Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

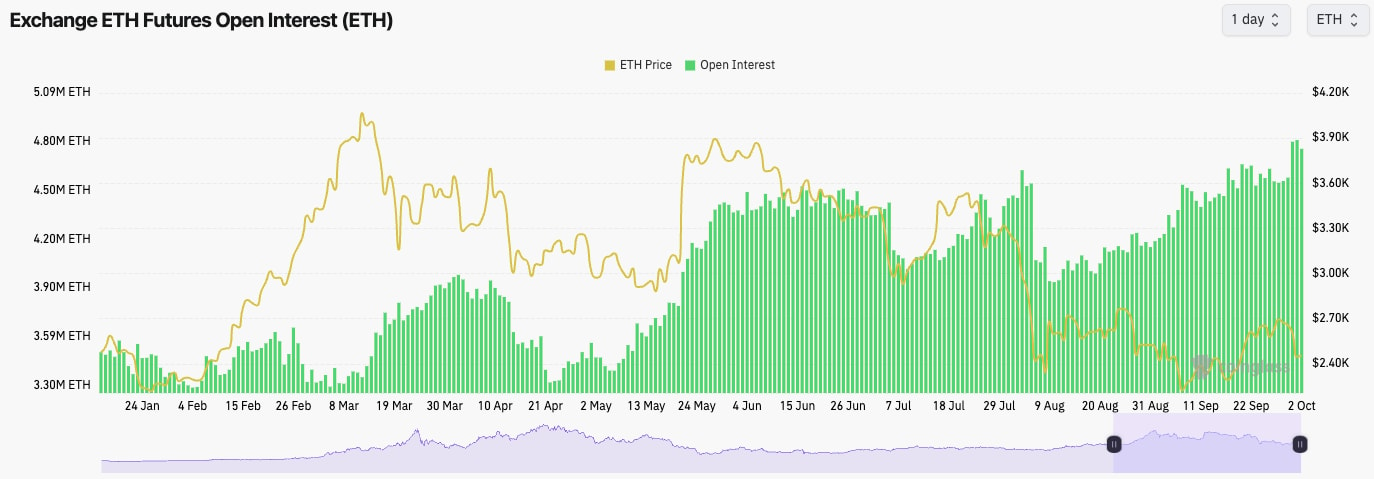

- Interestingly, ETH's Open Interest increased over the past few days as prices declined, and the Funding Rate remained positive.

- This suggests that the selling came from Spot rather than Perps, and more leverage went on as the price declined, likely new Longs.

Technical analysis

- ETH was rejected from the $2,700 and was not able to hold above the local horizontal support of $2,557.

- Price has since fallen in to the $2,400's although it is still holding above it's local uptrend line.

- The $2,420 line could be considered local support.

- On this price pullback, the RSI has meaningfully reset, which is positive.

- Price is slowly moving closer to the main downtrend line, although it does now have the horizontal level of $2,557 above the current price which may act as a resistance in the short-term.