Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

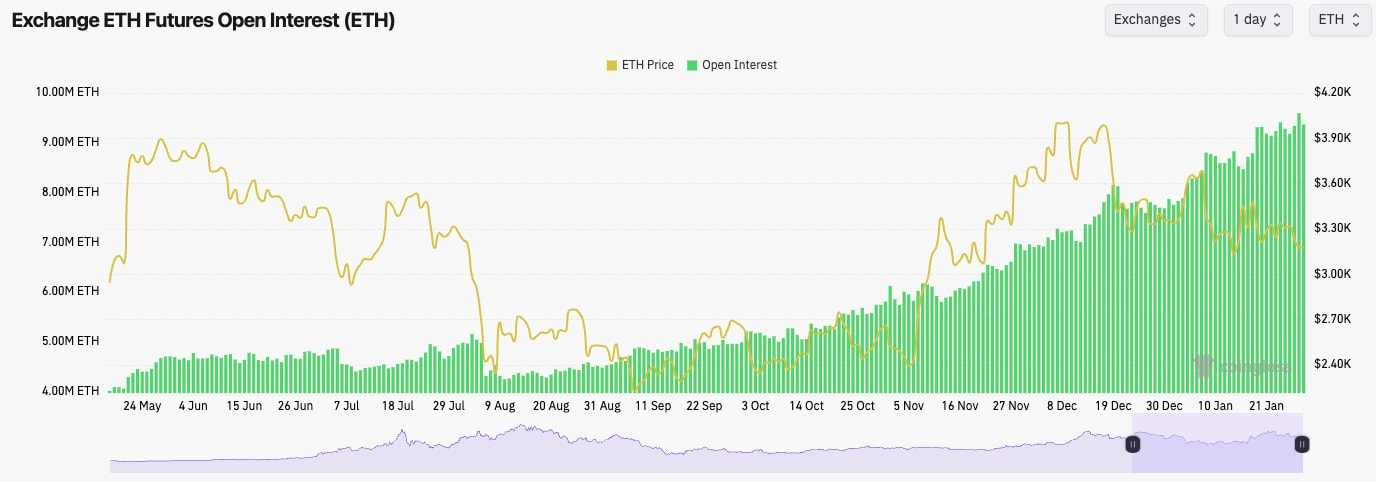

- ETH's Open Interest is still sky-high due to the cash-and-carry trade. It's becoming somewhat pointless to look at ETH's OI because of this.

- ETH's Funding Rate is at 0.008%, suggesting there's an even mix of Longs and Shorts.

Technical analysis

- ETH has broken down from its main horizontal resistance of $3,480 and is also rejected at the main downtrend line.

- Price has then broken below the next horizontal level of $3,280, but we are seeing the $3,050 hold as support for now.

- The RSI is in middle territory, but it's in a downtrend and also below its moving average.

- The key breakout will be a move above $3,480 and a break above the downtrend line.

- Next Support: $3,050

- Next Resistance: $3,280 (then $3,480)

- Direction: Neutral/Bearish

- Upside Target: $3,280

- Downside Target: $2,900

Cryptonary's take

ETH has been pretty boring here, and there isn't a mega-development beyond our last update. However, the new information we have is that ETH hasn't broken out of its downtrend line, and it's now also below the horizontal level of $3,280 - last time, it was butting up to $3,480 (the key breakout level).It's possible ETH can move back up to $3,400 - $3,500; however, we wouldn't be surprised if the Yellow box is eventually filled in the coming weeks. Again, this is another that we'll wait on for it to show us direction.