Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

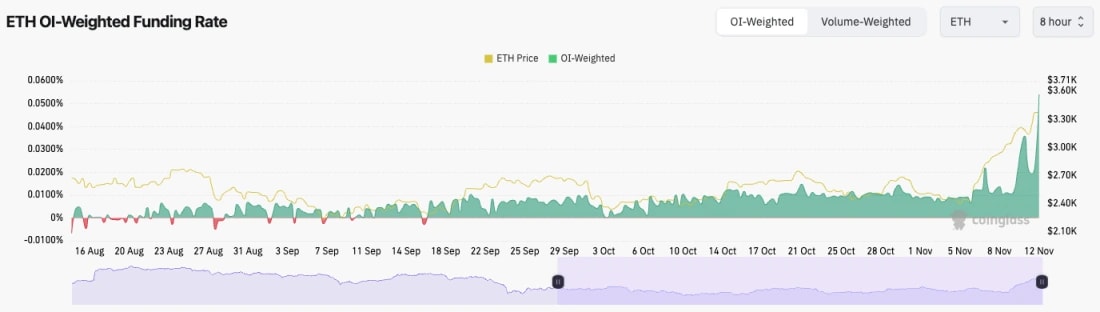

- ETH's Open Interest has hit an al-ltime high in both USD terms and the number of coins (ETH) terms.

- However, ETH's funding is high here at 0.06%, 66% annually.

- This suggests a flush out is needed here also as there's a lot of leverage overly positioned one-sided, Long.

Technical analysis

- It is a massive breakout and potentially a game changer for ETH, with a Trump victory providing hope for a new regulatory regime.

- ETH smashed through two major horizontal levels, the first at $2,875 and the second one at $3,240.

- Price has now moved up to the next horizontal resistance at $3,480, and it has pulled back from there. Expected after such a huge move higher.

- Price is now battling to find and maintain support at the $3,240 horizontal level. It would be very positive for Price to hammer this level in as new support and spend some time cementing itself above this level.

- The RSI for ETH is also very high at 73. It's likely we need to see more of a pull back for price or at least a period of price slowing down and consolidating, ideally in the range above $3,200.

- Next Support: $3,100 to $3,240

- Next Resistance: $3,480

- Direction: Neutral

- Upside Target: $3,480 (and then $4,000)

- Downside Target: $3,100