Ethereum, Solana, HYPE struggle as Bitcoin wavers

Bitcoin hovers at critical resistance, Ethereum struggles, and Solana fights for support. HYPE forms a bearish setup while traders watch the upcoming summit for market-moving news. Let’s dive into the key price levels and what’s next for crypto.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

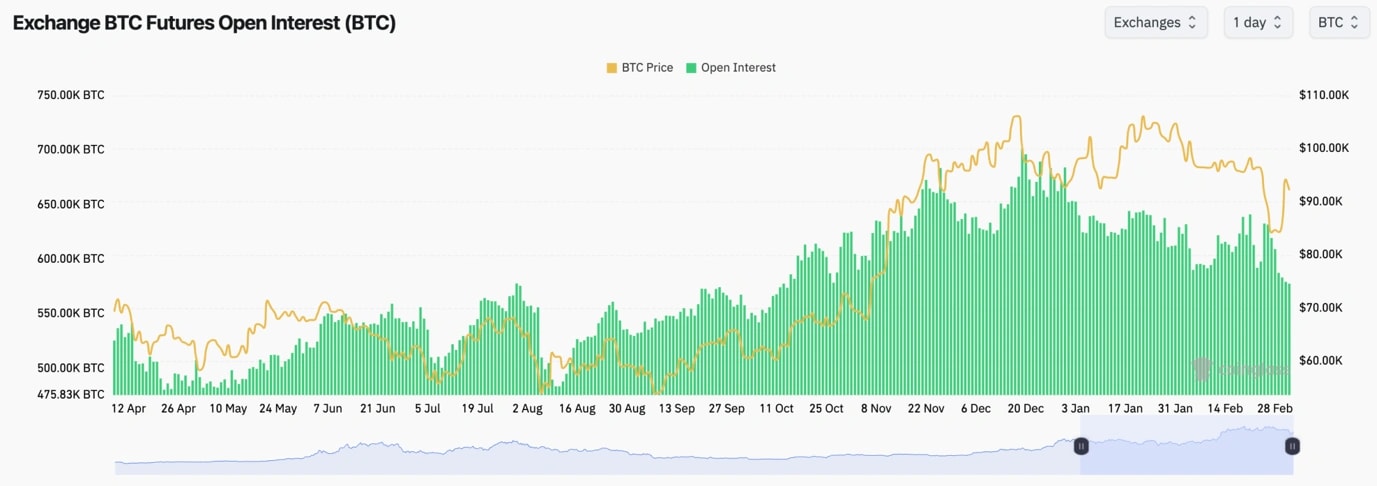

BTC:

- BTC's Open Interest has continued its slight downtrend, this is in spite of the large move up yesterday in price.

- This suggests that yesterday's move up in price was a spot-driven move rather than a perps-driven one.

- Funding Rates have also remained relatively flat, with Shorts and Longs being mostly evenly balanced.

Technical analysis

- At the back end of last week, price moved in to the Yellow box, printed it's lowest oversold reading since August 2023, and price swiftly bounced.

- Price has now moved into the underside of the horizontal resistance at $95,700, and so far, it looks as if it's rejecting. Today's candle close will be an important assessment of this.

- BTC is now fighting at the major horizontal level of $91,700. This may become new support if price can hold. If price falls below it and remains below it (uses it as resistance), expect $80k again.

- The RSI has bounced out of extreme oversold territory, but remains in it's downtrend. It has now put in a hidden bearish divergence (higher high on the oscillator, lower high in price).

- Next Support: $91,700

- Next Resistance: $95,600

- Direction: Bearish

- Upside Target: $95,600 (maybe $98,900)

- Downside Target: $91,700 (then $87,000)

Cryptonary's take:

The move yesterday was really extreme, and you can get that kind of move when confidence/sentiment is on the floor. The good news is then overpriced as all those that have sold out rush to buy back in.For now, though, this move remains a move into high timeframe resistance, where there's a strong potential we can see a lower high put-in and price move lower in the coming month. The Crypto audience will now expect big announcements at the Summit this week. So, unless the move is ultra bullish (outright buying of coins) then expect it to be a 'sell the news event'.

