Market Direction

Election outcome to drive BTC's next move

BTC is trading near key support with high open interest, just as the election approaches. Will the results send Bitcoin past resistance or into a retreat? Explore BTC’s current trends and future possibilities.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

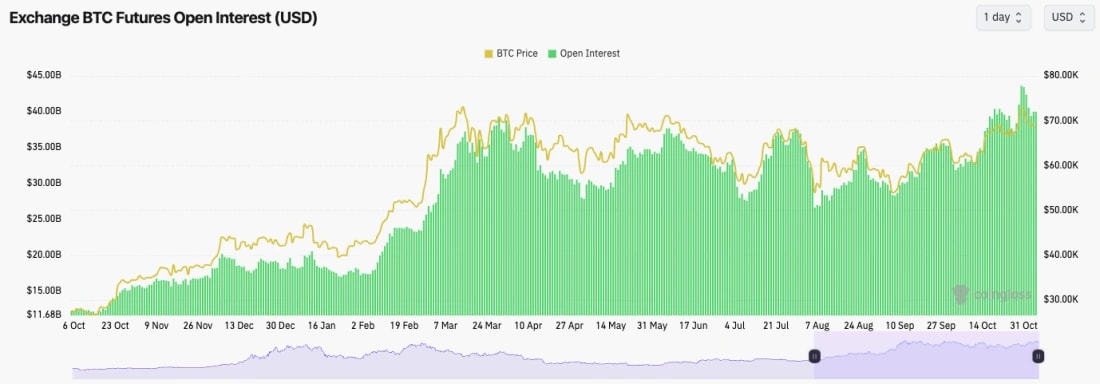

- BTC's Open Interest remains high, although it has pulled back slightly in the last few days as Trump's odds have come in and "Trump trade" assets have pulled back.

- BTC's Funding Rate remains positive, around the upper end, but still a healthy area of 0.01%.

Technical analysis

- BTC was rejected from the all-time highs at $73,600 and has since pulled back to the prior horizontal resistance at $68,900.

- To the upside, $73,600 (all-time high) is now the major resistance and a clean break out above likely ignites the "euphoria" stage of the bull run.

- On the downside, the current level of $68,000 to $68,900 should act as support going into the election.

- Beneath $68,000, $66,000, and then $63,400 are the key horizontal levels.

- Since poking into the all-time highs, the RSI has pulled back from overbought levels, and it's now in a more middle and neutral territory at 54.

- Next Support: $68,000

- Next Resistance: $73,500

- Direction: Neutral

- Upside Target: $73,500

- Downside Target: $66,000

Cryptonary's take

It seems the obvious explanation for this pullback is that price moved into all-time highs on strong odds of a Trump win. However, as those odds have come in slightly, there has been profit-taking on "Trump trade" assets which has then led to a pullback. It was also unlikely that risk appetite was going to increase substantially pre-election.Most smart money waits for an outcome, regardless of what the outcome is, to put capital into work. If Trump wins, it's very likely we'll see BTC trade north of $75k by the end of this week. If Harris wins, it's possible that BTC will sell off and potentially trade between $60k and $63k. However, we would see this as a buying opportunity. We're bullish mid and long-term, regardless of who the winner is.