Market Direction

ETH battles key levels as sentiment fades

As ETH clings to key support and BTC faces its own pullback, market sentiment stays fragile. Traders watch critical levels closely across major cryptos, eyeing the next big move. Let’s break down what’s happening across the board.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

ETH:

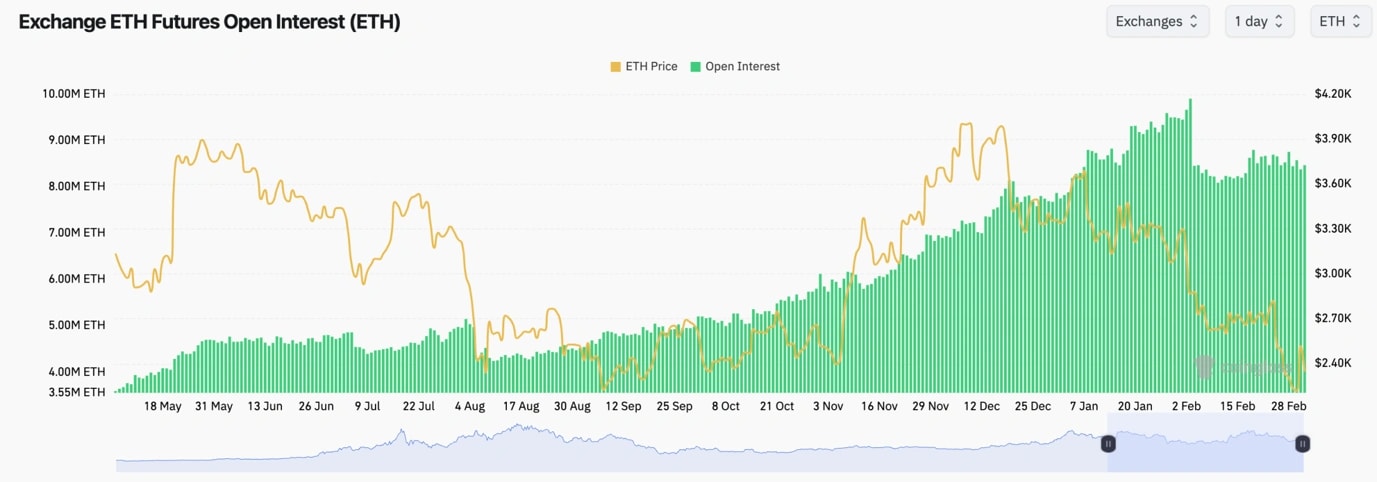

- Like Bitcoin, ETH's Funding Rate remained relatively flat (even balance between Longs and Shorts) whilst the Open Interest remained level also.

- This suggests that the price increase was spot-driven.

Technical analysis

- ETH broke down to the last horizontal support at $2,160, and fortunately price was able to hold this level, and ETH bounced on yesterday's Trump tweet.

- Price is now battling at the $2,420 horizontal level. A reclaim of this and price can potentially be setup for a retest in to $2,600.

- The RSI has broken out of it's downtrend, and it's sat on top of it's moving average. This is perhaps the only positive element of the chart currently.

- The key supports are $2,160 and then, if that's lost, $1,745.

- Next Support: $2,160

- Next Resistance: $2,420 (then $2,600)

- Direction: Bearish

- Upside Target: $2,600

- Downside Target: $1,745

Cryptonary's take:

Despite the positivity and the whip-saw to the upside in general sentiment following Trumps tweet yesterday, if we look at the ETH chart, it looks pretty poor here. It's possible in the short-term we see price just grind along and chop between $2,160 and $2,600 (more likely $2,420).And then in the upcoming month, potentially we see ETH break down to $1,745. We're not bullish on any timeframe on ETH here to be quite frank. Look at that chart and zoom out, it's hard to see where the bullish turn will come from as well. For now, we're sat watching this and expecting more chop, and then downside from there to say the $1,745 level.