Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

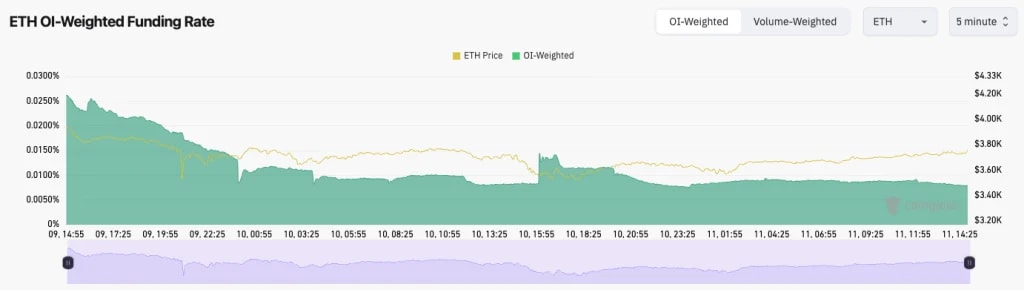

- ETH's Open Interest still remains high and hasn't seen as much of a flush out.

- ETH's Funding Rate has pulled back substantially from 0.03% to just 0.01% in the last 48 hours. So we've seen some flush out of excess Longs.

Technical analysis

- Really clean price action.

- Price was in a really clean uptrend and rejected at the main horizontal resistance at $4,000.

- The price then broke below the main uptrend line and swiftly revisited the main horizontal support at $3,480, where the price bounced perfectly.

- Price is now out of the main uptrend, so therefore, the underside of the uptrend line and the horizontal resistance of $4,000 will act as strong resistance.

- The RSI has also pulled back to 58, which is close to middle territory and nowhere near being overbought.

- Next Support: $3,480

- Next Resistance: $4,000

- Direction: Neutral/Bullish

- Upside Target: $4,000 (then $4,500)

- Downside Target: $3,480