Market Direction

ETH also broke above the local downtrend. A break above $2,120 would send ETH to $2,340. Further upside ahead?

TLDR

- Ethereum bounces off key $1,933 support, now facing resistance at $2,060

- Bullish indicators with RSI not overbought on most timeframes

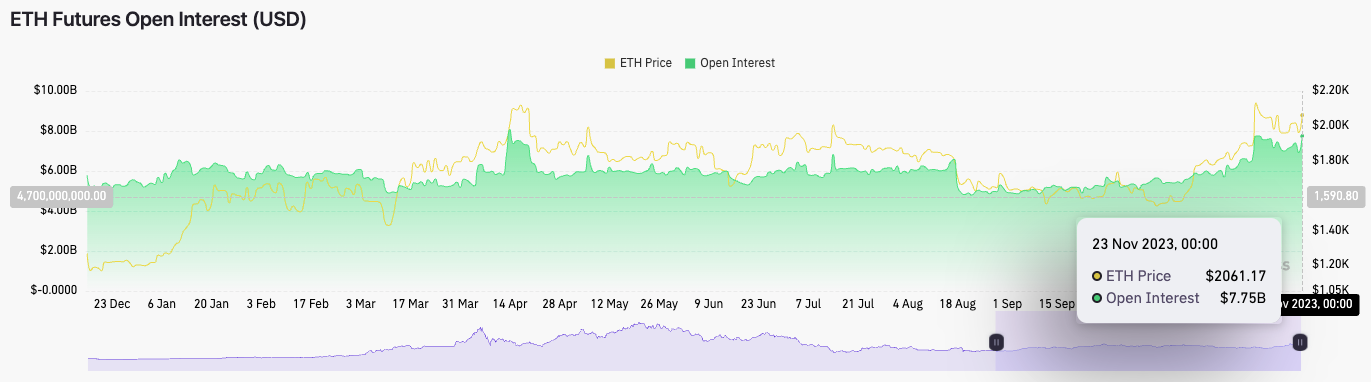

- Open interest spiked 10% on a recent move up to $2,060

- Rangebound, like Bitcoin, needs to clear $2,060 and $2,120 for an upside breakout

ETH 12hr

Technical analysis

ETH has broken above its local downtrend line but is now running into a horizontal resistance.- It's a really nice move up, recovering well from the major support at $1,933.

- ETH is now butting into the local resistance of $2,060. This is a key level for ETH to clear to target $2,120 and then get the more major breakout.

- ETH is also currently running into resistance from the underside of the uptrend line.

- However, ETH has broken out of the local downtrend line, which should help it target $2,120.

- The RSI on all timeframes is in bullish territory and not overbought, except for the 3D timeframe, which is also putting in a bearish divergence.

Market mechanics

Regarding the mechanics, ETH still has a healthy setup, but there are some parts to watch.- ETH’s Open Interest spiked up yesterday on the move from $1,960 to $2,060, with Open Interest increasing by 10%.

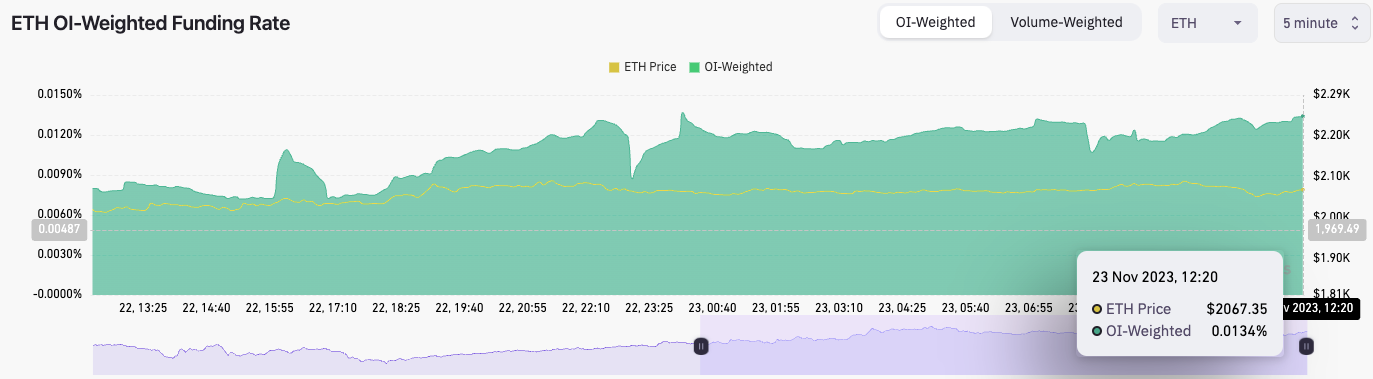

- The OI-Weighted Funding Rate has been steadily increasing and is now at 0.0134%, indicating there is a bias amongst traders to be Long.

From a mechanics perspective, ETH still looks good here. If there is a further increase in the level of Open Interest, then this may be a sign for us to become more cautious, particularly if the Long/Short Ratio

Cryptonary’s take

ETH has shown significant strength every time it's pulled back to a key support level, having bounced from the $1,933 support several times.If ETH can break $2,060 and then $2,120, there’s clear room up to $2,340. Even though ETH looks very bullish, while Bitcoin remains beneath the $38,000 resistance, the market may struggle to get any major breakouts.

We will not look to take any short-term trades until there is a break of the range, and we will continue to DCA below $1,950, with our DCA buys becoming more aggressive sub $1,860.