Market Direction

Despite healthy market mechanics that normally signal bullish sentiment, ETH may plunge back into support levels below $2,000.

So, why do ETH bears appear to be in charge?

TLDR

- ETH rejected from $2,050 resistance and underside of the uptrend line.

- It is now facing a local downtrend along with Bitcoin hitting resistance.

- Market mechanics like open interest and funding rates are still healthy.

- However, technicals favour the bears until ETH can regain higher levels.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

The macro context follows through to all other assets that essentially trade with a high correlation to other risk assets.ETH 12hr

Technical analysis

After breaking below its uptrend line, can ETH reclaim the level?- Yesterday, ETH moved higher to test the underside of the uptrend line but found that area as new resistance, which also converged with the local horizontal resistance at $2,050.

- The main horizontal support at $1,933 provided support for price on a move down. If ETH continues to move lower, $1,933 will likely be tested again.

- There is also now a local downtrend suppressing price.

- In terms of the RSI, all timeframes look healthy. The 3D is very close to overbought territory, but that’s the only timeframe that looks like it needs a pullback, and while it isn’t coming off overly high levels, this shouldn’t be a concern.

Market mechanics

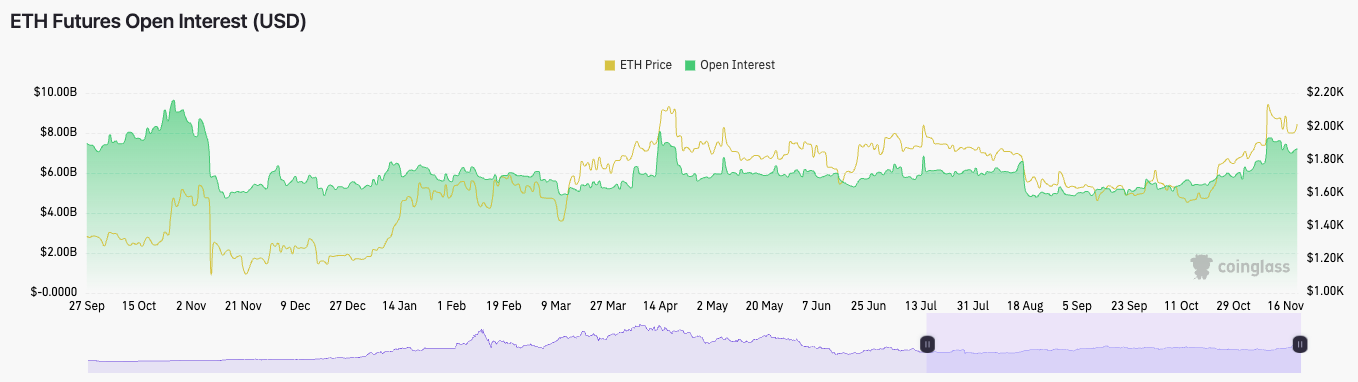

In terms of the mechanics, ETH has a healthy setup.- ETH’s open interest has picked up slightly but remains relatively low, especially when compared to historical levels—there’s no real sign of froth here.

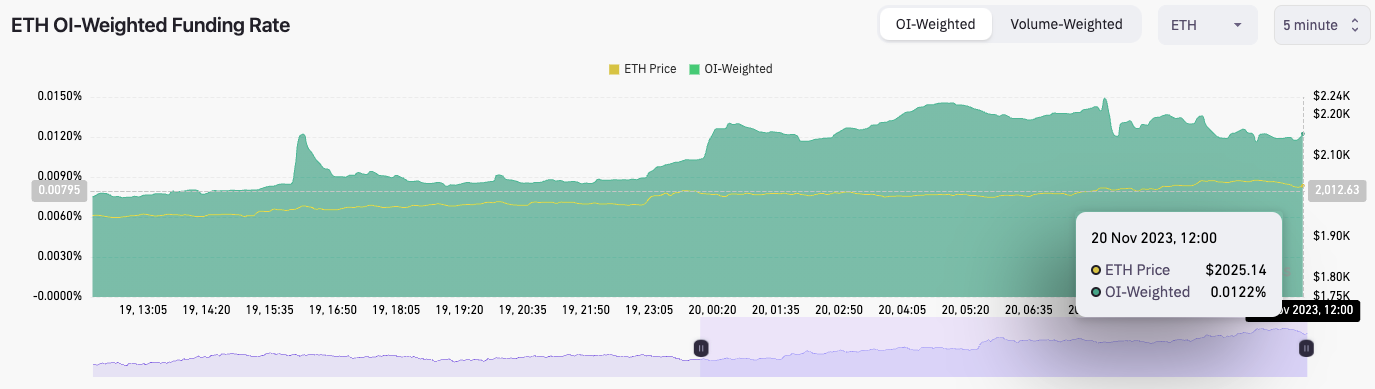

- The OI-weighted funding rate is at 0.0104%. This means there is a bias to be long, but longs and shorts are in a much more even balance. Again, another sign of health.

Cryptonary’s take

Despite the mechanics being in a healthy position, the technical setup for ETH is quite poor. ETH has rejected from a local horizontal level of $1,950, along with the underside of the uptrend line and the local downtrend. ETH will likely need considerable momentum if it breaks above $2,050 and then retests the $2,120 level.Unless Bitcoin can break above its resistance of $38,000, we see ETH likely retesting the $1,933 horizontal support. If that level can’t hold, then price will likely retest $1,850.

We would look to be DCA buyers of ETH at $1,933 (assuming ETH does turn lower and gets there). If ETH falls into the late $1,800’s, we would be more aggressive DCA buyers there.