Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

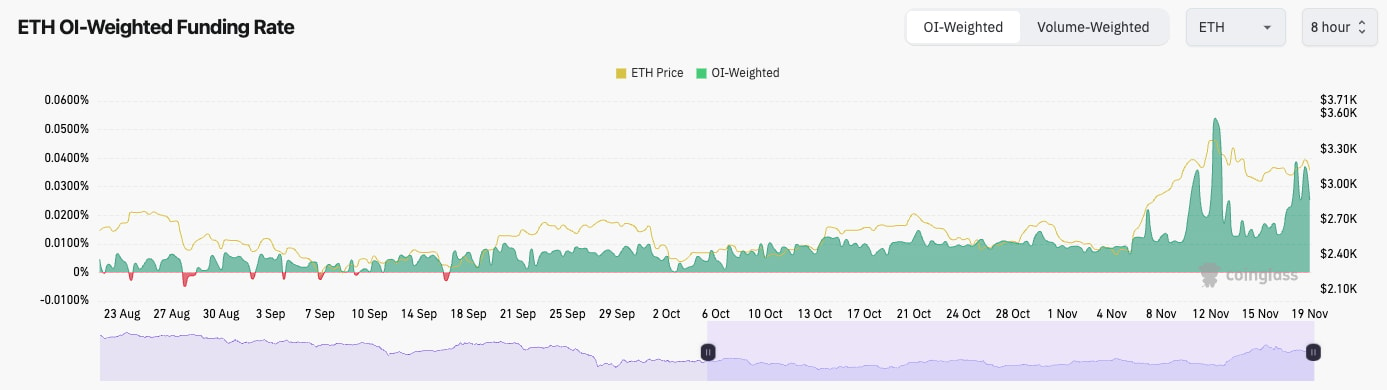

- ETH's Open Interest remains at very high levels.

- The funding rate has also increased more meaningfully.

- The leverage market as a whole is quite overheated here, and therefore, a flush out to the downside may be on the cards.

Technical analysis

- Since rejecting the $3,400 level, ETH has pulled back to the psychological level of $3,000, but it has managed to bounce from there.

- However, ETH is now forming a bear flag, which would have a breakdown target of somewhere between $2,875 and $3,000. It's possible that the $3,000 psychological level can be held as support if there is a breakdown for price.

- The RSI has pulled back meaningfully from overbought conditions, and it's now back to a more middle territory of 58. This is a healthy reset.

- To the upside, the key levels for the price to reclaim are $3,280 and then $3,480. A break above $3,480 and ETH will likely swiftly move on to $4,000.

Cryptonary's take

Other than BTC, most of the market is seeing a slight pullback here, including ETH. Whilst ETH is set up bearishly in the immediate term, we're still very bullish in the medium and long term. Therefore, if ETH does move down to $3,000, this may be a good level to add buys, particularly if there is a move into the $2,875 area.Bearish to neutral in the immediate term. Bullish beyond that.