Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

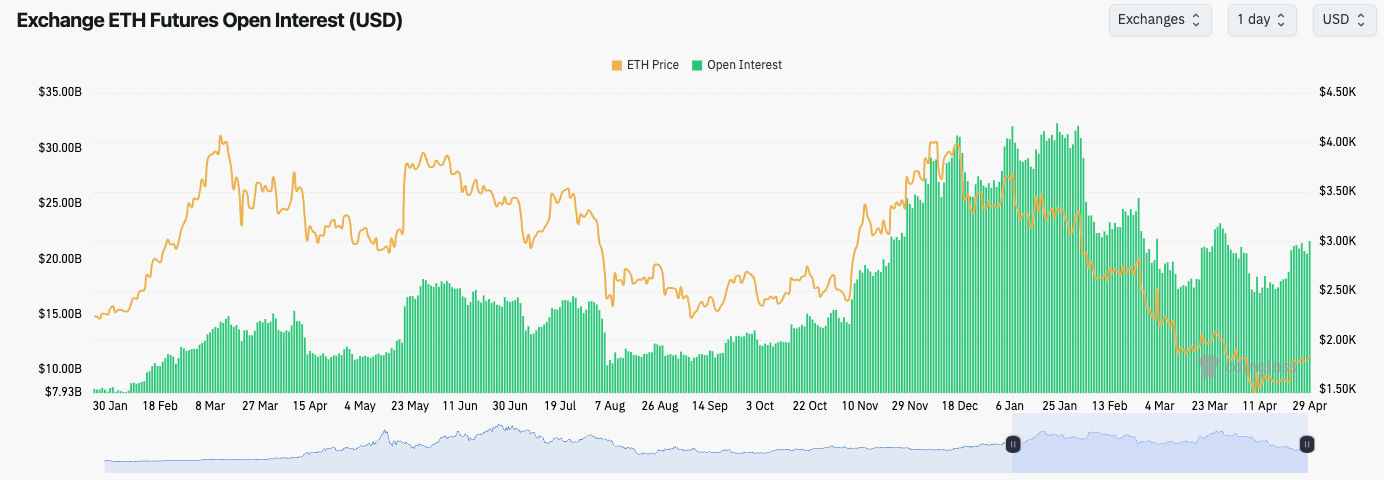

- ETH's Open Interest has ticked up slightly, but the Funding Rate has also come down somewhat; however, they still remain slightly positive. This suggests that some Shorts have begun stepping in.

Technical analysis

- ETH has found support above the key horizontal level of $1,745, whilst price grinds along into the main downtrend line.

- If ETH can break out of its main downtrend line, the upside targets would be $2,000 and then $2,160.

- To the downside, the key level for ETH will be maintaining above the $1,745 horizontal support, but if that level does break, then $1,530 is the likely target area.

- The RSI is in middle territory, and nowhere near being overbought. This suggests that there can still be further upside for price.

- Next Support: $1,745

- Next Resistance: $2,000

- Direction: Bullish

- Upside Target: $2,160

- Downside Target: $1,530

Cryptonary's take

For us, it's difficult to bet on upside in this market when we have concerns over the macro environment over the coming months. However, if you are looking to bet on upside, ETH is the play, and it looks attractive to Long in comparison to other plays.If the general market can hold up (not meaningfully pull back), then ETH can break out and test $2,000 and then $2,160 in the short term.