Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

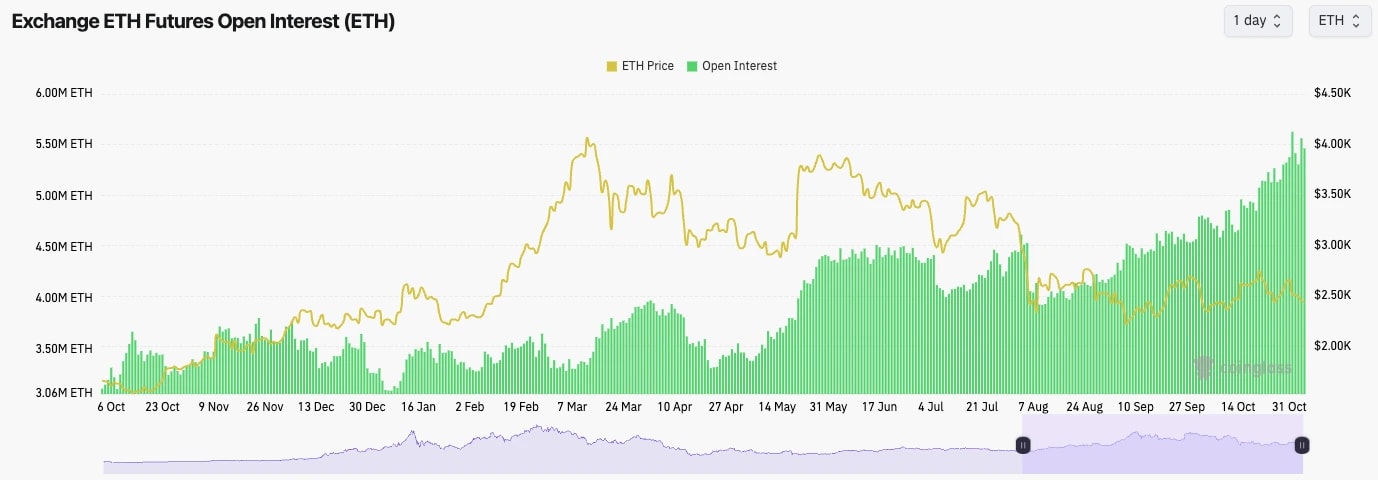

- ETH's Open Interest remains at highs (measured in the number of coins rather than USD) suggesting there are a lot of leverage bets on ETH currently.

- The funding rate is at 0.01%, so it is still at a relatively healthy level.

- If there is a Harris win, it's possible we see price trade lower and OI be flushed down.

Technical analysis

- ETH is now entering its fourth month in the lower price range of $2,150 to $2,800.

- ETH was rejected in the $ 2,700s and underside of the local uptrend line. Price has now fallen back into the main downtrend and beneath the key horizontal level of $2,557 - not great!

- Price is now approaching its local support level at $2,420, which will need to hold or $2,300 is likely and the door to the major support at $2,150 will be open.

- On the upside, honestly, our focus is just on reclaiming $2,557 at this rate. This will likely only happen if we see a Trump win.

- ETH's RSI is at 41, so somewhat still in middle territory, although the smaller timeframes are putting in bullish divergences.

- Next Support: $2,420

- Next Resistance: $2,550

- Direction: Neutral

- Upside Target: $2,550

- Downside Target: $2,150