The key level to watch in the short-term is $91,700. If that level is lost, and news out of the Summit isn't super bullish, then we expect lower prices. PS - the CME gap that was created is now down to $81k. It's common for gaps to be filled.

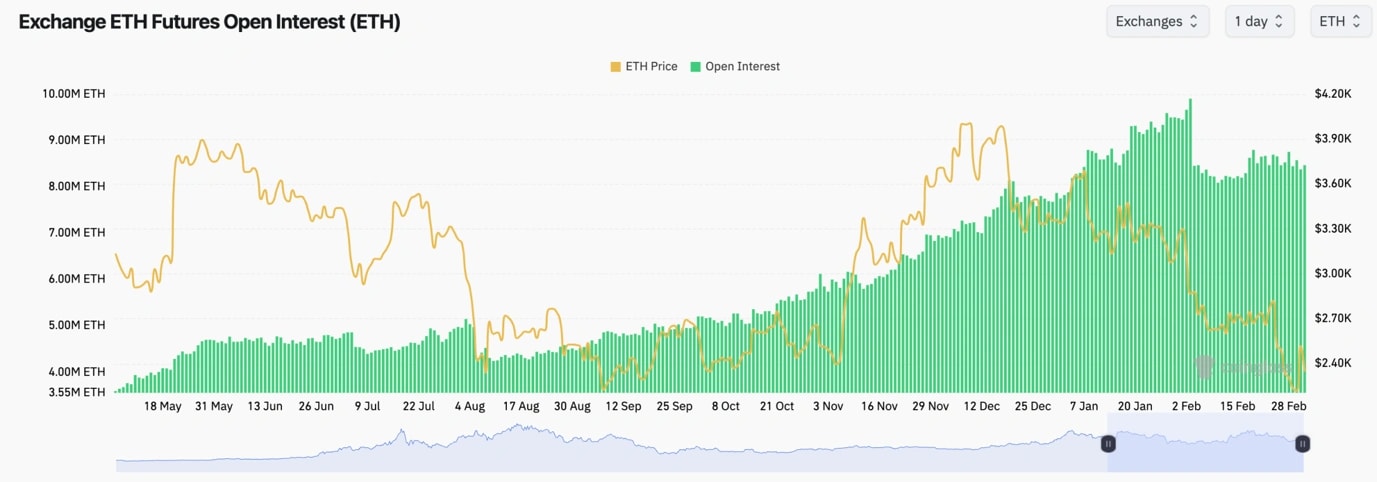

ETH:

- Like Bitcoin, ETH's Funding Rate remained relatively flat (even balance between Longs and Shorts) whilst the Open Interest remained level also.

- This suggests that the price increase was spot-driven.

Technical analysis

- ETH broke down to the last horizontal support at $2,160, and fortunately price was able to hold this level, and ETH bounced on yesterday's Trump tweet.

- Price is now battling at the $2,420 horizontal level. A reclaim of this and price can potentially be setup for a retest in to $2,600.

- The RSI has broken out of it's downtrend, and it's sat on top of it's moving average. This is perhaps the only positive element of the chart currently.

- The key supports are $2,160 and then, if that's lost, $1,745.

- Next Support: $2,160

- Next Resistance: $2,420 (then $2,600)

- Direction: Bearish

- Upside Target: $2,600

- Downside Target: $1,745

Cryptonary's take:

Despite the positivity and the whip-saw to the upside in general sentiment following Trumps tweet yesterday, if we look at the ETH chart, it looks pretty poor here. It's possible in the short-term we see price just grind along and chop between $2,160 and $2,600 (more likely $2,420).And then in the upcoming month, potentially we see ETH break down to $1,745. We're not bullish on any timeframe on ETH here to be quite frank. Look at that chart and zoom out, it's hard to see where the bullish turn will come from as well. For now, we're sat watching this and expecting more chop, and then downside from there to say the $1,745 level.

