Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

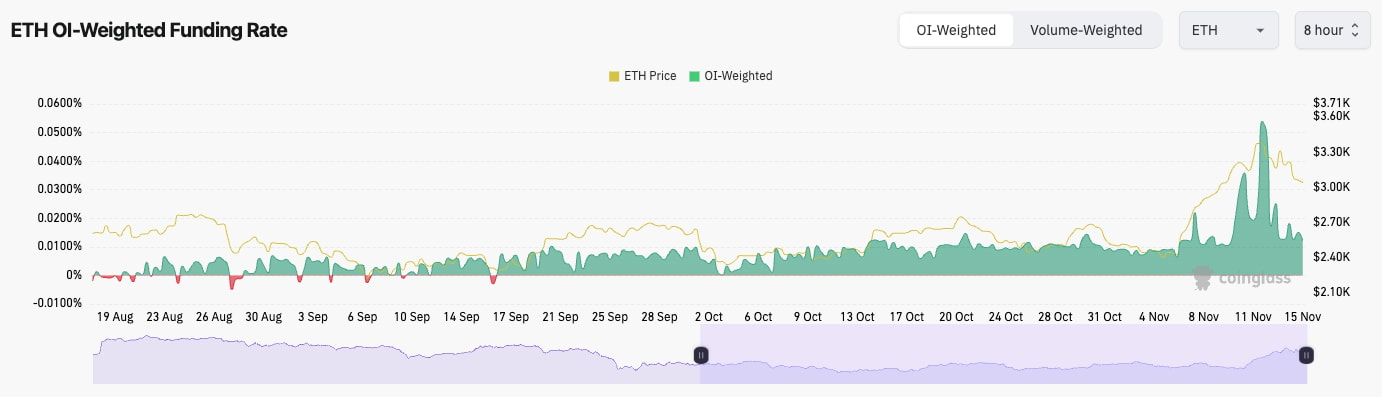

- ETH's Open Interest remains extremely high and at all-time highs in USD value and by the number of ETH.

- Like BTC, ETH's Funding Rate has also pulled back to more sensible and therefore healthy levels. This is positive.

Technical analysis

- Even though ETH's move was also mostly straight up, we're referring back to the Daily timeframe for the ETH chart.

- ETH moved into the range between two key levels: $3,280 and $3,480. ETH couldn't sustain in this higher range and has since pulled back.

- It's possible that the psychological level of $3,000 acts as local support for ETH. However, the major support for ETH is at $2,875.

- ETH was very overbought, but via pulling back, the RSI has reset more meaningfully, and it's back in the middle territory and finding support on its moving average. This is better and needed.

- On the upside, it's likely that $3,280 to $3,480 will be more significant resistance for ETH to overcome.

- Next Support: $3,000

- Next Resistance: $3,280

- Direction: Neutral

- Upside Target: $3,280 (then $3,480)

- Downside Target: $2,875

Cryptonary's take

It was a massive move higher for ETH, so it could be expected that some of that move is given back, which we're seeing now. Since pulling back, some of the indicators have reset from very overbought levels, and ETH is close to approaching an area of support.We expect ETH to hold above $2,875 and potentially find support in that range between $2,875 and $3,000. Let's see if we get that over the coming days/week. We're not looking to sell any Spot ETH, and we're looking to hold through this period, which we merely see as a small pullback in a wider bull market.