Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

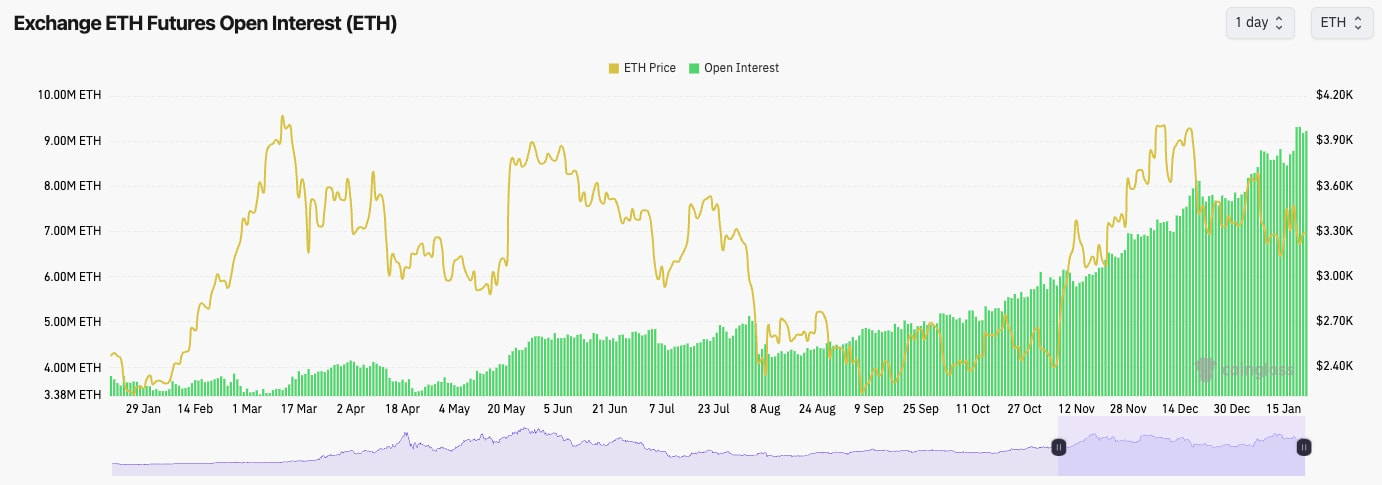

- ETH's Open Interest just continues to soar. This is likely TradFi taking advantage of the 'cash-and-carry' trade alongside protocols/mechanisms like Ethena.

- Funding is at 0.01%, so there is an even balance between Longs and Shorts.

- The signals aren't that clear or decisive here.

Technical analysis

- ETH remains range-bound between the major horizontal resistance of $3,480 and the local support of $3,140 (this is a new level).

- There are also other key horizontal levels to monitor: $3,050 and $3,280.

- ETH remains in its main downtrend, and to see a major bull reversal, we'll need to see the price breakout of the downtrend and also the horizontal resistance of $3,480.

- The RSI is also in a downtrend, and it hasn't yet broken out, whilst it's currently battling to remain above its moving average.

- Next Support: $3,140

- Next Resistance: $3,480

- Direction: Neutral

- Upside Target: $3,700

- Downside Target: $3,050

Cryptonary's take

Like BTC, ETH doesn't really look either here or there. Although arguably, BTC has shown some strength, whereas ETH has just held its level, it seems to be losing a bit of momentum. This week remains a tricky week to navigate, with the market just essentially waiting on Executive Orders from Trump.If there is a sell-off, and we think this is still possible for ETH to achieve, then $3,050 is likely the minimum target. But, if Trump issues very pro-Crypto executive orders, then this could see ETH get the breakout that it really needs.