Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

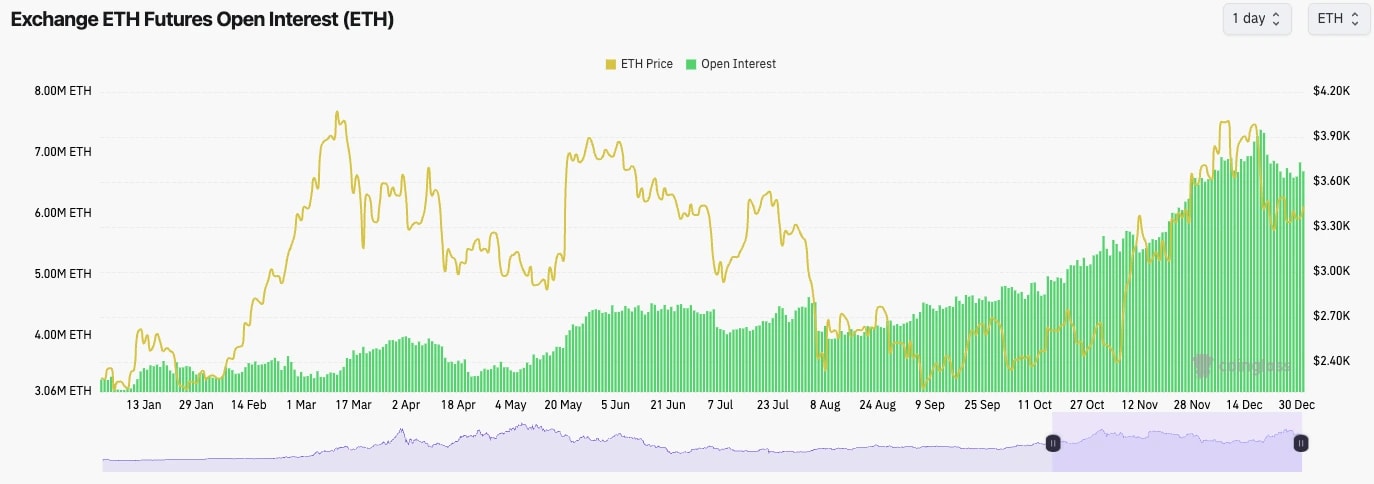

- ETH's Open Interest is also down approximately 10% from its highs, although it has started moving higher again in the past few days. Perhaps traders are looking to get exposure to ETH going into the New Year.

- The Funding Rate for ETH is at 0.01%, indicating a healthy dynamic between Longs and Shorts. Funding isn't skewed in either direction for now.

Technical analysis

- Overall, it is a really interesting chart with prices respecting key levels.

- The price was rejected on the underside of the uptrend line, and the horizontal resistance was at $3,967.

- Price has since pulled back to the low $ 3,00,0, and it has been mostly range-bound between the horizontal support of $3,280 and the horizontal resistance of $3,480.

- A break out of $3,500 likely sends the price swiftly back to $3,700.

- The RSI is in the middle territory at 47, but it is breaking above its moving average. This could see price follow through a push up to $3,700 in the immediate term.

- Next Support: $3,280

- Next Resistance: $3,480

- Direction: Neutral (Bullish)

- Upside Target: $3,700

- Downside Target: $3,280