Ethereum technical analysis today: Will ETH surge to $3,500?

Ethereum enthusiasts, brace yourselves for a pivotal moment. While ETH might seem to be playing second fiddle to Bitcoin's recent surge, our analysis reveals a compelling narrative of tension and opportunity. With key resistance levels in sight and the Grayscale supply overhang nearing its end, is ETH coiling up for a spectacular breakout?

Market mechanics

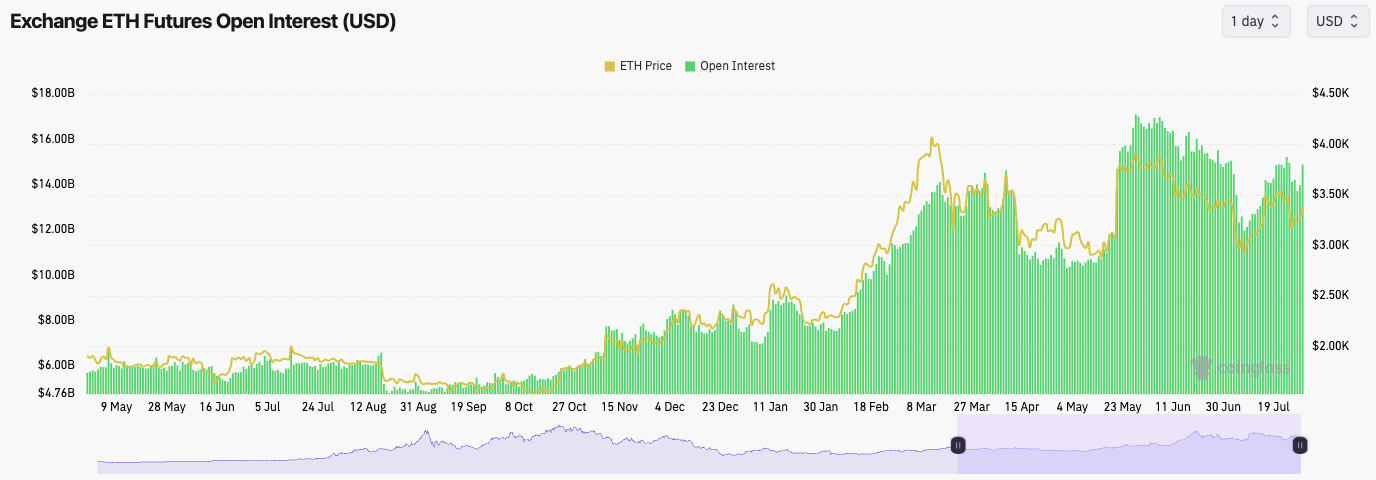

ETH's Open Interest also increased in the last day from $13.9b to $14.9b; however, it remains well below the late May highs of $17.1b. This suggests that leverage traders are mostly looking elsewhere for trades rather than ETH.ETH's funding rate is also flat at 0.01%, indicating that the bias amongst traders is mostly long, but there is some short interest.

Expect volatility this week, with both sides likely to have turns at being flushed out/whipsawed.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

ETH Open Interest:

Technical analysis

- ETH rejected at the horizontal resistance of $3,485 and the main downtrend line.

- However, price found support at $3,100, swiftly climbing back up and reclaiming the local horizontal support of $3,280.

- Price is now once again retesting the main downtrend line, but it remains below the main horizontal resistance of $3,485.

- ETH is at a key inflection point. A Bitcoin breakout this week could finally help ETH get the major breakout it's been looking for.

- The RSI is in the middle territory, so this doesn't provide any headwinds for price in the short term.

Cryptonary's take

In terms of risk/reward for a trade, ETH perhaps looks better than Bitcoin here simply because its price hasn't increased like that of BTC. However, we do note ETH's general weakness, as it seems to be outperformed by the other majors. However, we do expect that once the Grayscale supply overhang ends, ETH can grind higher.We wouldn't look to scale into any big Long trades here, but we're happy to sit on our ETH Spot positions, and we expect to substantially increase in value over the coming months. We're just staying patient on ETH here.

If we were looking for a degen play, a potential Long from $3,280 (assuming we get a retest) could be the play. But we'd keep the Stop Loss wide and give the trade room to allow for volatility.

Simply explained: Ethereum (ETH)

Ethereum (ETH) is a groundbreaking decentralized platform that facilitates the creation and execution of smart contracts and decentralized applications (dApps) without the need for intermediaries. Launched by Vitalik Buterin in 2015, Ethereum's innovative blockchain technology enables a wide range of applications and has become a cornerstone of the decentralized finance (DeFi) space. Ethereum's ATH is $4,868.How to buy ETH:

- Via Centralized Exchange (CEX):

- Select a CEX like Binance, Coinbase, or Kraken.

- Sign up and complete any verification processes.

- Deposit funds into your account.

- Go to the ETH trading section and purchase ETH.