Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- ETH's funding rate is 0.01%, which indicates an even mix between longs and shorts.

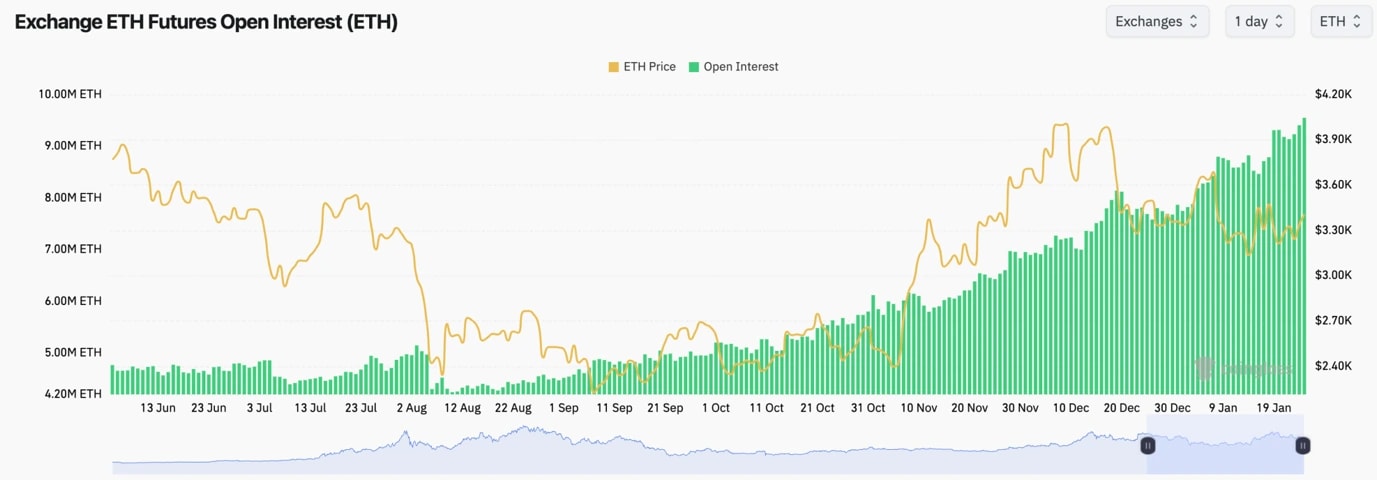

- The Open Interest for ETH remains really high, and alongside that, we've seen Spot purchases not be as strong.

Technical analysis

- ETH is beginning to look more interesting here from a TA perspective.

- We have ETH, having been able to hold the lows/the supports at $3,150, and the price has now reclaimed $3,280 and is pushing onto the main horizontal resistance of $3,480.

- The $3,480 horizontal resistance also converges with the main downtrend line. If the price can break out of these converging resistance areas, then the price will likely swiftly move up to $3,700.

- ETH's RSI is now also battling at its uptrend line and looking for a breakout.

- Next Support: $3,280

- Next Resistance: $3,480

- Direction: Neutral

- Upside Target: 3,700

- Downside Target: $3,050

Cryptonary's take

Key decision time here for ETH. It's managed to hold the lows and move higher, with it now really testing the main resistance levels (the horizontal resistance at $3,480 and the main downtrend line). We need to see ETH get some follow-through here. Otherwise, confidence may be lost again, and we might see a price rollover and retest of $3,050.The key decision for ETH is here. If it can be helped/pushed by the rest of the market, then that's great, as that's what it may need.