Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

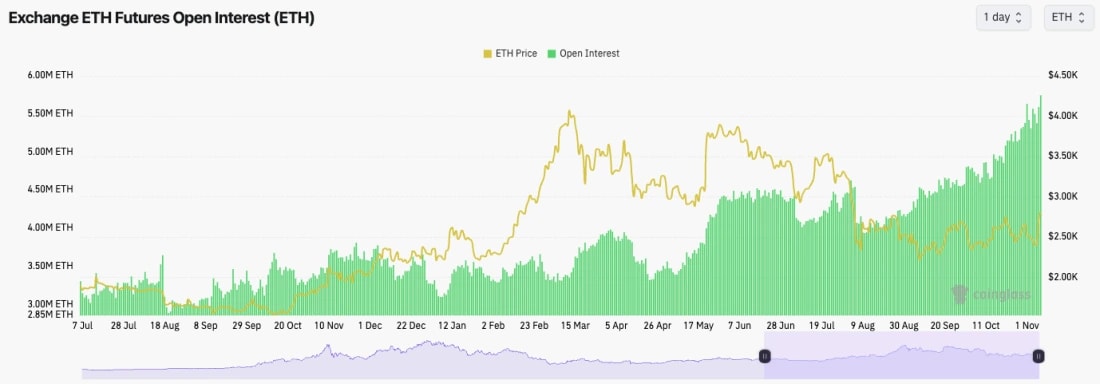

- The ETH Open Interest is in an aggressive uptrend and hit new all-time highs yesterday. This indicates a lot of leverage has gone in to ETH.

- The Funding Rate is similar to BTC. Positive but contained on larger exchanges, but the

- Funding Rate is rising on the smaller, less liquid exchanges, indicating traders are paying a higher and higher premium to be Long here.

Technical analysis

- So far, a really lovely move, and maybe the first time we're seeing some life from ETH following a Trump victory that potentially improves the regulatory environment, benefitting ETH.

- ETH broke back above the main downtrend line and shot straight up to the main horizontal resistance of $2,875 that we've had in place for a number of months now.

- Price has so far been rejected from $2,875; although the price now being in this higher range, it's likely we will see a breakout of $2,875 in the coming weeks.

- Local support for ETH should be around the $2,700 mark. Really, in this market, ETH should be able to hold the $2,700 local support.

- Beyond $2,875, ETH's next major horizontal resistance is $3,280.

- ETH's RSI is approaching overbought territory, but isn't yet close. If price consolidates for a few days, this'll reset the RSI more and likely give more room for ETH to then break above $2,875 more convincingly. Likely more upside to go here.

- Next Support: $2,700

- Next Resistance: $2,875

- Direction: Neutral/Bullish

- Upside Target: $2,875 (to $3,280 upon breakout)

- Downside Target: $2,700

Cryptonary's take

A much more positive looking chart which is to be expected considering ETH and just the blockchain space is now likely to be moving in to a new regulatory regime.We're expecting the price to be range-bound between $2,700 to $2,875 for a few more days and then to breakout above $2,875 potentially by the end of the weekend.