Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

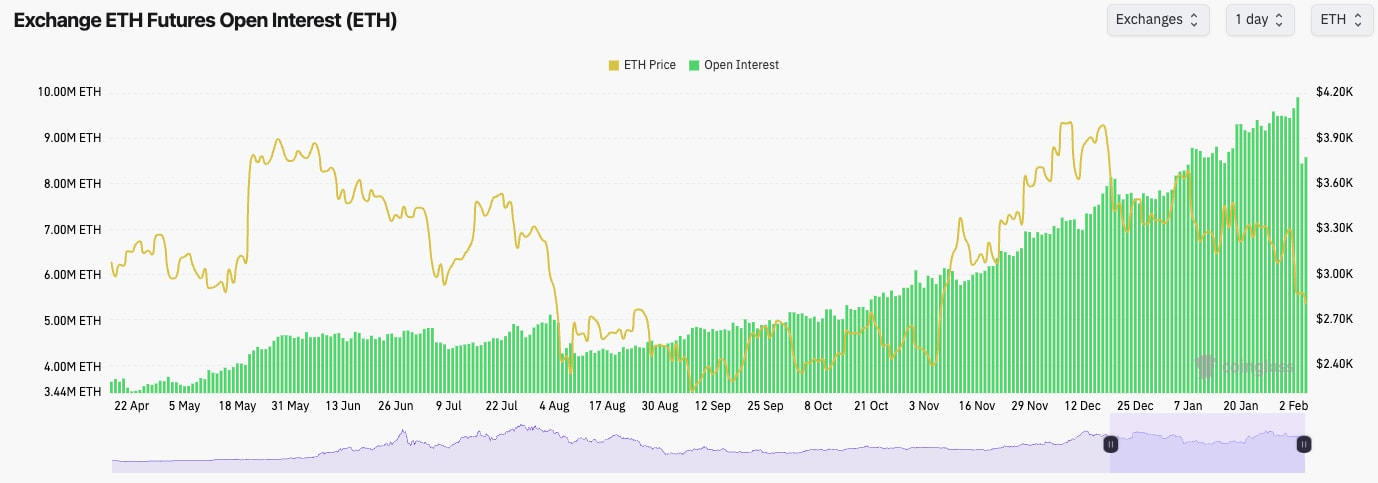

- ETH's Open Interest plummeted over the last 48 hours, showing that this was a large leverage washout event.

- ETH's Open Interest (by number of coins) fell by 16%.

- ETH's Funding Rate was very negative on Monday, but it has now returned to slightly positive. However, funding keeps flip-flopping between positive and negative, showing indecision among traders, who are most likely being chopped up.

Technical analysis

- ETH rejected into the horizontal resistance of $3,480. A failed breakout then sent the price to $3,280, which also couldn't hold.

- The capitulation event sent ETH well below the next horizontal support of $2,420, but the price has recovered and is now trying to stabilise around the Yellow Box - which has now been filled, as we called for.

- $2,600 is the next horizontal support, whilst $2,875 is the next horizontal resistance.

- ETH's RSI is close to being oversold, and it remains well below its moving average.

- Next Support: $2,600

- Next Resistance: $3,050

- Direction: Bearish/Neutral

- Upside Target $3,050

- Downside Target: $2,400