Please note: The video above is set to start at the 07:03 timestamp, featuring an in-depth technical analysis of Ethereum (ETH) assets.

- Let’s start with ETH’s funding Rate. It’s currently negative, indicating that traders are paying a premium to be Short.

- Considering the RSI is the most oversold it’s been since August 2023; this looks ripe for a Short squeeze straightaway.

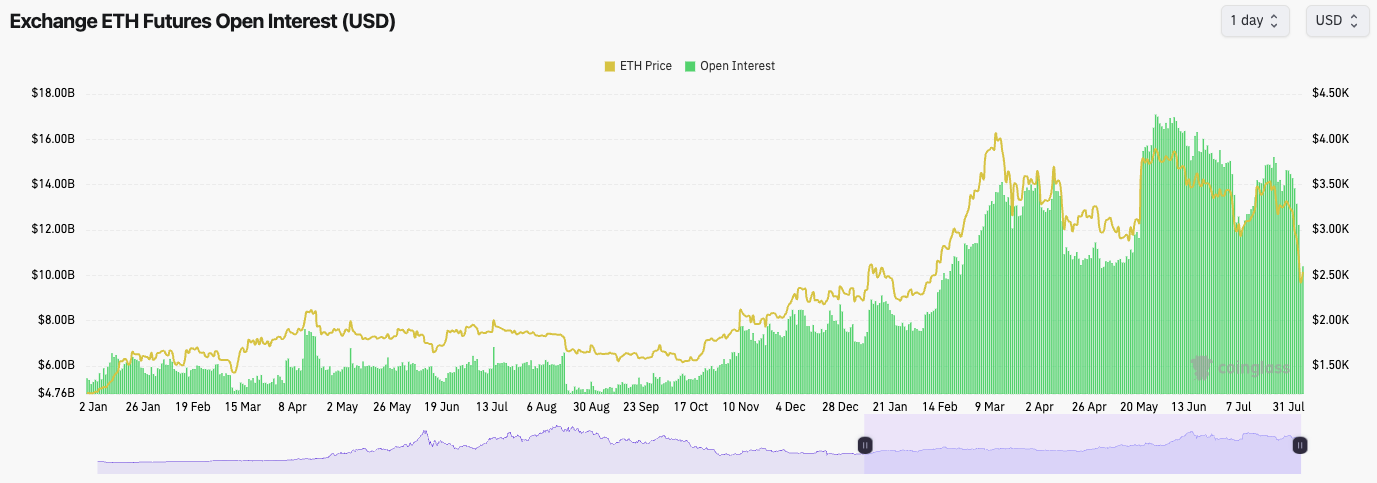

- The Open Interest has also substantially reset; again, this is another healthy sign.

- From the mechanics perspective, we’d steer clear of Shorting ETH. If anything, on any retests of the lows, we’d be strong buyers.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

ETH Open Interest:

Technical analysis

- ETH smashed below the key $2,875 horizontal support, potentially aided by Jump Trading dumping their ETH.

- Price did find support at the old horizontal level of $2,150.

- We do note that price is very oversold here, having printed at 21 on the RSI.

- Between $2,150 and $2,380 is likely to act as a strong support zone for ETH going forward.

- The major horizontal resistance and the key level ETH will need to reclaim is $2,875.

- Like BTC, we’ll need to see what kind of formation price forms. We will get more info on this as more days go by.

Cryptonary’s take

ETH, like BTC, will potentially be in a wider range between $2,150 and $2,875.ETH is very oversold here, and we’ve seen a significant leverage flush out that has now seen Shorts pile in and look quite offside. The potential outcome of this is a Short Squeeze in the near term. We do, however, expect the price to be range-bound (between $2,150 and $2,875) for some weeks, even if we get a Short Squeeze.

We would be aggressive buyers of ETH if it managed to retest the zone of support between $2,150 and $2,380. We’d even consider a low-leverage Long trade from that area. Ultimately, if price were to pull back further (possibly to $2,150 to $2,380), we would see this as a big opportunity to buy ETH/add to ETH bags.