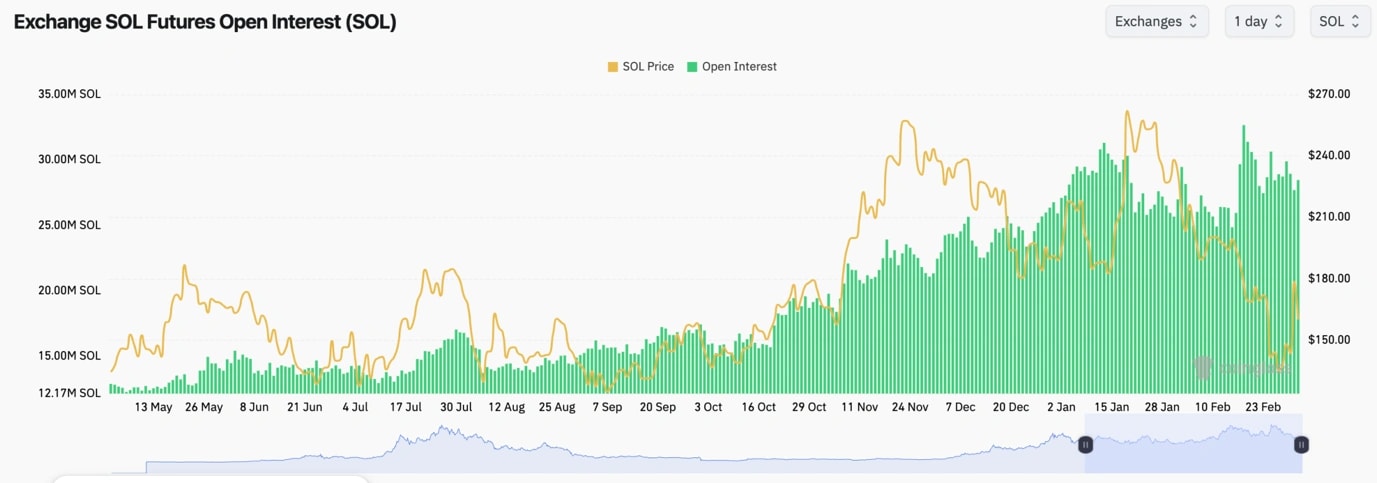

SOL:

- SOL's Open Interest spiked when the price collapsed in mid-February. This is mostly just due to it then being much cheaper to leverage 1 SOL coin. This Open Interest is now decreasing again though, suggesting there's less confidence amongst traders to use leverage.

- SOL's Funding Rate has fluctuated between slightly positive and slightly negative, again indicating indecision amongst traders.

Technical analysis

- SOL bounced perfectly from the Yellow Box, and the price broke out of the downtrend line.

- Price also broke above the key horizontal level of $161, with price now having pulled back to this horizontal level and testing it as new support.

- If the $161 horizontal support can't hold, it'll be important for the $143 level to hold, as to then put in a higher low.

- To the upside, $182 and $203 are the next major horizontal resistance levels.

- The RSI has broken out of it's downtrend line, which is a positive, but it has run potentially further than expected.

- Next Support: $143

- Next Resistance: $182

- Direction: Neutral/Bearish

- Upside Target: $182

- Downside Target $120

Cryptonary's take:

SOL has broken out of what was a drastic downtrend. However, we don't expect this break out to last or push higher from here in the short-term. Our current expectations are that SOL will battle at the $161 level for a day or so and then likely break down to $143.In the short and medium term, we're not expecting any fireworks from SOL. Of course, there is the possibility that Friday's Summit might bring some news, but we are expecting it to be a 'sell the news' event.

HYPE:

- HYPE broke down from its main pennant pattern, and it has seemingly found support at the $18.50 area (a new area we've marked out).

- There is a local horizontal resistance of around $21, and that price will need to be cleared.

- $23 to $24 still remains the key resistance area for the price to get above for it to have a shot at reaching all-time highs.

- Price is currently forming a bear flag, which would have a breakdown target of $14 to $15.

- The RSI isn't oversold, although it is moving lower in a downtrend, whilst it's below it's moving average.

- Next Support: $18.50

- Next Resistance: $22.00

- Direction: Neutral/Bearish

- Upside Target: $22.00

- Downside Target $15.00

Cryptonary's take:

HYPE looks to have broken it's range bound price structure. And whilst it's in a lower range, we have seen a bear flag be formed, which does have a breakdown target of $14 to $15.Therefore, we are expecting price to be choppy, but to remain under $22, and likely that we see a breakdown to at least $15, assuming we're right and the bear flag breaks down.