Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

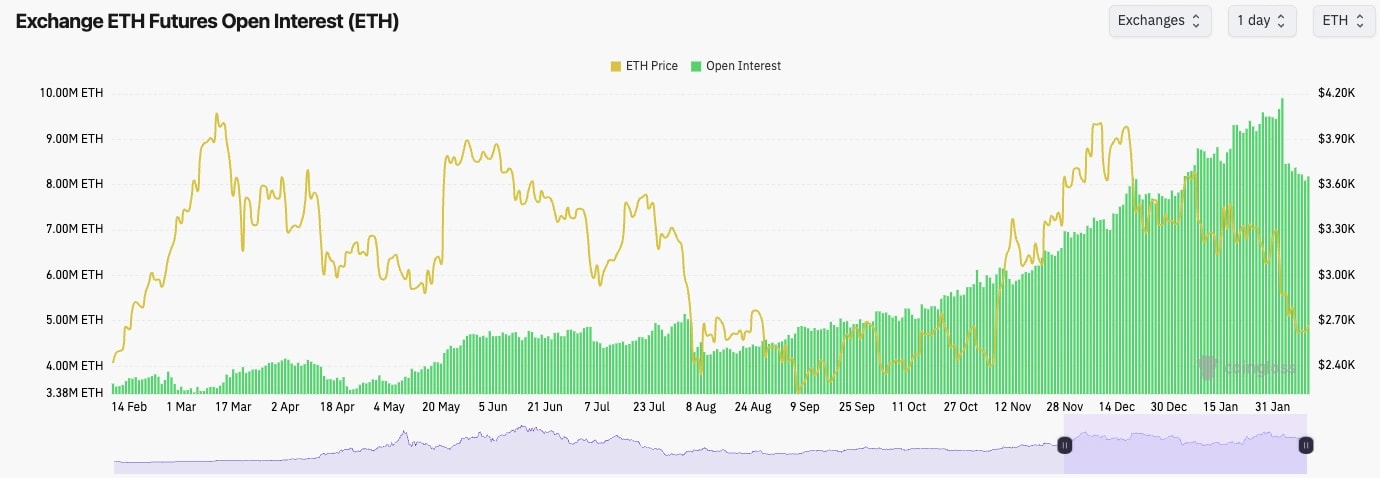

- ETH's Open Interest has been on a rapid increase until recently when we saw a 20% flush out on the large price move down over the first few days of February.

- ETH's Funding is similar to BTC, in that it has fluctuated around 0.00%, although it is now grinding up to 0.01% again, indicating that there is a slight bias amongst traders to go Long.

Technical analysis

- ETH fully filled our Yellow box, and the price actually broke below it. We had this as a target zone that has now been hit and hence removed.

- ETH has seemingly found support in the short term between $2,500 and $2,600.

- But, the major support is at $2,420. A breakdown below this level would be very bearish/negative, and it might take ETH a long time to recover.

- To the upside, ETH is below the two main horizontal resistances between $2,875 and $3,050.

- The RSI is very close to oversold territory, which is positive and might mean we could see a bounce but as of yet, we haven't formed any bullish divergences which are sometimes needed to see a more substantial relief bounce.

- Next Support: $2,420

- Next Resistance: $2,875

- Direction: Neutral

- Upside Target: $2,875

- Downside Target: $2,420

Cryptonary's take

Whilst ETH occasionally looks attractive for short-term trades, it's hard to be super positive on it in the immediate and medium term considering its overperformance (lack of upside when the market rises, and it pulls back matching the market when the market bleeds).ETH remains in a downtrend and below some key horizontal levels. We likely won't become interested in the short-term, until we see some of these components reverse, we'll instead remain patient on ETH. In the short-term, however, ETH might retest $2,800 if we see BTC move up to $102k say. But other than that, we're not too interested in ETH here.