ETH's bull flag breakdown brought a flush of shorts, with funding rates skewing long. But key support at $1,933 held firm, preserving the uptrend. Now, the stage is set for Ethereum to resume its push higher in sync with broader risk asset tailwinds.

TLDR

- ETH bounced from key $1,933 support after the bull flag broke down.

- The mechanics align for a volatile move higher to wipe out shorts.

- ETH will likely head higher in the short term to retest the $2,120 resistance.

- Fantastic long-term entry around $2,000, strong buy zone if revisited.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

The macro context follows through to all other assets that essentially trade with a high correlation to other risk assets.Technical analysis

ETH had a breakdown of its bull flag, and price is now trying to reclaim it. When price broke down yesterday, it bounced perfectly from the horizontal level of $1,933 that we had marked as a key support level over the past week. Alongside this, the uptrend is also still intact. If the uptrend is lost and price falls beneath $1,933, this would invalidate the bullish structure, but despite this, we would be strong DCA buyers sub $1,900.To the upside, the key level to break above is now $2,120. If this level can be broken, then this opens the door for ETH to move meaningfully higher to test $2,340.

The RSI is looking much better on the daily timeframe, having come out of overbought territory and now at 64. The 3D and the weekly timeframes are very close to overbought territory, but they aren’t overbought, so this is definitely a positive.

ETH 1D

Market mechanics

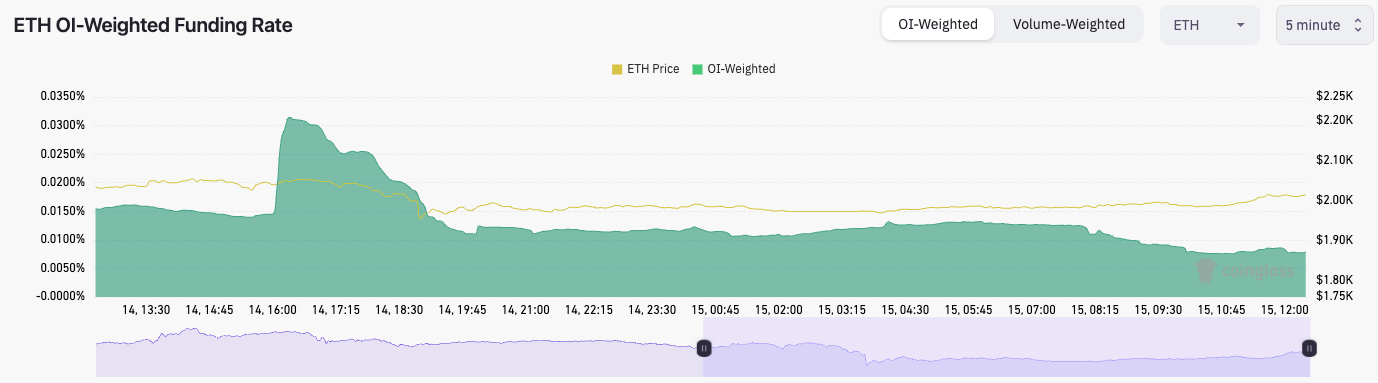

When looking at the funding rate, there was a big spike yesterday (longs piling in) that was then flushed out. We now see the funding rate at 0.0078%, which means there’s a closer balance between longs and shorts.

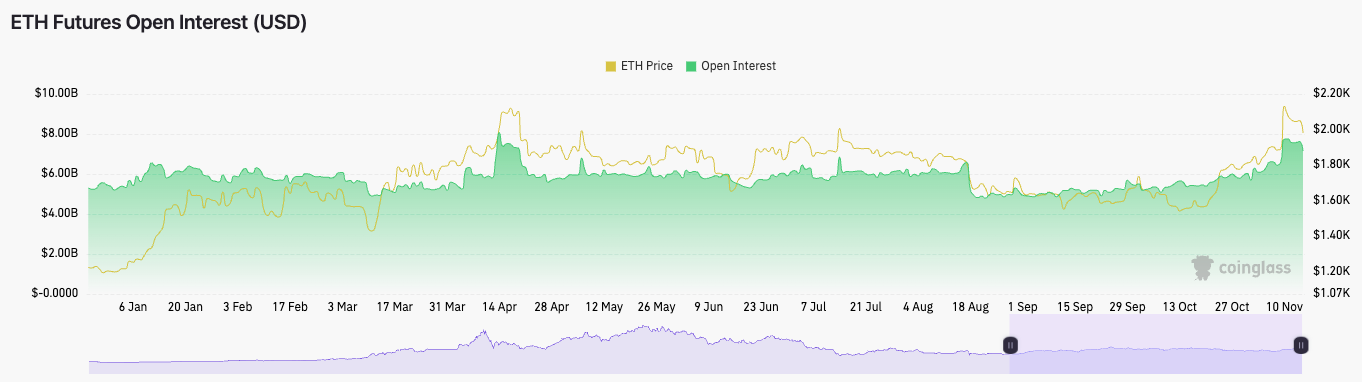

The open interest for ETH has come down a little, but not by much.

So, this is a similar picture to Bitcoin. The reason is that the long/short ratio is at 0.9227 over the past 24 hours, meaning that shorts piled in yesterday, likely on the move lower. Despite the high open interest, this has also brought the funding rate into a more even balance.

Cryptonary’s take

We may get a more volatile move in the near term, and the likelihood points towards wiping out yesterday’s late shorters, meaning the volatile move for price would be higher.Anything around $2,000/sub $2,000 is a fantastic long-term entry for ETH. It’s one of the majors that isn’t as over-extended, plus it’s also set up well in the short term from a technical and mechanics viewpoint.

In the short term, we see ETH's price going higher to at least retesting $2,120.