Market Direction

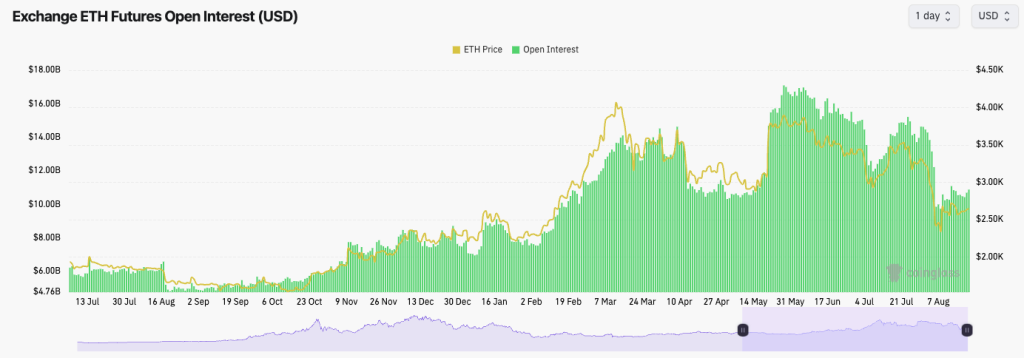

ETH's Open Interest has also remained more subdued following the flush out, indicating that traders are not rushing back to leverage Long or Short ETH here. This is a really healthy resetting in leverage, which is usually positive for prices going higher in the following weeks and months.

ETH's Open Interest:

Technical analysis

- Like Bitcoin, ETH remains in the lower range between the major horizontal support of $2,150 and the horizontal resistance of $2,875.

- Locally, ETH is range-bound between $2,400 and $2,750. These are the levels to watch for a more material breakout.

- ETH is in an ascending wedge, which tends to have a bias to break out to the downside; however, this isn't a clean wedge in terms of its formation.

- A breakdown from the wedge would likely send ETH to $2,400 to $2,500, which we would see as a buying zone for ETH.

- The RSI is at 42, so it is middle territory, but there is more upside to be had.