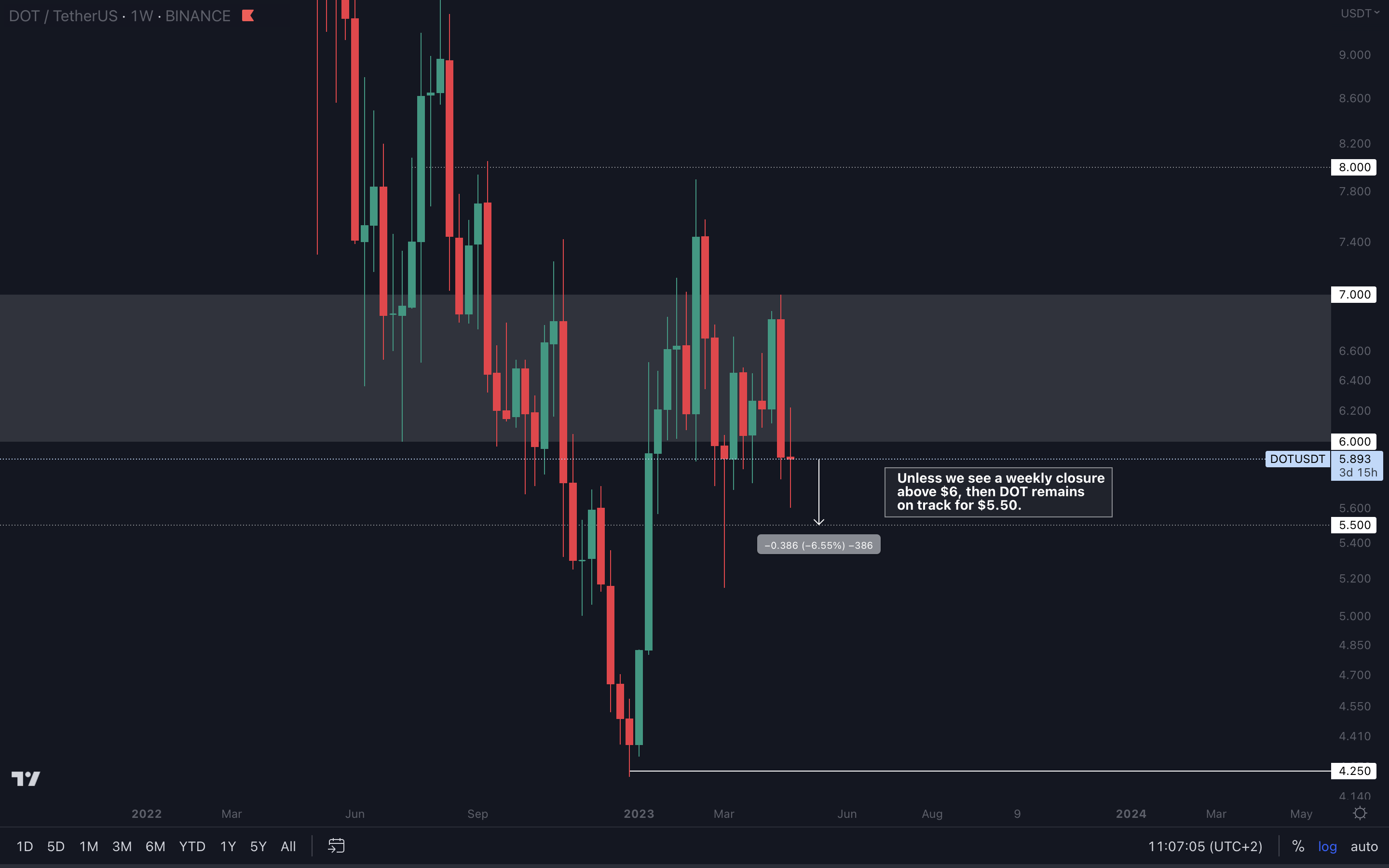

Polkadot | DOT (Weekly)

Litecoin | LTC (Weekly)

Cryptonary’s take 🧠

Is your head spinning from all this volatility? Sit back, take a long look at the charts, and deal with the facts instead of the what-ifs.Many assets closed bearish engulfings last week, suggesting increased selling pressure. Total Market Cap, BTC, and ETH are at major resistance on the higher timeframes. So before deciding to trade or invest right now, be sure to consider the risks.

We’d rather protect our capital and prepare for other opportunities, which is exactly what we did in our April Skin in the Game.

Action points 🎯

- BTC’s closing the week under $28,750 underscores the possibility of a pullback. If this happens, you’ll wish you had taken profits and protected your capital.

- For BTC to turn bullish, $32,000 needs to be flipped into support. Only then will the bearish scenario be invalidated and swapped for bullish moves in the short term.