Market Direction

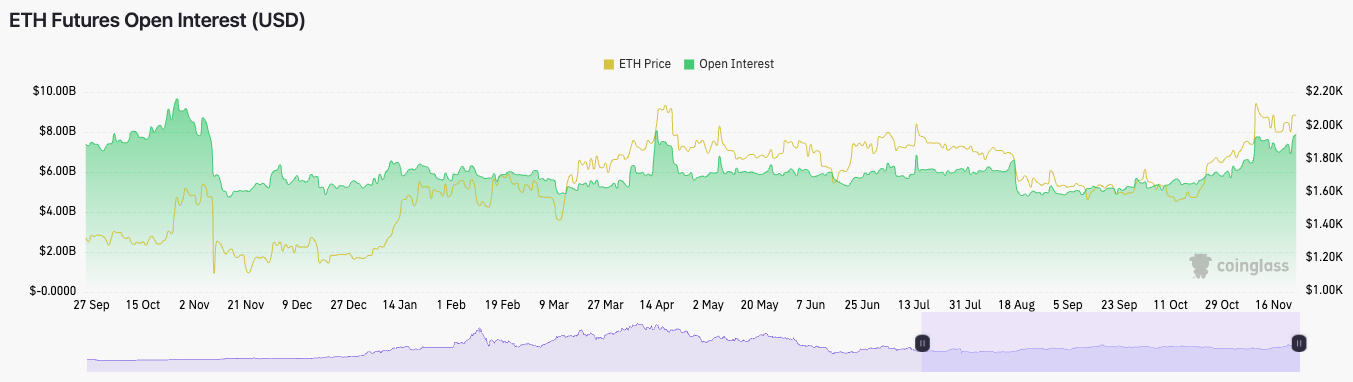

But this morning, Open Interest has spiked, with Funding going from 0.010% to 0.019%. Longs are ape'ing in. We need to see Spot follow through here.

TLDR

- ETH is pushing into the key $2,120 horizontal resistance zone.

- The break above this resistance could send price upwards to $2,340.

- However, futures are outpacing spot - we need higher spot volumes to break resistance.

- A rejection back down to mid $2,000s is likely if BTC falters at $38K.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

ETH 12hr

Technical analysis

From a technical perspective, ETH finds itself at a critical level, butting into the main resistance at $2,120. A break above could send ETH to $2,340.- ETH has broken above its local downtrend line.

- ETH is now testing into a key horizontal resistance at $2,120. If ETH can clear this level, that opens the door for a move up to $2,340.

- The local support is at $2,060. However, it’s a relatively weak support. The major support for ETH is at $1,933.

- The RSI remains healthy on all timeframes except the 3D, which puts a bearish divergence in overbought territory.

Market mechanics

ETH was coming off the back of a healthy mechanics setup. However, that has changed slightly over the past 12 hours.- ETH’s Open Interest has moved higher and is now back to its highs at $7.86b, up 10% since yesterday.

- The OI-Weighted Funding Rate is perhaps where the concern is. It has increased steadily since this morning, from 0.0089% to 0.0197%. This is Longs ape’ing in, and usually isn’t positive for price.

Cryptonary’s take

For price to break higher, Bitcoin will need to break out, but ultimately, more Spot volume will be needed, rather than the current move we’re seeing being more heavily dominated by Futures.Overall, ETH looks good from a technical analysis perspective. Currently, the concern is the mechanics. However, if we can see a flush out in the short-term, ETH can rebound, having flushed out these Longs that have piled in this morning.

If Bitcoin rejects - which it’s looking like it might again - then ETH can be pulled back lower. The key will be holding the mid $2,000s.

We will continue to DCA into $1,933 if price gives us that opportunity, and we’re not currently looking to take advantage of any short-term trades.