Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's Funding Rate remains positive, but at a healthy level,

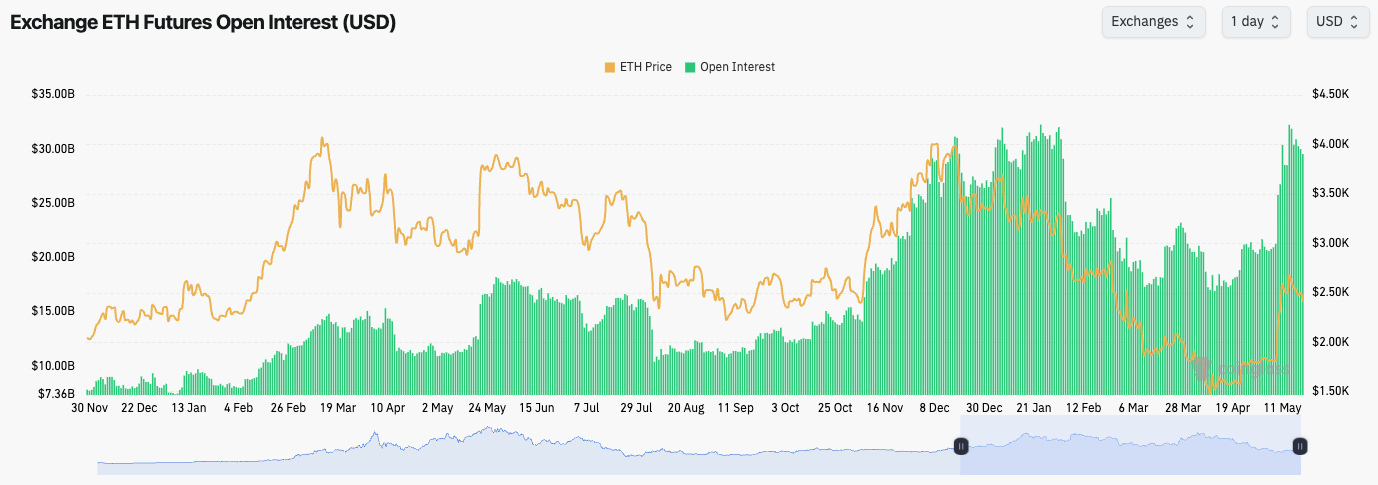

- ETH's Open Interest has increased dramatically on this price rebound. This is likely large players scaling into Shorts.

Technical analysis

- The positive development was ETH reclaiming back above $2,420, and the price began to use that level as horizontal support.

- However, price has since retested below that level, and it's now battling to maintain above it.

- To the downside, the two key horizontal levels are $2,420 (current level) and then $2,160.

- To the upside, the key horizontal level is $2,700.

- ETH's RSI moving average has moved well into overbought territory. It's possible we see a small move up of the RSI, and a rejection of its moving average. This likely results in the price moving into $2,160 over the coming weeks.

- Next Support: $2,420

- Next Resistance: $2,700

- Direction: Bearish

- Upside Target: $2,700

- Downside Target: $2,160